A Budget Should Be Based On A Person's Income

Breaking News Today

Mar 21, 2025 · 6 min read

Table of Contents

A Budget Should Be Based on a Person's Income: A Comprehensive Guide to Financial Wellness

Creating a budget is a cornerstone of financial health, yet many struggle to grasp its importance or find it difficult to implement effectively. The fundamental truth, often overlooked, is that a budget should be intrinsically linked to a person's income. Ignoring this crucial relationship leads to unrealistic expectations, persistent debt, and a constant feeling of financial instability. This comprehensive guide will explore this core principle, offering practical strategies and actionable steps to build a sustainable budget tailored to your unique financial situation.

Understanding the Income-Based Budget Foundation

The premise is simple yet powerful: your spending should never exceed your earnings. This seems obvious, but many fall into the trap of basing their spending on aspirations or lifestyle choices rather than their actual income. This often leads to a vicious cycle of debt and financial stress. An income-based budget reverses this paradigm, prioritizing your income as the absolute limit for spending and saving.

Why Income is Paramount

-

Realistic Expectations: A budget rooted in your income establishes realistic financial goals. You're not setting yourself up for failure by attempting to maintain a lifestyle beyond your means. It fosters a sense of control and empowers you to make informed decisions.

-

Debt Management: A crucial aspect of an income-based budget is its ability to manage and reduce existing debt. By understanding your income and carefully allocating funds towards debt repayment, you can strategically eliminate debt faster, saving money on interest and improving your credit score.

-

Emergency Fund Creation: An income-based budget allows for systematic savings. Even a small percentage of your income consistently saved creates an emergency fund, providing a safety net against unforeseen circumstances like job loss or medical emergencies.

-

Financial Goals Achievement: Whether it's buying a house, funding your children's education, or planning for retirement, an income-based budget allows you to prioritize your financial goals. By allocating specific amounts towards these goals, you can track your progress and stay motivated.

-

Stress Reduction: Perhaps the most significant benefit of an income-based budget is the reduction of financial stress. Knowing where your money is going, having a plan, and making consistent progress towards your financial goals provides peace of mind and improves your overall well-being.

Crafting Your Income-Based Budget: A Step-by-Step Guide

Creating an effective income-based budget requires careful planning and consistent effort. Here’s a step-by-step guide to help you navigate the process:

1. Track Your Income: The Foundation of Your Plan

Begin by meticulously tracking your income for a period of at least three months. This includes your salary, bonuses, side hustles, investments returns, and any other form of regular income. Be as comprehensive as possible. This detailed accounting will provide a clear picture of your average monthly income.

2. Categorize Your Expenses: Unveiling Your Spending Habits

Next, meticulously track your expenses for the same period. Use a budgeting app, spreadsheet, or notebook to categorize your spending. Common categories include:

- Housing: Rent or mortgage payments, property taxes, homeowners insurance.

- Transportation: Car payments, gas, insurance, public transportation.

- Food: Groceries, eating out, coffee.

- Utilities: Electricity, water, gas, internet.

- Healthcare: Insurance premiums, medical expenses, prescriptions.

- Debt Repayment: Credit card payments, loan payments.

- Personal Care: Toiletries, haircuts, clothing.

- Entertainment: Movies, concerts, subscriptions.

- Savings: Emergency fund, investment accounts, retirement contributions.

- Other: Any miscellaneous expenses.

This detailed breakdown reveals your spending habits, identifying areas where you can potentially reduce expenses.

3. Analyze Your Spending: Identifying Areas for Improvement

Once you've categorized your expenses, analyze the data to identify areas of overspending. Ask yourself:

-

Are there any unnecessary expenses? Can you reduce your dining out expenses? Can you negotiate lower rates for your insurance? Could you switch to a less expensive phone plan?

-

Can you eliminate any subscriptions you don't regularly use? Streaming services, gym memberships, and magazines are common culprits.

-

Are you making the most of your current resources? Can you save on groceries by planning meals, using coupons, or buying in bulk?

-

Can you lower your transportation costs? Carpooling, using public transportation, or cycling can save money on gas and car maintenance.

4. Allocate Your Funds: Prioritizing Needs and Wants

Based on your income and expense analysis, allocate your funds accordingly. Prioritize your essential expenses (housing, food, transportation, healthcare) before allocating funds to discretionary spending (entertainment, dining out).

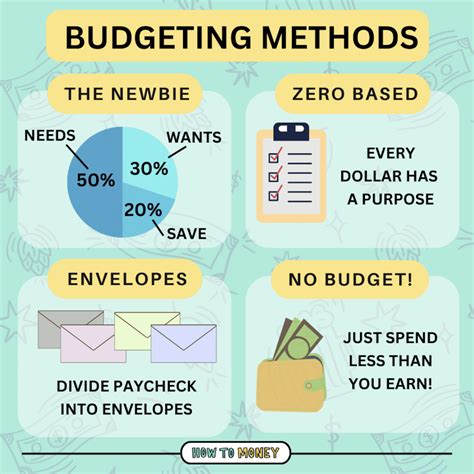

The 50/30/20 Rule: This popular budgeting method suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, you may need to adjust these percentages based on your individual circumstances.

5. Create a Realistic Budget: Finding a Balance Between Needs and Desires

Your budget should be realistic and sustainable. It shouldn't feel restrictive or overwhelming. It's crucial to find a balance between meeting your needs and fulfilling your wants. This might involve making some sacrifices, but the long-term benefits of a well-managed budget far outweigh any temporary inconvenience.

6. Review and Adjust: Adapting to Changing Circumstances

Your budget isn't a static document. Regularly review and adjust your budget as your income or expenses change. Life throws curveballs; unexpected expenses may arise, or you may receive a raise. Regular reviews help ensure your budget remains relevant and effective.

Advanced Strategies for Income-Based Budgeting

For those seeking more advanced strategies, consider the following:

Zero-Based Budgeting: Allocating Every Dollar

In a zero-based budget, every dollar of your income is allocated to a specific expense or saving goal. This ensures that you're actively managing your finances and prevent your money from accumulating in an unallocated pool.

Envelope System: A Cash-Based Approach

The envelope system involves allocating cash to different expense categories and placing this cash in separate envelopes. Once the cash in an envelope is gone, you stop spending in that category until the next budget cycle. This tangible approach can help you visualize your spending and avoid overspending.

Budgeting Apps and Software: Utilizing Technology

Numerous budgeting apps and software programs can automate much of the budgeting process. These tools can track your income and expenses, categorize transactions, create personalized budgets, and provide valuable insights into your spending habits.

Avoiding Common Budgeting Pitfalls

While crafting an income-based budget is relatively straightforward, several common pitfalls can derail your efforts. Be mindful of these potential problems:

-

Underestimating Expenses: Accurately tracking your spending for an extended period is crucial. Underestimating expenses often leads to budget shortfalls.

-

Ignoring Irregular Expenses: Budget for irregular expenses like car repairs or holiday spending. Including these expenses prevents unexpected financial strain.

-

Lack of Flexibility: Life is unpredictable; create a budget that's adaptable to changing circumstances.

-

Lack of Motivation: Consistency is key to successful budgeting. Find ways to stay motivated, such as setting realistic goals, rewarding yourself for milestones, and seeking support from friends or family.

The Power of an Income-Based Budget: Long-Term Financial Wellness

A budget based on your income is not merely a financial tool; it's a pathway to long-term financial wellness. By aligning your spending with your earnings, you gain control over your finances, reduce financial stress, and create a solid foundation for achieving your financial goals. Remember that building a sustainable budget is a journey, not a destination. Consistent effort, realistic expectations, and regular adjustments will pave your way to financial freedom. Embrace the power of an income-based budget and start building your financial future today.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Characteristic Of Plants

Mar 28, 2025

-

A Patient With Spontaneous Respirations Is Breathing

Mar 28, 2025

-

Vicente Es De Costa Rica El Es De

Mar 28, 2025

-

Explain The Reciprocal Relationship Between Human Society And Limiting Factors

Mar 28, 2025

-

The Organization Of Beats Into Regular Groupings Is Called

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about A Budget Should Be Based On A Person's Income . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.