A Debit Balance In Manufacturing Overhead Means Overhead Was

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

A Debit Balance in Manufacturing Overhead Means Overhead Was… Underapplied!

Understanding manufacturing overhead is crucial for accurate cost accounting and informed decision-making in any manufacturing business. A debit balance in the manufacturing overhead account signifies a specific relationship between actual and applied overhead costs. Let's delve into what that means, why it happens, and how to handle it.

Understanding Manufacturing Overhead

Manufacturing overhead encompasses all indirect costs incurred in the production process. These aren't directly traceable to a specific product unit but are essential for overall production. Examples include:

- Indirect materials: Consumables like lubricants, cleaning supplies, and small tools that aren't directly incorporated into the final product.

- Indirect labor: Salaries and wages of employees who don't directly work on the product, such as supervisors, maintenance staff, and quality control personnel.

- Factory rent and utilities: Costs associated with the manufacturing facility, including rent, electricity, water, and heating.

- Depreciation on factory equipment: The allocation of the cost of factory equipment over its useful life.

- Insurance and property taxes: Costs associated with protecting and maintaining the factory building and equipment.

Applying Manufacturing Overhead

Because it's difficult to directly trace these costs to individual products, manufacturing overhead is applied to production using a predetermined overhead rate. This rate is calculated at the beginning of the accounting period (usually annually) based on an estimated total overhead cost and an estimated activity base. Common activity bases include:

- Direct labor hours: The total number of hours worked by direct labor employees.

- Machine hours: The total number of hours that manufacturing machines are used.

- Direct labor cost: The total cost of direct labor used in production.

The formula for calculating the predetermined overhead rate is:

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Activity Base

Once the predetermined overhead rate is determined, it's applied to production based on the actual activity level during the period. For example, if the predetermined overhead rate is $10 per direct labor hour and 1000 direct labor hours were used, $10,000 of overhead would be applied to the Work in Process (WIP) inventory account.

The Significance of a Debit Balance in Manufacturing Overhead

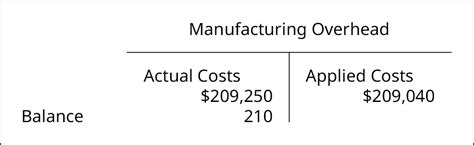

A debit balance in the manufacturing overhead account means that actual overhead costs exceeded applied overhead costs. This situation is known as underapplied overhead. In simpler terms, the company spent more on overhead than it allocated to the production process.

Why does underapplied overhead occur?

Several factors can contribute to a debit balance in the manufacturing overhead account:

- Inaccurate estimations: The predetermined overhead rate is based on estimations of both overhead costs and the activity base. If these estimations are significantly off, it can lead to under- or over-application of overhead. For example, if the estimated overhead costs were too low or the estimated activity base was too high, the resulting predetermined overhead rate would be too low, resulting in underapplied overhead.

- Unforeseen expenses: Unexpected events like equipment breakdowns, significant increases in utility costs, or changes in material prices can increase actual overhead costs beyond initial estimations.

- Increased production volume: If actual production volume significantly exceeds the estimated activity base, the applied overhead might not be sufficient to cover actual overhead costs. This is particularly relevant if the overhead costs are not entirely variable with production volume. Fixed overhead costs remain constant regardless of production levels.

- Changes in the manufacturing process: Introduction of new technology, changes in production methods, or even seasonal fluctuations can impact overhead costs significantly.

- Inefficient operations: Inefficiencies in the production process, such as excessive machine downtime or high material waste, can contribute to increased overhead costs.

Handling a Debit Balance (Underapplied Overhead)

There are several ways to handle an underapplied overhead balance at the end of the accounting period. The most common methods include:

1. Adjusting the Cost of Goods Sold (COGS): This is the simplest method. The debit balance in the manufacturing overhead account is closed out by debiting the Cost of Goods Sold account and crediting the Manufacturing Overhead account. This approach directly reflects the underapplied overhead in the period's cost of goods sold.

2. Proration Based on Ending Balances: This method allocates the underapplied overhead balance proportionally across the ending balances of Work in Process (WIP), Finished Goods, and Cost of Goods Sold. This approach attempts to more accurately reflect the underapplied overhead’s impact on the ending balances of inventory accounts. The formula for this would be unique to each balance based on their proportion to the total balances.

3. Adjusting Multiple Accounts: A more refined version of the proration method. Instead of simply using ending balances, this method considers the proportion of overhead applied to each account throughout the entire period. This method requires more detailed records and analysis but provides a potentially more precise allocation of the underapplied overhead.

The choice of method depends on the company's accounting policies and the materiality of the underapplied overhead amount. For small amounts, the adjustment to COGS might be sufficient. However, for significant amounts, a more detailed proration approach may be preferred to ensure greater accuracy in the financial statements.

Preventing Underapplied Overhead

While some degree of variance is inevitable, steps can be taken to minimize the occurrence of significant underapplied overhead:

- Accurate Budgeting and Forecasting: Develop detailed budgets that accurately reflect expected overhead costs and activity levels. Regularly review and update these budgets to account for changing conditions.

- Regular Overhead Monitoring: Track actual overhead costs throughout the period and compare them to the budget. Identify and investigate any significant variances promptly.

- Improved Cost Control: Implement effective cost control measures to reduce unnecessary expenses and improve operational efficiency. This could include waste reduction initiatives, preventative maintenance programs, and improved scheduling.

- Refine the Overhead Allocation Base: Regularly review the chosen activity base. If it's no longer an accurate reflection of the overhead cost drivers, consider switching to a more appropriate base.

- More Frequent Overhead Rate Adjustments: Instead of relying on annual predetermined rates, consider adopting more frequent adjustments (e.g., quarterly or monthly) to better reflect the actual overhead costs and activity levels. This approach is particularly helpful in industries with highly variable overhead costs.

Overapplied Overhead: The Opposite Scenario

It’s important to note that the opposite situation – where applied overhead exceeds actual overhead – is known as overapplied overhead. This results in a credit balance in the manufacturing overhead account. The methods for handling overapplied overhead are similar to those for underapplied overhead, with the debit and credit entries reversed. The implications are also reversed: overapplied overhead implies the company under-costed its goods.

Conclusion

A debit balance in manufacturing overhead, signifying underapplied overhead, indicates that actual overhead costs exceeded the overhead costs applied to production. Understanding the causes of underapplied overhead is crucial for improving cost control, refining cost estimation techniques, and enhancing the accuracy of financial reporting. While some variance is acceptable, consistently significant underapplied overhead suggests a need for process improvements and more accurate cost accounting practices. By carefully considering the various methods for handling underapplied overhead and implementing preventative measures, manufacturing businesses can improve their accuracy and decision-making processes. Choosing the most appropriate method depends on the materiality of the amount and the company’s accounting policies. The goal is always to ensure that the financial statements accurately reflect the true cost of goods sold and inventory values.

Latest Posts

Latest Posts

-

After A Classified Document Is Leaked Online

Mar 14, 2025

-

Which Of The Following Represents Critical Information

Mar 14, 2025

-

Fundamentals Of Physics 12 Edition Instructors Solutions Manual Pdf

Mar 14, 2025

-

What Is Photosynthesis Check All That Apply

Mar 14, 2025

-

The Concept Overview Video Assignments Are Organized

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about A Debit Balance In Manufacturing Overhead Means Overhead Was . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.