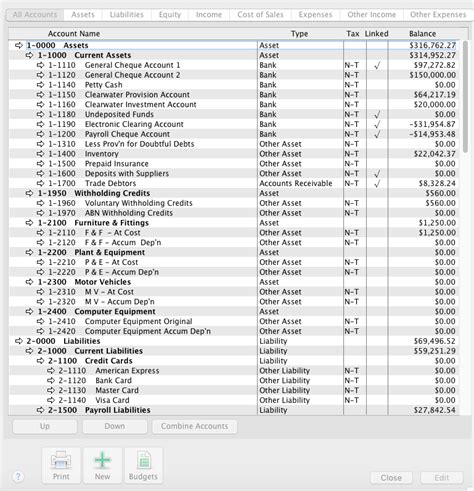

A List Of Accounts Used By A Business

Breaking News Today

Mar 13, 2025 · 6 min read

Table of Contents

A Comprehensive Guide to Business Accounts: Types, Uses, and Best Practices

Running a successful business involves meticulous financial management. Understanding and effectively utilizing various business accounts is crucial for maintaining financial health, tracking performance, and making informed decisions. This comprehensive guide explores the diverse types of business accounts available, their specific purposes, best practices for management, and the implications of choosing the right account for your unique business needs.

Understanding the Importance of Business Accounts

Before diving into the specifics of different account types, it’s vital to grasp the overarching importance of maintaining well-organized business accounts. These accounts aren't simply places to store money; they are essential tools that:

-

Separate Personal and Business Finances: This crucial step protects your personal assets from business liabilities and simplifies tax preparation. Commingling funds can lead to significant legal and financial complications.

-

Track Income and Expenses: Accurate record-keeping allows you to monitor your business's financial health, identify profitable areas, and pinpoint areas requiring improvement.

-

Facilitate Financial Planning: Well-maintained accounts provide the data needed to create realistic budgets, forecast future revenue, and make informed strategic decisions.

-

Simplify Tax Preparation: Properly categorized transactions streamline the tax filing process, minimizing the risk of errors and penalties.

-

Attract Investors and Lenders: Clear and organized financial records build credibility and confidence, making it easier to secure loans or attract investors.

Types of Business Accounts: A Detailed Overview

The specific business accounts you need will depend heavily on your business structure, industry, and financial goals. Here's a detailed look at common account types:

1. Business Checking Accounts

These are the workhorse accounts for most businesses. They offer convenient features like:

- Debit Card Functionality: Facilitates everyday business transactions.

- Online Banking and Bill Pay: Streamlines financial management.

- Check Writing Capabilities: Provides a formal method for paying vendors and suppliers.

- Multiple Signatories: Enhances security and accountability.

Key Considerations: Look for accounts with minimal fees, high interest rates (though this is rare for checking accounts), and robust online banking features. Consider features like mobile deposit and fraud protection.

2. Business Savings Accounts

While not as actively used as checking accounts, business savings accounts are vital for:

- Emergency Funds: Provides a financial cushion for unexpected expenses.

- Short-Term Savings Goals: Allows for accumulating funds for specific purchases or investments.

- Interest Accumulation: Generates passive income on uninvested funds.

Key Considerations: Focus on accounts with competitive interest rates and convenient access to funds without incurring significant penalties.

3. Money Market Accounts

These accounts offer a blend of checking and savings account features:

- Higher Interest Rates: Generally earn more interest than standard savings accounts.

- Limited Check Writing: Usually allows a limited number of checks per month.

- Debit Card Access: Provides convenient access to funds.

Key Considerations: Assess the minimum balance requirements and the frequency of interest calculations. They can be beneficial for businesses with consistent cash flow.

4. Merchant Accounts

Essential for businesses accepting credit and debit card payments, merchant accounts facilitate:

- Electronic Payment Processing: Allows customers to pay using various card types.

- Secure Transaction Handling: Minimizes the risk of fraud and data breaches.

- Settlement of Funds: Deposits processed payments into your business account.

Key Considerations: Compare processing fees, transaction charges, and monthly fees from different providers. Choose a provider with a robust security system and excellent customer support.

5. Payroll Accounts

Specifically designed for managing payroll, these accounts simplify:

- Direct Deposit: Efficiently distributes employee wages.

- Tax Withholding: Automates the process of deducting taxes from employee pay.

- Reporting and Compliance: Facilitates the generation of payroll reports for tax purposes.

Key Considerations: Explore the integration capabilities with payroll software and the level of reporting offered. Ensure the account provider is compliant with all relevant labor laws and regulations.

6. High-Yield Savings Accounts

These accounts offer significantly higher interest rates than traditional savings accounts but often have higher minimum balance requirements. They are ideal for businesses:

- Parking Surplus Funds: Safely storing excess cash and earning a substantial return.

- Long-Term Savings Goals: Accumulating funds for major purchases or investments.

Key Considerations: Carefully weigh the interest rate against the minimum balance requirements. Consider if the potential return outweighs the inconvenience of maintaining a large minimum balance.

7. Certificate of Deposit (CDs)

CDs offer fixed interest rates for a specific period. They are suitable for businesses:

- Locking in Interest Rates: Protecting against potential interest rate declines.

- Long-Term Savings Goals: Saving for significant future expenses.

Key Considerations: The trade-off for higher interest rates is the inability to access funds before maturity without penalties. Carefully consider your liquidity needs before investing in CDs.

Best Practices for Managing Business Accounts

Effective management of your business accounts is crucial for financial success. Follow these best practices:

- Regular Reconciliation: Match bank statements with your internal records to identify discrepancies promptly.

- Automated Payment Systems: Reduce errors and save time by automating bill payments.

- Budgeting and Forecasting: Create realistic budgets and forecast future revenue to guide financial decisions.

- Secure Access Controls: Restrict account access to authorized personnel only and implement strong passwords.

- Fraud Prevention Measures: Monitor accounts regularly for suspicious activity and report any fraudulent transactions immediately.

- Regular Review: Periodically review your account fees and features to ensure they align with your evolving needs.

- Professional Assistance: Consider consulting with an accountant or financial advisor for guidance on managing your finances.

Choosing the Right Accounts for Your Business

The optimal mix of business accounts varies greatly depending on your specific circumstances. Consider these factors when making your decisions:

- Business Structure: Sole proprietorships, partnerships, LLCs, and corporations have different accounting and tax requirements, influencing account choices.

- Industry: Certain industries require specialized accounts, such as those involved in high-volume transactions or international trade.

- Business Size: Small businesses may require fewer accounts than larger enterprises.

- Financial Goals: Short-term and long-term financial objectives will impact your account selections.

- Cash Flow: Your business's cash flow will dictate the type and number of accounts you need to manage funds effectively.

The Implications of Choosing Incorrectly

Failing to select the appropriate business accounts can have significant negative repercussions, including:

- Increased Fees: Unnecessary fees from accounts with features you don't need.

- Inaccurate Financial Reporting: Making it difficult to track performance and make informed decisions.

- Compliance Issues: Violations of tax laws or regulations, leading to penalties.

- Security Risks: Vulnerability to fraud and data breaches.

- Difficulty Securing Funding: Inability to attract investors or lenders due to poor financial record-keeping.

Conclusion: Building a Strong Financial Foundation

Establishing and effectively managing business accounts is a cornerstone of any successful enterprise. By understanding the various account types, their specific uses, and best practices, you can build a strong financial foundation that supports growth, profitability, and long-term sustainability. Remember, choosing the right accounts and maintaining meticulous records are crucial steps in achieving your business goals. Regularly review and adjust your financial strategies to adapt to your business's evolving needs and ensure its continued success. Remember to always seek professional advice when needed to ensure compliance and make the most informed decisions for your business's financial health.

Latest Posts

Latest Posts

-

Life And Health Insurance Exam Cheat Sheet Pdf

Mar 13, 2025

-

What Inference Does The Text Best Support

Mar 13, 2025

-

Paper 2 Option B Comp Sci Definitions

Mar 13, 2025

-

Why Would Labor Be Treated As A Variable Cost

Mar 13, 2025

-

What Occurrences Might Disrupt The Natural Processes Of The World

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about A List Of Accounts Used By A Business . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.