A Partial Surrender Is Allowed In What Type Policy

Breaking News Today

Mar 22, 2025 · 7 min read

Table of Contents

A Partial Surrender Is Allowed: Understanding Policy Options

Partial surrender, the ability to withdraw a portion of your policy's cash value without surrendering the entire policy, is a valuable feature offered by certain types of life insurance policies. However, not all policies allow for this flexibility. Understanding which policies permit partial surrenders and the implications involved is crucial for making informed financial decisions. This comprehensive guide explores the types of policies that allow partial surrenders, the benefits and drawbacks, and crucial factors to consider before undertaking such a transaction.

What Types of Policies Allow Partial Surrenders?

Primarily, permanent life insurance policies offer the option of partial surrenders. This is because permanent policies build cash value over time, providing a pool of funds that the policyholder can access. The most common types of permanent life insurance that allow partial surrenders include:

1. Whole Life Insurance:

Whole life insurance policies are designed to provide lifelong coverage, accumulating cash value on a tax-deferred basis. Partial surrenders are a standard feature of whole life policies, allowing policyholders to withdraw a portion of their accumulated cash value without completely terminating their coverage. The cash value grows at a fixed rate, offering predictability and stability.

2. Universal Life Insurance:

Universal life insurance policies also offer flexibility in terms of premium payments and death benefits. Partial surrenders are generally allowed in universal life insurance policies, providing access to the cash value accumulated within the policy. However, the growth rate of cash value in universal life insurance is often variable, depending on the underlying investment options.

3. Variable Universal Life Insurance (VUL):

VUL policies are a more complex variation of universal life insurance. They allow policyholders to invest their cash value in a range of sub-accounts, similar to mutual funds. Partial surrenders are usually permitted in VUL policies, but the amount available for withdrawal depends on the performance of the chosen investment options. The risk of loss is higher in VUL policies compared to whole life or universal life policies due to the investment component.

4. Indexed Universal Life (IUL) Insurance:

Indexed universal life insurance policies offer a hybrid approach, linking the cash value growth to a market index, such as the S&P 500. While the growth potential is higher than with traditional universal life, it's still subject to market fluctuations. Partial surrenders are often available in IUL policies, although the specifics depend on the policy's terms and conditions.

Important Note: While these are the most common types of policies allowing partial surrenders, it's crucial to review your specific policy documents. The policy contract outlines the exact terms and conditions related to partial surrenders, including any limitations or fees.

Benefits of Partial Surrenders

Partial surrenders offer several advantages compared to a full surrender:

- Maintain Life Insurance Coverage: The primary benefit is the ability to access cash value without sacrificing your life insurance coverage. This is vital for maintaining financial protection for your loved ones while addressing immediate financial needs.

- Flexibility and Control: Policyholders retain control over their financial resources. They can withdraw only the amount needed, avoiding the complete surrender and loss of future cash value growth.

- Tax Advantages (Generally): While taxes may apply depending on certain circumstances (more on this below), withdrawals from the cash value generally enjoy favorable tax treatment compared to other types of loans or withdrawals.

- Avoid Surrender Charges: Many policies impose surrender charges if the entire policy is surrendered within a specific period. Partial surrenders often bypass these fees, saving you money.

- Preservation of Death Benefit: A full surrender eliminates the death benefit. A partial surrender helps maintain the intended protection for beneficiaries.

Drawbacks of Partial Surrenders

Despite the benefits, partial surrenders also have potential downsides:

- Reduced Cash Value: Each partial surrender reduces the overall cash value of the policy, affecting its future growth potential. This can impact the ability to later access larger amounts of cash or to leave a larger death benefit for your heirs.

- Potential Tax Implications: While generally tax-advantaged, withdrawals may be subject to income tax if the amount withdrawn exceeds the cost basis. Consult with a tax advisor to understand the tax implications of your specific situation.

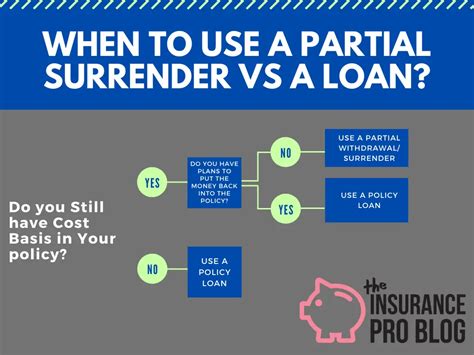

- Loan vs. Surrender: Some policies might offer loans against the cash value as an alternative. Loans don't reduce the death benefit, but they do accrue interest. Carefully compare the advantages of a loan versus a partial surrender.

- Policy Lapse: Repeated or substantial partial surrenders might lead to the policy lapsing if the cash value falls below a certain threshold. This would result in the loss of both the cash value and the death benefit.

- Fees and Charges: While partial surrenders often avoid surrender charges, there may be other fees associated with the withdrawal process. Check your policy documentation for any applicable fees.

Understanding the Mechanics of a Partial Surrender

The process of executing a partial surrender usually involves these steps:

-

Reviewing the Policy: Carefully examine your policy document to understand the rules and regulations regarding partial surrenders. Note any limitations on the amount you can withdraw, any surrender charges, and the timeframe for processing the request.

-

Calculating the Withdrawal Amount: Determine the amount you wish to withdraw, keeping in mind the potential impact on future cash value growth and the overall policy.

-

Submitting the Request: Contact your insurance company to formally request a partial surrender. This typically involves completing a specific form and providing any necessary documentation.

-

Processing the Withdrawal: The insurance company will process your request, which may take several days or weeks.

-

Receiving the Funds: Once processed, the funds will be disbursed to you according to your instructions, typically through a direct deposit or check.

Comparing Partial Surrenders with Other Options

Before opting for a partial surrender, compare it to other available options for accessing your policy's cash value:

-

Policy Loans: Policy loans allow you to borrow against the cash value without surrendering any part of the policy. However, interest accrues on the loan amount, and unpaid loans can reduce the death benefit or even lead to policy lapse.

-

Cash Value Withdrawals (Not Partial Surrenders): Some policies allow cash value withdrawals that are different from partial surrenders. These withdrawals might have different tax implications or may not reduce the death benefit as much as a partial surrender. Clarify this aspect in your policy documents.

Factors to Consider Before a Partial Surrender

Before proceeding with a partial surrender, consider these vital factors:

-

Your Financial Goals: Assess whether a partial surrender aligns with your short-term and long-term financial objectives. Will the withdrawal significantly hinder the growth of your policy's cash value?

-

Your Risk Tolerance: Understand the implications of reducing your cash value. How will this impact your ability to meet future financial needs or your ability to leave a significant death benefit for beneficiaries?

-

Tax Consequences: Consult a tax professional to thoroughly understand the tax implications of the withdrawal and to minimize any potential tax liabilities.

-

Alternative Financing Options: Explore alternative sources of funds, such as personal loans or lines of credit, before resorting to a partial surrender.

-

Future Needs: Consider your future financial needs and how a partial surrender might impact your ability to meet them.

-

Insurance Needs: Evaluate if surrendering a portion of your policy still provides adequate insurance coverage for your family.

Conclusion: Making Informed Decisions

Partial surrenders offer a unique way to access the accumulated cash value in permanent life insurance policies without completely terminating the coverage. However, they are not a decision to be made lightly. Carefully weigh the benefits and drawbacks, consider the implications for future cash value growth and death benefit, explore alternative financing options, and consult with a financial advisor and tax professional to ensure you're making the best decision for your specific circumstances. Always refer to your policy documents for specific terms and conditions related to partial surrenders. A well-informed choice can lead to effective management of your financial resources while preserving essential life insurance protection.

Latest Posts

Latest Posts

-

When Is A Dea 222 Form Used Quizlet

Mar 23, 2025

-

What Is Cocaine Still Used For Medically Quizlet

Mar 23, 2025

-

What Is The Underlying Concept Regarding Level Premiums Quizlet

Mar 23, 2025

-

How Does Lobbying Benefit The Government Quizlet

Mar 23, 2025

-

Un Sandwich De Jamon Y Queso Quizlet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about A Partial Surrender Is Allowed In What Type Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.