A Recession Is Defined As A Period In Which Quizlet

Breaking News Today

Mar 24, 2025 · 7 min read

Table of Contents

A Recession is Defined As a Period in Which: A Comprehensive Guide

A recession. The word itself evokes images of economic hardship, job losses, and financial uncertainty. But what exactly is a recession, and how is it defined? Understanding this crucial economic concept is vital for individuals, businesses, and policymakers alike. This comprehensive guide will delve deep into the definition of a recession, exploring its various aspects, causes, consequences, and how it differs from other economic downturns.

Defining a Recession: More Than Just a Slowdown

While many associate a recession with a general economic slowdown, the definition is far more precise. A recession isn't simply a period of low economic growth; it's characterized by a significant, widespread, and prolonged decline in economic activity. This decline is typically measured by two key indicators:

1. Real Gross Domestic Product (GDP) Contraction: The Key Metric

The most crucial indicator of a recession is a sustained decline in real GDP. Real GDP represents the total value of all goods and services produced within a country's borders, adjusted for inflation. A decline in real GDP signifies that the economy is producing fewer goods and services than before. This contraction isn't a one-off event; it needs to persist for a specific period to be classified as a recession.

2. Broad-Based Economic Weakness: Beyond GDP

While a decline in real GDP is paramount, it's not the sole criterion. Economists also consider other indicators of economic weakness, reflecting a broad-based downturn across various sectors. These may include:

- Rising unemployment: A significant increase in job losses indicates a weakening labor market, reflecting decreased economic activity.

- Decreased consumer spending: Reduced consumer confidence and spending power lead to lower demand for goods and services, further dampening economic growth.

- Falling investment: Businesses reduce investments in new projects and expansion plans due to uncertainty and reduced profitability.

- Declining industrial production: A decrease in factory output signals a contraction in manufacturing activity and overall economic output.

- Reduced consumer confidence: Surveys measuring consumer sentiment often show decreased optimism about the future economy during recessions.

These indicators paint a more comprehensive picture of economic health than GDP alone, confirming the severity and widespread nature of the downturn.

The Duration of a Recession: How Long Does it Last?

There's no fixed duration for a recession. While some last only a few months, others can stretch for several years, inflicting prolonged hardship. The length depends on various factors, including the severity of the initial shock, government policy responses, and the resilience of the economy. Historically, recessions in developed economies have lasted, on average, around 11 months. However, this is just an average, and individual recessions can vary greatly in length.

Who Declares a Recession? The Role of Official Organizations

In many countries, official bodies like the National Bureau of Economic Research (NBER) in the United States or similar organizations in other nations are responsible for officially declaring recessions. These organizations use a complex methodology that goes beyond simply observing two consecutive quarters of negative GDP growth. They consider a broad range of economic data, including the factors mentioned above, to determine whether a recession has truly occurred. Their decisions are based on thorough analysis and are not always immediate. They often wait several months or even a year after the end of a recession before officially declaring it due to the need for accurate and comprehensive data.

Differentiating a Recession from Other Economic Slowdowns

It's crucial to distinguish a recession from other economic slowdowns:

- Economic Slowdown: A general decrease in economic growth rate, but not necessarily a contraction. It might be a temporary dip or a period of slower growth than the trend. It doesn't necessarily meet the criteria for a full-blown recession.

- Depression: A far more severe and prolonged downturn than a recession, characterized by extremely high unemployment, deflation, and widespread economic hardship. Depressions are rare and significantly more impactful than recessions.

- Recession vs. Depression: While both involve a decline in economic activity, a depression is far more severe and prolonged than a recession, involving a much deeper and longer-lasting contraction.

Causes of Recessions: Unraveling the Complexities

Recessions are rarely caused by a single factor but rather a confluence of events. Some key causes include:

1. Financial Crises and Market Crashes: The Domino Effect

Major financial crises, such as the 2008 global financial crisis, can trigger recessions. These crises often involve banking failures, asset bubbles bursting, and widespread credit market disruptions. This can lead to a rapid contraction in lending, investment, and overall economic activity.

2. Asset Bubbles: The Peril of Overvaluation

Rapid increases in asset prices (like housing or stocks) that are not supported by underlying fundamentals create bubbles. When these bubbles burst, it can trigger a sharp decline in asset values, impacting consumer wealth and confidence, leading to decreased spending and investment.

3. External Shocks: Unexpected Events

External shocks, such as pandemics (like COVID-19), natural disasters, wars, or global supply chain disruptions, can significantly impact economic activity. These shocks can disrupt production, trade, and consumer confidence, leading to a recession.

4. Monetary Policy Errors: Tightening the Screws Too Much

Incorrect monetary policy decisions by central banks can also contribute to recessions. For example, aggressively raising interest rates to combat inflation can stifle economic growth and potentially trigger a recession if the increase is too drastic or poorly timed.

5. Fiscal Policy Mistakes: Government Spending and Taxation

Government fiscal policy, involving taxation and government spending, can also play a role. For example, significant cuts in government spending during an economic slowdown can worsen the situation, exacerbating the contraction.

Consequences of Reccessions: The Ripple Effect

The consequences of recessions can be far-reaching and affect various aspects of life:

1. Job Losses and Unemployment: The Human Cost

Recessions often lead to significant job losses and rising unemployment rates. This can have devastating consequences for individuals and families, leading to financial hardship, reduced living standards, and increased poverty.

2. Reduced Consumer Spending and Investment: A Vicious Cycle

Decreased consumer confidence and reduced disposable income lead to lower consumer spending, further dampening economic activity. Similarly, businesses cut back on investments due to uncertainty and reduced profitability, creating a vicious cycle.

3. Increased Government Debt: The Burden of Intervention

Governments often respond to recessions by implementing fiscal stimulus measures, such as increased government spending or tax cuts. This can lead to an increase in government debt, potentially creating long-term fiscal challenges.

4. Social and Political Instability: The Societal Impact

Recessions can lead to social unrest and political instability. Increased unemployment, poverty, and economic hardship can fuel social tensions and dissatisfaction with the government, potentially leading to political upheaval.

5. Global Economic Interdependence: The Contagion Effect

In today's interconnected global economy, recessions in one country or region can quickly spread to others. This is because countries are intertwined through trade, finance, and investment, making them vulnerable to economic shocks elsewhere.

Mitigating the Impact of Recessions: Strategies for Resilience

While recessions are an inevitable part of the economic cycle, various strategies can be implemented to mitigate their impact:

1. Counter-cyclical Fiscal Policy: Government Intervention

Governments can use fiscal policy to counter the effects of a recession by increasing government spending (e.g., infrastructure projects) or cutting taxes to boost demand and stimulate economic activity. The goal is to offset the decline in private sector spending.

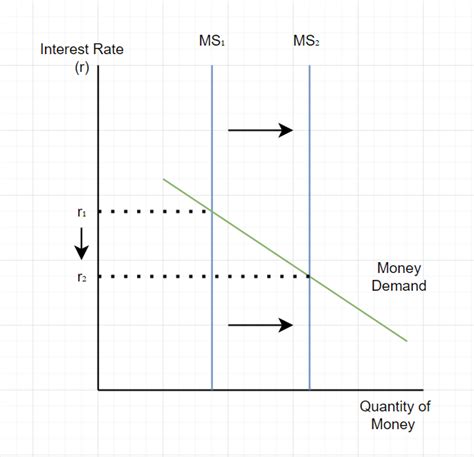

2. Monetary Policy Adjustments: Central Bank Response

Central banks can lower interest rates to make borrowing cheaper, encouraging investment and consumption. They can also implement quantitative easing, injecting liquidity into the financial system to boost lending and economic activity.

3. Structural Reforms: Long-Term Solutions

Long-term structural reforms, such as improving education and training systems, enhancing labor market flexibility, and promoting innovation, can improve the economy's resilience to future shocks.

4. International Cooperation: Global Response

International cooperation is crucial in mitigating the impact of global recessions. Countries can work together to coordinate fiscal and monetary policies, provide financial assistance to struggling nations, and address global economic imbalances.

5. Diversification and Resilience: Preparing for the Unexpected

Businesses and individuals can improve their resilience to recessions by diversifying their investments, building emergency funds, and focusing on acquiring in-demand skills. Proactive planning can lessen the impact of economic downturns.

Conclusion: Navigating the Economic Cycle

Understanding the definition of a recession, its causes, consequences, and mitigation strategies is crucial for navigating the economic cycle. While recessions are an unavoidable part of economic life, informed individuals, businesses, and policymakers can employ various tools and strategies to mitigate their impact and foster greater economic resilience. By understanding the complexities of recessions and taking proactive steps, we can better prepare for and weather these challenging economic periods. Continuous monitoring of key economic indicators, coupled with proactive planning, will help individuals, businesses, and governments navigate the uncertain landscape of the economic cycle.

Latest Posts

Related Post

Thank you for visiting our website which covers about A Recession Is Defined As A Period In Which Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.