All Of These Statements Concerning Settlement Options Are True Except

Breaking News Today

Mar 24, 2025 · 5 min read

Table of Contents

All of These Statements Concerning Settlement Options are True EXCEPT… A Comprehensive Guide

Choosing the right settlement option after a personal injury, a lawsuit win, or a significant life event can be a daunting task. Navigating the complexities of structured settlements, lump-sum payments, and annuities requires a deep understanding of the various options and their implications. This article will delve into the intricacies of settlement options, clarifying common misconceptions and helping you identify which statement about settlement options is false. We'll explore the pros and cons of each approach, providing you with the knowledge to make informed decisions.

Understanding Settlement Options: A Broad Overview

Settlement options aren't one-size-fits-all. The best option depends heavily on your individual circumstances, financial goals, and risk tolerance. The most common settlement options include:

1. Lump-Sum Settlement: One-Time Payment

This involves receiving the entire settlement amount in a single payment. The allure of immediate access to a large sum of money is undeniable. However, it's crucial to consider the potential drawbacks:

- Financial Responsibility: You are solely responsible for managing the entire amount. Poor financial planning could lead to rapid depletion of funds.

- Tax Implications: Lump-sum settlements are often subject to significant taxes, potentially reducing the net amount received.

- Vulnerability to Poor Decisions: The temptation to make impulsive purchases or investments can lead to regret.

2. Structured Settlement: Periodic Payments

A structured settlement involves receiving the settlement amount in installments over a specified period. This offers several advantages:

- Financial Discipline: Regular payments can foster better financial planning and budgeting habits.

- Tax Efficiency: Depending on the structure, some portions of structured settlements might receive more favorable tax treatment.

- Long-Term Financial Security: Provides a steady stream of income, potentially mitigating the risk of running out of money.

3. Annuities: Guaranteed Income Stream

Annuities are contracts with an insurance company that provide a guaranteed stream of income for a specified period or for life. They offer:

- Predictability: Regular, guaranteed payments offer financial stability.

- Inflation Protection: Some annuities offer protection against inflation, ensuring the purchasing power of payments doesn't erode over time.

- Estate Planning: Can be structured to provide income for beneficiaries after your death.

Common Misconceptions about Settlement Options

Many misconceptions surround settlement options, leading to poor financial decisions. Let's debunk some of these:

Myth 1: A Lump-Sum Payment is Always Better. While immediate access to funds is tempting, the lack of long-term financial planning support and potential tax implications often outweigh the benefits for many.

Myth 2: Structured Settlements are Only for the Elderly or Infirm. Structured settlements are beneficial for anyone who benefits from disciplined spending habits and long-term financial security. They are not solely for the elderly.

Myth 3: Annuities are Too Complex and Risky. While annuities have their complexities, they offer a level of predictable income that many find attractive. Understanding the terms and conditions is crucial, but the risk is often lower than other investment options.

Identifying the False Statement: A Critical Analysis

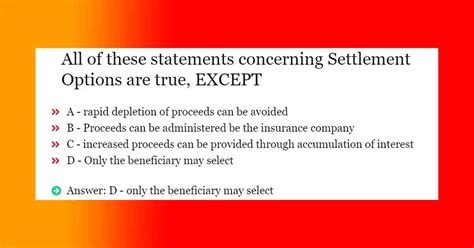

Now, let's tackle the core question: "All of these statements concerning settlement options are true EXCEPT…" To answer this, we need a set of statements to analyze. For the sake of this exercise, let's consider these example statements:

Statement A: Lump-sum settlements offer immediate access to funds but require careful financial planning.

Statement B: Structured settlements provide a steady income stream and can offer tax advantages.

Statement C: Annuities guarantee a stream of income, often providing inflation protection.

Statement D: Choosing the best settlement option depends solely on the size of the settlement amount.

Statement E: Professional financial advice is highly recommended when making settlement decisions.

Analysis:

Statements A, B, C, and E are all generally true. They accurately reflect the characteristics and considerations associated with each settlement option and emphasize the importance of professional guidance.

Statement D, however, is FALSE. The size of the settlement certainly influences the choice of option, but it is not the sole determining factor. Individual circumstances, risk tolerance, financial goals, and long-term needs all play a crucial role in making an informed decision. Someone with modest financial literacy might benefit more from a structured settlement even with a large lump sum, while someone with sophisticated investment knowledge might manage a substantial lump sum effectively.

Therefore, the answer to "All of these statements concerning settlement options are true EXCEPT…" is Statement D.

Making Informed Decisions: Key Considerations

When deciding on a settlement option, consider these crucial factors:

- Your Financial Literacy: Are you comfortable managing a large sum of money?

- Your Financial Goals: Do you need a steady income stream or a large sum for a specific purpose?

- Your Risk Tolerance: Are you comfortable with the potential for investment losses or do you prefer guaranteed income?

- Your Long-Term Needs: Will you require ongoing income for retirement or other long-term expenses?

- Tax Implications: Understand the tax consequences of each option. Consult with a tax professional.

- Professional Advice: Seek guidance from a financial advisor, lawyer, and/or accountant to ensure you're making the best decision for your individual circumstances.

Conclusion: Navigating the Settlement Landscape

Choosing a settlement option is a significant financial decision. Understanding the nuances of lump-sum payments, structured settlements, and annuities is crucial. By carefully considering your individual needs and seeking professional guidance, you can navigate this complex process and make informed decisions that secure your financial future. Remember, the "best" option isn't universal; it's the one that aligns perfectly with your unique circumstances and goals. Always prioritize thorough research and expert advice to make the most of your settlement.

Latest Posts

Latest Posts

-

Which Is Considered A Good Conductor Milady

Mar 26, 2025

-

When Workers May Be Exposed To Blank

Mar 26, 2025

-

Cloud Computing Is Not Typically Suited For Situations

Mar 26, 2025

-

In The 21st Century We Define Justice As

Mar 26, 2025

-

Internet Acquaintances Can Pose A Security Threat

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about All Of These Statements Concerning Settlement Options Are True Except . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.