An Adjustable-rate Mortgage Is One That Quizlet

Breaking News Today

Mar 31, 2025 · 6 min read

Table of Contents

An Adjustable-Rate Mortgage (ARM) Is One That: A Comprehensive Guide

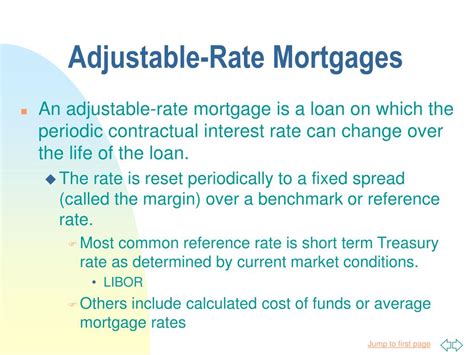

An adjustable-rate mortgage (ARM) is a home loan where the interest rate isn't fixed for the entire loan term. Unlike a fixed-rate mortgage, where your monthly payment remains consistent, an ARM's interest rate fluctuates based on an underlying economic index, resulting in varying monthly payments over the life of the loan. Understanding the intricacies of ARMs is crucial for prospective homeowners to make informed decisions about their financing. This comprehensive guide delves deep into the specifics of adjustable-rate mortgages, explaining their mechanisms, advantages, disadvantages, and helping you determine if an ARM is the right choice for you.

Understanding the Mechanics of an Adjustable-Rate Mortgage

The core principle behind an ARM is its adjustable interest rate. This rate isn't static; it's periodically adjusted based on a benchmark index, such as the Secured Overnight Financing Rate (SOFR), the London Interbank Offered Rate (LIBOR) – though LIBOR is being phased out – or the Constant Maturity Treasury (CMT) rate. The frequency of these adjustments varies depending on the loan terms, typically ranging from monthly to annually.

Key Components of an ARM:

- Index: This is the underlying economic indicator that the ARM's interest rate is tied to. It reflects broader market conditions and interest rate trends.

- Margin: This is a fixed percentage added to the index rate to determine your actual interest rate. It remains constant throughout the loan term.

- Initial Interest Rate: This is the rate you'll pay for a specified period, usually the first year or five years, before adjustments begin. This initial period is known as the introductory period or initial fixed-rate period.

- Adjustment Period: The frequency at which your interest rate is adjusted (e.g., annually, semiannually).

- Interest Rate Caps: These limits the amount your interest rate can increase or decrease at each adjustment and over the life of the loan. There are typically two types: periodic caps (limiting the increase/decrease at each adjustment) and lifetime caps (limiting the total increase over the loan's life).

- Payment Caps: These limit the amount your monthly payment can increase at each adjustment. However, it's crucial to understand that even with payment caps, the loan's amortization schedule might extend, meaning you could end up paying more interest over the loan's lifetime.

Types of Adjustable-Rate Mortgages

ARMs aren't one-size-fits-all. Several types exist, each with varying characteristics:

1. 5/1 ARM: This popular ARM offers a fixed interest rate for the first five years, after which the rate adjusts annually.

2. 3/1 ARM: Similar to the 5/1 ARM but with a fixed rate for only three years before annual adjustments.

3. 7/1 ARM: This provides a fixed rate for seven years before annual adjustments.

4. 10/1 ARM: Offers a fixed rate for ten years before annual adjustments.

The number before the slash indicates the initial fixed-rate period, and the number after indicates the frequency of rate adjustments. Longer initial fixed-rate periods generally lead to lower initial payments but carry higher long-term interest rate risk.

Advantages of Adjustable-Rate Mortgages

- Lower Initial Interest Rates: ARMs often start with lower interest rates than fixed-rate mortgages, leading to lower initial monthly payments. This can be particularly beneficial for first-time homebuyers with tighter budgets or those anticipating a shorter stay in the house.

- Potential for Lower Overall Interest Costs: If interest rates decline during the loan term, your monthly payments could decrease, potentially resulting in lower overall interest costs compared to a fixed-rate mortgage.

- Flexibility: ARMs offer more flexibility than fixed-rate mortgages, allowing you to potentially refinance to a fixed-rate mortgage if interest rates rise significantly.

Disadvantages of Adjustable-Rate Mortgages

- Interest Rate Risk: This is the primary disadvantage. Rising interest rates can significantly increase your monthly payments, potentially making your mortgage unaffordable. Understanding potential payment shocks is essential before opting for an ARM.

- Payment Uncertainty: The unpredictability of future payments can make budgeting difficult and stressful.

- Negative Amortization: In some cases, especially if your interest rate increases substantially, your monthly payment may not cover the accrued interest, leading to negative amortization. This means you'll owe more on your loan than you initially borrowed.

- Potential for Higher Overall Interest Costs: If interest rates rise throughout the loan term, you could end up paying substantially more interest than with a fixed-rate mortgage.

How to Determine if an ARM is Right for You

Choosing between an ARM and a fixed-rate mortgage depends on your individual financial circumstances, risk tolerance, and expectations. Consider these factors:

- Your Risk Tolerance: Are you comfortable with the possibility of significantly higher monthly payments in the future? If you're risk-averse, a fixed-rate mortgage might be a safer choice.

- Your Financial Situation: Can you comfortably afford the initial payments, even if they increase significantly? Consider your income stability and any potential changes that might affect your ability to repay.

- Your Expected Homeownership Timeline: If you plan to sell your home before the initial fixed-rate period expires, the risk of fluctuating interest rates is less impactful.

- Interest Rate Predictions: Analyze current interest rate trends and forecasts to gauge the potential for future rate changes. However, remember that predicting interest rates is not an exact science.

- Consult a Financial Advisor: A financial professional can help you assess your risk tolerance, analyze your financial situation, and provide guidance on the most suitable mortgage type.

Comparing ARMs to Fixed-Rate Mortgages

The decision between an ARM and a fixed-rate mortgage involves weighing several key differences:

| Feature | Adjustable-Rate Mortgage (ARM) | Fixed-Rate Mortgage |

|---|---|---|

| Interest Rate | Variable, adjusts periodically | Fixed for the entire loan term |

| Monthly Payment | Varies over time | Remains consistent throughout the loan term |

| Initial Payment | Typically lower | Typically higher |

| Risk | Higher interest rate risk | Lower interest rate risk |

| Predictability | Lower | Higher |

| Long-term cost | Potentially lower, potentially higher | Predictable and consistent |

Minimizing the Risks of ARMs

While ARMs carry inherent risks, you can take steps to mitigate them:

- Choose a Longer Initial Fixed-Rate Period: A longer initial fixed-rate period reduces the exposure to interest rate fluctuations.

- Consider ARMs with Caps: Look for ARMs with both periodic and lifetime caps to limit the potential for dramatic rate increases.

- Build an Emergency Fund: Having a substantial emergency fund can help you manage unexpected payment increases.

- Monitor Interest Rates: Stay informed about interest rate trends and consider refinancing if rates fall significantly.

Conclusion: Making the Right Choice

Choosing the right mortgage is a significant financial decision. While ARMs offer the potential for lower initial payments and potentially lower overall interest costs, they carry significant interest rate risk. Carefully weigh the advantages and disadvantages, consider your risk tolerance, and consult with a financial professional before making a final decision. Understanding the nuances of ARMs, including their mechanics, types, and associated risks, is crucial for informed decision-making and ensuring a comfortable and sustainable homeownership experience. Remember, the best mortgage for you depends on your specific circumstances and financial goals. Don't hesitate to seek expert advice to navigate this important process.

Latest Posts

Latest Posts

-

Which Of The Following Is Not True Of Online Communication

Apr 02, 2025

-

Nurses Touch The Leader Case 2 Client Safety Event

Apr 02, 2025

-

Explain How Seafood Watch Promotes Environmentally Responsible Fishing Practices

Apr 02, 2025

-

A Statement Of Stockholders Equity Lists Balances Of

Apr 02, 2025

-

At Minimum How Far Above The Floor

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about An Adjustable-rate Mortgage Is One That Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.