An Annual Percentage Rate Or Apr Represents How Much Quizlet

Breaking News Today

Mar 31, 2025 · 5 min read

Table of Contents

An Annual Percentage Rate (APR) Represents How Much? A Comprehensive Guide

Understanding the Annual Percentage Rate (APR) is crucial for anyone navigating the world of finance. Whether you're applying for a loan, credit card, or investing in a savings account, the APR plays a significant role in determining the true cost or return of your financial product. This comprehensive guide will delve deep into what an APR represents, its calculation, its importance in different financial scenarios, and how to use this knowledge to make informed financial decisions.

What is an Annual Percentage Rate (APR)?

The Annual Percentage Rate (APR) is the annual interest rate that reflects the total cost of borrowing or the total return on an investment. It's a standardized way to compare the costs of different financial products, enabling consumers to make well-informed choices. Unlike the simple interest rate, the APR accounts for all fees and charges associated with a loan or investment, providing a more holistic picture of the actual cost.

In simple terms: The APR represents the percentage of the principal amount you'll pay as interest over a year. This includes not only the interest but also other charges like origination fees, processing fees, and other associated costs. This makes it a far more accurate representation of the true cost than simply looking at the nominal interest rate.

APR vs. Nominal Interest Rate: Key Differences

Many people confuse the APR with the nominal interest rate. The nominal interest rate is the stated interest rate without considering any additional fees or charges. The APR, on the other hand, incorporates all these factors, providing a more complete picture of the actual cost.

Here's a table summarizing the key differences:

| Feature | Nominal Interest Rate | Annual Percentage Rate (APR) |

|---|---|---|

| Definition | Stated interest rate | Total cost of borrowing/investment |

| Fees Included | No | Yes |

| Accuracy | Less accurate | More accurate |

| Comparison | Difficult | Easy |

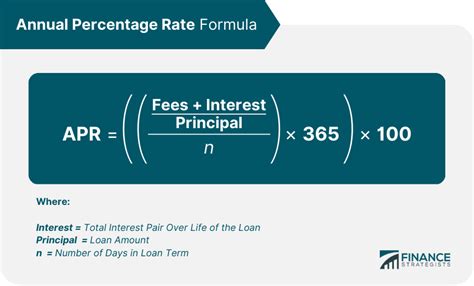

How is APR Calculated?

The calculation of APR is complex and involves several steps. While the exact formula can vary slightly depending on the financial product and jurisdiction, the general principle remains the same: it accounts for all fees and charges incurred over the life of the loan or investment.

Key components involved in APR calculation:

- Principal: The initial amount borrowed or invested.

- Interest Rate: The stated interest rate.

- Fees: Any additional charges associated with the loan or investment (e.g., origination fees, processing fees, closing costs).

- Loan Term: The length of the loan or investment.

- Compounding Frequency: How often interest is calculated and added to the principal.

Simplified Example:

Imagine a loan with a principal of $10,000, a nominal interest rate of 5%, and an origination fee of $200. The APR will be higher than 5% because it incorporates the $200 fee. The exact APR will depend on the loan term and compounding frequency. The APR calculation is usually done using complex mathematical formulas or specialized software, so it's not something you'd manually calculate easily.

APR in Different Financial Scenarios

The APR plays a crucial role in various financial scenarios:

1. Loans: Mortgages, Auto Loans, Personal Loans

When taking out a loan, the APR provides a critical benchmark for comparing different lenders and loan offers. A lower APR means lower overall borrowing costs, making it a significant factor in choosing the best loan option. Carefully comparing APRs across different lenders is vital to secure the most affordable loan.

2. Credit Cards

Credit cards often present an APR for purchases and cash advances. This APR significantly impacts the amount of interest you’ll accrue on outstanding balances. High APRs on credit cards can quickly lead to high debt burdens, emphasizing the importance of understanding and managing credit card debt effectively.

3. Savings Accounts and Investments

While the term "APR" is commonly associated with borrowing, it also applies to savings accounts and investments. In this context, a higher APR indicates a higher return on your investment. Comparing APRs across different savings accounts and investment options helps to maximize returns and make informed investment decisions.

4. Other Financial Products

The concept of APR extends beyond loans, credit cards, and investments. Many other financial products, such as lines of credit and certain types of insurance, also use APR to represent the total cost or return.

Importance of Understanding APR

Understanding APR is critical for making sound financial decisions. It empowers you to:

- Compare Financial Products: Easily compare different loan offers, credit cards, and investment options based on their true cost or return.

- Avoid Overspending: A high APR can lead to significant additional costs over time, especially on loans and credit cards. Understanding APR helps you to budget effectively and avoid unnecessary expenses.

- Negotiate Better Terms: Knowledge of APR can put you in a stronger position to negotiate better loan terms with lenders, potentially securing a lower interest rate.

- Make Informed Investments: A higher APR on savings accounts or investments indicates greater returns, helping to maximize your investment outcomes.

Tips for Minimizing Your APR

While you can’t always control the APR offered by a lender, you can take steps to improve your chances of securing a favorable rate:

- Improve your credit score: A higher credit score often qualifies you for lower APRs.

- Shop around: Compare offers from multiple lenders to find the best APR.

- Consider a shorter loan term: This will generally result in a lower APR, though your monthly payments will be higher.

- Make a larger down payment: A larger down payment can often secure a better interest rate.

- Negotiate with lenders: Don't be afraid to negotiate with lenders to try and secure a lower APR.

Conclusion

The Annual Percentage Rate (APR) is a crucial metric in personal finance. It represents the true cost of borrowing or the total return on an investment, accounting for all fees and charges. Understanding its calculation and implications allows individuals to make informed decisions regarding loans, credit cards, investments, and other financial products. By carefully comparing APRs and taking steps to minimize your borrowing costs, you can take control of your finances and build a strong financial future. Remember to always shop around and compare offers before committing to any financial product. The knowledge you gain will greatly benefit your financial wellbeing.

Latest Posts

Latest Posts

-

Which Of The Following Best Describes A Focus Group

Apr 02, 2025

-

A Corporation Is Created By Obtaining A Charter From

Apr 02, 2025

-

Quiz On Act 1 Of The Crucible

Apr 02, 2025

-

Weight Lifting Is An Example Of An Anaerobic Exercise

Apr 02, 2025

-

Kaci Will Be An Effective Speaker Because She

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about An Annual Percentage Rate Or Apr Represents How Much Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.