An Individual Who Removes The Risk Of Losing Money

Breaking News Today

Mar 25, 2025 · 7 min read

Table of Contents

The Risk-Averse Investor: Strategies to Secure Your Financial Future

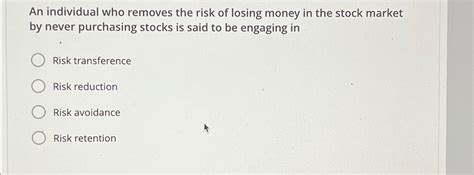

Losing money is a fear that plagues many investors. The rollercoaster ride of the market, the unpredictable nature of global events, and the constant threat of unforeseen circumstances can leave even the most seasoned individuals feeling vulnerable. But what if there was a way to significantly mitigate, if not eliminate, the risk of losing your hard-earned money? This article explores various strategies employed by risk-averse investors to safeguard their financial future and build wealth without the constant anxiety of potential losses.

Understanding Your Risk Tolerance: The Foundation of Secure Investing

Before delving into specific strategies, it’s crucial to understand your own risk tolerance. Are you comfortable with the possibility of short-term losses for the potential of higher long-term gains? Or do you prioritize capital preservation above all else? Honesty is key here. Ignoring your risk aversion can lead to impulsive decisions and ultimately, financial distress.

Identifying Your Risk Profile:

- Conservative: You prioritize capital preservation and are willing to accept lower returns to minimize risk. You sleep well at night knowing your money is safe.

- Moderate: You’re comfortable with some risk, balancing potential gains with the acceptance of some losses. You understand market fluctuations are part of the game.

- Aggressive: You’re willing to take on higher risk for the potential of significantly higher returns. You're comfortable with market volatility and understand that losses are a possibility.

Determining your risk profile is the first step in building a robust investment strategy that aligns with your personality and financial goals.

Strategies for Risk-Averse Investors: Minimizing Losses and Maximizing Security

For those who prioritize security above all else, several strategies offer a path to financial success without the constant threat of significant losses.

1. Diversification: Spreading Your Risk Across Multiple Assets

Diversification is the cornerstone of any successful investment strategy, but it's particularly crucial for risk-averse investors. Instead of putting all your eggs in one basket, spread your investments across various asset classes:

- Stocks: While inherently volatile, stocks offer long-term growth potential. Diversify across different sectors (technology, healthcare, consumer goods) and market caps (large, mid, small).

- Bonds: Bonds are generally considered less risky than stocks and offer a fixed income stream. Government bonds are considered the safest, followed by corporate bonds.

- Real Estate: Real estate can provide diversification and potential rental income. However, it’s illiquid and requires significant capital investment.

- Commodities: Investing in commodities like gold or oil can act as a hedge against inflation and market volatility.

- Mutual Funds and ETFs: These pooled investment vehicles offer instant diversification across a range of assets, making it easier to manage risk.

Important Note: Even with diversification, it's impossible to completely eliminate risk. However, it significantly reduces the impact of any single investment performing poorly.

2. High-Yield Savings Accounts and Certificates of Deposit (CDs): The Safety Net

For a risk-averse investor, high-yield savings accounts and CDs provide a safe haven for a portion of their funds. While the returns may be modest compared to other investments, they offer:

- FDIC Insurance: Deposits in FDIC-insured banks are protected up to $250,000 per depositor, per insured bank, for each account ownership category. This ensures your money is safe even if the bank fails.

- Liquidity: Access to your funds is readily available with savings accounts. CDs have a fixed term, but you can often withdraw funds with a penalty.

- Predictable Returns: While returns are typically low, they are predictable and consistent, providing a sense of stability.

While these options might not generate substantial wealth, they provide a critical foundation of financial security and can act as a buffer during market downturns.

3. Index Funds and ETFs: Passive Investing for Consistent Returns

Index funds and ETFs track a specific market index (like the S&P 500), providing instant diversification and lower expense ratios than actively managed funds. This passive investing approach is ideal for risk-averse investors who want exposure to the market without the complexities of stock picking.

- Lower Fees: Index funds and ETFs typically charge lower fees than actively managed funds, meaning more of your investment grows over time.

- Broad Diversification: By tracking an index, you automatically gain exposure to a large basket of stocks, reducing the impact of any single stock's poor performance.

- Long-Term Growth: Index funds and ETFs provide consistent long-term growth aligned with the overall market performance.

4. Dollar-Cost Averaging (DCA): Reducing the Impact of Market Volatility

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps mitigate risk by:

- Averaging out the purchase price: You buy more shares when prices are low and fewer when they are high, effectively reducing your average cost per share.

- Reducing emotional decision-making: DCA eliminates the temptation to time the market, a notoriously difficult and often unsuccessful strategy.

- Minimizing losses from market downturns: By consistently investing, you avoid the risk of putting all your money into the market just before a significant drop.

5. Government Bonds: The Ultimate in Safety

Government bonds, issued by national governments, are considered one of the safest investments available. They offer:

- Low Risk: The likelihood of a government defaulting on its debt is extremely low, especially for developed countries.

- Fixed Income: Government bonds provide a predictable stream of income through regular interest payments.

- Inflation Protection: Some government bonds offer inflation protection, ensuring your returns keep pace with rising prices.

6. Seeking Professional Advice: The Expert's Touch

For those who feel overwhelmed by investment decisions, seeking advice from a qualified financial advisor is invaluable. A financial advisor can:

- Help determine your risk tolerance: They’ll help you understand your investment goals and create a personalized strategy aligned with your risk profile.

- Develop a diversified portfolio: They’ll create a diversified investment plan that suits your needs and helps manage risk.

- Monitor your investments: They’ll actively manage your portfolio and make adjustments as needed based on market conditions.

- Provide ongoing support and guidance: They'll be your trusted partner throughout your financial journey, answering your questions and alleviating concerns.

Beyond Investments: Protecting Your Financial Well-being

Minimizing the risk of losing money extends beyond investments. Several strategies ensure overall financial security:

1. Emergency Fund: A Safety Net for Unexpected Events

An emergency fund is a crucial element of financial security. It should cover 3-6 months of living expenses and acts as a buffer against unexpected job loss, medical emergencies, or home repairs.

2. Debt Management: Reducing Financial Burden

High levels of debt, particularly high-interest debt like credit card debt, can significantly increase your financial risk. Prioritize paying down debt to free up cash flow and reduce financial stress.

3. Insurance: Protecting Against Catastrophic Losses

Insurance policies, such as health, home, auto, and life insurance, protect against unexpected events that could cause significant financial losses. Adequate insurance coverage is essential for a secure financial future.

4. Financial Literacy: Empowering Yourself with Knowledge

Continuously educating yourself about personal finance empowers you to make informed decisions, manage risk effectively, and build a secure financial future.

Conclusion: Building a Secure Financial Future

Minimizing the risk of losing money requires a multi-faceted approach. By combining a diversified investment strategy, a healthy emergency fund, responsible debt management, appropriate insurance coverage, and continuous financial education, you can build a strong foundation for a secure financial future. Remember that the key lies in understanding your own risk tolerance and selecting strategies that align with your goals and comfort level. While eliminating all risk is impossible, employing these strategies empowers you to significantly reduce your exposure and sleep soundly knowing your financial well-being is protected. The journey to financial security requires commitment, discipline, and a proactive approach. But the peace of mind that comes with knowing your money is safe is worth the effort.

Latest Posts

Latest Posts

-

A Partial Bath Includes Washing A Residents

May 12, 2025

-

Which Of The Following Describes A Net Lease

May 12, 2025

-

Nurse Logic 2 0 Knowledge And Clinical Judgment

May 12, 2025

-

Panic Disorder Is Characterized By All Of The Following Except

May 12, 2025

-

Positive Individual Traits Can Be Taught A True B False

May 12, 2025

Related Post

Thank you for visiting our website which covers about An Individual Who Removes The Risk Of Losing Money . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.