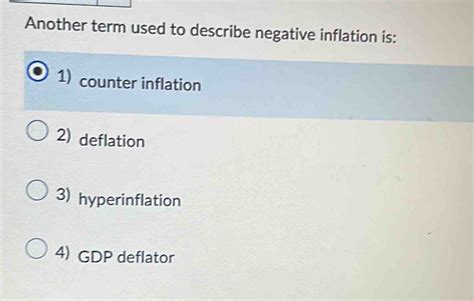

Another Term Used To Describe Negative Inflation Is

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Another Term Used to Describe Negative Inflation Is: Deflation – A Deep Dive into its Causes, Consequences, and Solutions

Another term used to describe negative inflation is deflation. While the terms might seem interchangeable, understanding the nuances of deflation is crucial for policymakers, businesses, and individuals alike. This article delves deep into the complexities of deflation, exploring its causes, consequences, both positive and negative, and potential solutions. We'll examine the various factors contributing to deflationary pressures and analyze its impact on economic growth, investment, and consumer behavior.

Understanding Deflation: More Than Just Falling Prices

Deflation, simply put, is a sustained decrease in the general price level of goods and services in an economy over a period of time. This is the opposite of inflation, where prices generally rise. While falling prices might initially seem beneficial to consumers – allowing them to purchase more goods with the same amount of money – the reality is far more nuanced and often detrimental to long-term economic health. The sustained nature of the price decline is key; a temporary dip in prices doesn't constitute deflation.

The Difference Between Deflation and Disinflation

It's essential to differentiate deflation from disinflation. Disinflation refers to a slowing of the rate of inflation. For instance, if inflation falls from 5% to 3%, this is disinflation. However, if prices actually begin to fall, even if only slightly, that signifies deflation. The key distinction lies in the direction of price movement: disinflation is a decreasing rate of inflation, while deflation is a negative inflation rate.

Causes of Deflation: A Multifaceted Phenomenon

Deflation rarely occurs in isolation; it's typically the result of a confluence of factors that interact in complex ways. Some of the major causes include:

1. Reduced Aggregate Demand

One of the most significant contributors to deflation is a decrease in aggregate demand – the total demand for goods and services in an economy. This can be triggered by various events, including:

- Economic Recessions: During recessions, consumer spending and business investment decline sharply, leading to decreased demand and falling prices.

- Reduced Consumer Confidence: When consumers are pessimistic about the future, they tend to postpone purchases, further reducing aggregate demand.

- Increased Savings: A rise in precautionary savings, driven by economic uncertainty or fear of job losses, can also suppress aggregate demand.

- Tight Monetary Policy: Central banks often raise interest rates to combat inflation. However, overly aggressive monetary tightening can lead to a sharp contraction in credit availability, reducing investment and spending, and ultimately deflation.

2. Increased Productivity and Technological Advancements

While seemingly positive, increased productivity and technological advancements can contribute to deflationary pressures. As businesses become more efficient, they can produce goods and services at lower costs, leading to lower prices for consumers. This can be beneficial in the short term, but if not balanced by increased demand, it can lead to deflationary spirals.

3. Supply Shocks

Unexpected increases in the supply of goods and services, such as a bumper crop or increased imports, can also cause prices to fall. While benefiting consumers in the short term, this can lead to deflation if not accompanied by a corresponding increase in demand.

4. Debt Deflation

This is a particularly dangerous type of deflation. It occurs when falling prices increase the real burden of debt for borrowers. As the value of collateral falls, borrowers may struggle to repay their loans, leading to defaults and further economic contraction. This vicious cycle can intensify deflationary pressures.

Consequences of Deflation: The Double-Edged Sword

While falling prices might initially seem attractive to consumers, deflation has severe negative consequences that outweigh any perceived benefits. These include:

1. The Deflationary Spiral

This is perhaps the most significant risk of deflation. Falling prices lead consumers to postpone purchases, anticipating even lower prices in the future. This reduced demand further pushes down prices, creating a vicious cycle that can lead to economic stagnation or even recession.

2. Reduced Investment

Businesses are hesitant to invest in expansion or new projects when they anticipate falling prices and reduced demand. This can stifle economic growth and job creation.

3. Increased Real Debt Burden

As mentioned earlier, deflation increases the real value of debt, making it harder for businesses and individuals to repay their loans. This can lead to bankruptcies and financial instability.

4. Lower Profit Margins

Falling prices squeeze profit margins for businesses, potentially leading to layoffs and reduced economic activity.

5. Currency Appreciation

In an open economy, deflation can lead to an appreciation of the domestic currency. This makes exports more expensive and imports cheaper, hurting domestic producers and potentially leading to a trade deficit.

Positive Aspects of Deflation (Rare and Conditional)

It's important to note that deflation isn't always inherently negative. In certain limited circumstances, controlled deflation can have some positive effects. However, these are typically associated with highly specific economic contexts and are often short-lived:

- Increased Purchasing Power: Consumers might have increased purchasing power in the short term, assuming their incomes remain stable.

- Stimulus for Savings: Deflation encourages saving, as people anticipate purchasing power gains in the future.

However, these potential benefits are far outweighed by the significant risks associated with sustained deflation, which is why policymakers actively seek to avoid it.

Addressing Deflation: Policy Responses

Combating deflation requires a multi-pronged approach involving both monetary and fiscal policies. Central banks typically employ the following strategies:

1. Monetary Policy: Lowering Interest Rates

Central banks can lower interest rates to encourage borrowing and spending. This increases the money supply and stimulates economic activity. However, extremely low or negative interest rates can have their own limitations, including impacting bank profitability and potentially leading to disincentives for saving.

2. Quantitative Easing (QE)

QE involves central banks injecting liquidity into the financial system by purchasing assets, such as government bonds. This aims to lower long-term interest rates and increase lending.

3. Fiscal Policy: Government Spending and Tax Cuts

Governments can stimulate the economy through increased spending on infrastructure projects or by cutting taxes. This increases aggregate demand and combats deflationary pressures.

4. Supply-Side Policies: Enhancing Productivity and Innovation

While not a direct response to immediate deflationary pressures, long-term supply-side policies focusing on increased productivity, innovation, and investment can help prevent future deflationary episodes.

Conclusion: Navigating the Deflationary Landscape

Deflation, or negative inflation, is a complex economic phenomenon with far-reaching consequences. While initially seeming beneficial due to falling prices, the risks of a deflationary spiral, increased debt burdens, reduced investment, and economic stagnation far outweigh any perceived benefits. Addressing deflation requires a comprehensive approach, employing both monetary and fiscal policies to stimulate demand and prevent a damaging economic downturn. Understanding the causes and consequences of deflation is crucial for policymakers, businesses, and individuals to navigate the economic landscape effectively. Continued monitoring of economic indicators and proactive policy responses are key to mitigating the risks associated with this potentially devastating economic condition. The ongoing challenge remains in finding the right balance between preventing deflation and controlling inflation, ensuring sustainable economic growth and stability.

Latest Posts

Latest Posts

-

The Manager Is Responsible For Knowing The Food Sanitation Rules

May 09, 2025

-

Which Of The Following Is Not A Neurotransmitter

May 09, 2025

-

How The Federal Government Aligns Resources And Delivers Core Capabilities

May 09, 2025

-

Horizontal Integration Helped Me Monopolize The Oil Market

May 09, 2025

-

Identify A Lateral Projection Of A Vertebra

May 09, 2025

Related Post

Thank you for visiting our website which covers about Another Term Used To Describe Negative Inflation Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.