Benefits Provided By A Medicare Supplement Policy Must Not

Breaking News Today

Mar 26, 2025 · 5 min read

Table of Contents

Medicare Supplement Policy: What Benefits You Must Not Overlook

Choosing the right Medicare plan can feel overwhelming. While Original Medicare (Parts A and B) provides foundational coverage, it often leaves significant gaps in your out-of-pocket expenses. This is where Medicare Supplement Insurance (Medigap) steps in. However, understanding the nuances of Medigap plans – and specifically, what they don't cover – is crucial to making an informed decision. This article delves deep into the essential aspects of Medigap policies, highlighting the areas where you must not expect coverage. Knowing these limitations will empower you to make the best choice for your healthcare needs and financial security.

What Medicare Supplement Plans DO Cover

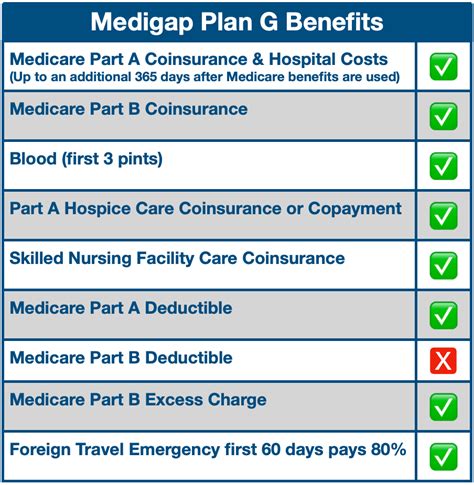

Before we explore the critical areas of non-coverage, let's briefly recap what Medigap plans typically do cover. These plans help fill the gaps in Original Medicare, reducing your out-of-pocket costs for:

-

Hospital Costs (Part A): Many Medigap plans cover your Medicare Part A deductible, coinsurance, and even some hospital costs beyond what Medicare pays. This is especially valuable during prolonged hospital stays.

-

Medical Expenses (Part B): Medigap plans often cover your Part B deductible, coinsurance, and some of the 20% you typically owe after Medicare pays its share. This can significantly decrease your bills from doctor visits, outpatient care, and other medical services.

-

Foreign Travel Emergency: Some plans offer limited coverage for emergency care received while traveling outside the United States.

The Crucial "Must Nots" of Medicare Supplement Plans

While Medigap policies offer valuable protection, it's vital to remember their limitations. Understanding these non-coverage areas is critical for avoiding unexpected medical bills:

1. Long-Term Care: A Significant Gap

Long-term care, including nursing home stays, assisted living facilities, and in-home care services, is not covered by Medicare Supplement plans. This is a major area where many seniors face significant financial burdens. Long-term care costs can quickly escalate, and having a separate long-term care insurance policy or planning for these costs is crucial.

2. Vision, Hearing, and Dental Care: Out-of-Pocket Expenses

Medigap policies generally do not cover routine vision, hearing, and dental care. These services are typically considered preventative or elective, and Original Medicare has minimal coverage in these areas. You'll need to budget for these expenses separately or consider supplemental plans specifically designed for vision, hearing, or dental care. Understanding this gap is critical to preventing surprise bills related to eyeglasses, hearing aids, and dental work.

3. Most Prescription Drugs: Rely on Part D

Prescription drug coverage is not included in standard Medigap plans. To cover prescription drugs, you must enroll in a separate Medicare Part D plan. Failing to enroll in a Part D plan when eligible can result in significant out-of-pocket expenses for medications. Careful consideration of Part D plans, including formularies and costs, is essential.

4. Preventive Services: Check Your Coverage Carefully

While many preventive services are covered by Original Medicare Part B, the extent of coverage might vary depending on the specific service and the doctor's recommendations. Medigap policies will typically only cover the cost-sharing amounts, such as copayments and coinsurance, but not the entire cost of preventive services. Always confirm with your provider and plan administrator to clarify if preventive services will require any out-of-pocket payments.

5. Foreign Travel – Extensive Coverage Not Guaranteed

While some Medigap policies offer limited emergency coverage for medical care received while traveling outside the U.S., it's essential to understand the restrictions. Coverage is typically for emergencies only and often excludes pre-existing conditions. Comprehensive travel health insurance is usually necessary for extensive travel abroad.

6. Experimental or Investigational Treatments: Uncovered Expenses

Medigap plans generally do not cover experimental or investigational treatments. These treatments are not yet fully approved by the FDA and are often very costly. Researching the approval status of a treatment is crucial before proceeding, and financial preparedness is essential in case of unapproved treatments.

7. Health and Wellness Programs: Limited or No Coverage

Many health and wellness programs, such as weight loss programs, smoking cessation programs, or fitness memberships, are not covered by Medigap plans. These programs often require separate funding, and considering alternative options or exploring available discounts is recommended.

8. Cosmetic Procedures: Strictly Out-of-Pocket

Cosmetic procedures are almost always not covered by Medigap plans. These procedures are generally elective and not considered medically necessary. Budgeting for cosmetic surgery or related procedures should be done independently and without expectation of insurance coverage.

Choosing the Right Medigap Plan: Navigating the Complexities

Selecting the correct Medigap plan depends on your individual needs and financial situation. Understanding the areas where Medigap plans don't provide coverage allows you to make informed decisions and adequately prepare for potential healthcare expenses. Comparing plans from different providers and considering your projected healthcare needs are essential steps.

Key Considerations:

-

Your Health Status: Pre-existing conditions significantly impact your choice of plan and its coverage. Understanding how pre-existing conditions are addressed is crucial.

-

Your Financial Situation: Medigap plans vary in cost. A thorough assessment of your financial situation and potential healthcare expenditures is crucial for selecting a plan that aligns with your budget.

-

Future Healthcare Needs: Consider your projected healthcare needs, especially as you age. The plan you select should account for potential increases in healthcare costs.

-

Professional Guidance: Consulting with a licensed insurance agent or a Medicare counselor is highly recommended. Their expertise can help you understand the nuances of various Medigap plans and their limitations.

Conclusion: Informed Decisions Lead to Financial Security

Medicare Supplement Insurance can significantly reduce your out-of-pocket expenses for covered healthcare services. However, understanding what it doesn't cover is equally important. By focusing on the gaps in coverage, particularly long-term care, prescription drugs, vision, hearing, and dental care, you can make informed decisions that secure your financial well-being in your later years. Remember, proactive planning, careful consideration of additional insurance policies, and seeking professional guidance are key to navigating the intricacies of Medicare and securing your healthcare future. Armed with this knowledge, you can choose a Medigap plan that best suits your needs and reduces the risks of unexpected financial burdens related to your healthcare.

Latest Posts

Latest Posts

-

Cyberbullying Prevention Provides A Safe Environment By

Mar 27, 2025

-

Which Is A True Statement Regarding Depressive Disorders

Mar 27, 2025

-

What Is One Of The Characteristics Of Multicultural Literature

Mar 27, 2025

-

Which Of These Is The Best Example Of Fragmentation

Mar 27, 2025

-

The Most Likely Cause Of Bedding In This Image Is

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Benefits Provided By A Medicare Supplement Policy Must Not . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.