Cgl Always Excludes Liability Arises Out Of

Breaking News Today

Mar 21, 2025 · 6 min read

Table of Contents

CGL Always Excludes Liability Arising Out of: A Comprehensive Guide

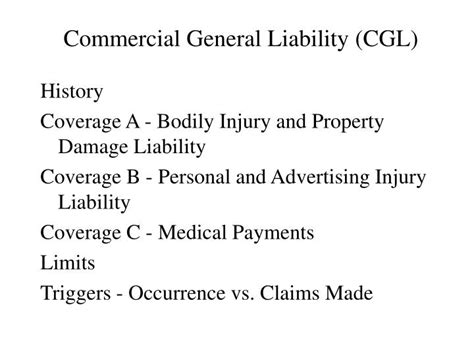

Commercial General Liability (CGL) insurance policies are designed to protect businesses from financial losses arising from third-party claims of bodily injury or property damage. However, these policies are not all-encompassing. CGL policies consistently exclude liability arising out of specific situations, and understanding these exclusions is crucial for businesses to adequately protect themselves. Failure to understand these limitations can lead to significant financial hardship in the event of a claim. This article will delve into the common exclusions found in CGL policies, explaining their implications and how businesses can mitigate their risks.

Key Exclusions Found in Most CGL Policies

CGL policies typically exclude coverage for claims arising from a wide range of circumstances. While the specifics may vary slightly depending on the insurer and policy wording, several key exclusions are almost universally present. These include, but are not limited to:

1. Expected or Intended Injury or Damage:

This is perhaps the most common and fundamental exclusion. CGL insurance does not cover injuries or damages that the insured intended or could have reasonably expected to occur as a result of their actions. This exclusion prevents the policy from being used as a means of covering intentional acts, such as assault or battery. The key here is the intent or reasonable expectation of the outcome. For example, a bar owner who knowingly serves excessive alcohol to a visibly intoxicated patron and that patron subsequently injures someone in a car accident would likely not be covered.

2. Contractual Liability:

CGL policies typically exclude liability assumed under a contract. This means that if a business agrees in a contract to assume responsibility for the actions of another party, that liability is generally not covered under the CGL policy. Businesses should carefully review their contracts to determine if they are assuming any liability that would not be covered by their CGL policy. This often necessitates obtaining separate insurance coverage. Consider a contractor agreeing to be liable for damages to a client's property caused by subcontractors – this specific liability would likely be excluded.

3. Workers' Compensation:

Claims related to injuries sustained by employees in the course of their employment are not covered by a CGL policy. Employers are required to carry separate workers' compensation insurance to cover such claims. This is a crucial distinction; attempting to use a CGL policy to cover employee injuries will be unsuccessful.

4. Pollution or Environmental Damage:

Most CGL policies exclude liability for pollution or environmental damage, often with specific definitions of "pollution." This exclusion is broad and can encompass a wide range of situations, from chemical spills to groundwater contamination. Businesses that handle hazardous materials should secure specialized pollution liability insurance. This is a particularly critical exclusion for industries like manufacturing or waste disposal.

5. Auto Accidents:

Liability arising from the operation of automobiles is typically excluded from CGL policies. Businesses need to maintain separate commercial auto insurance to cover accidents involving company vehicles. This applies to accidents caused by company employees while driving company cars, as well as accidents involving company-owned vehicles even if driven by a third party.

6. Professional Services:

If a business provides professional services (e.g., medical, legal, accounting), errors or omissions in those services are usually not covered by a standard CGL policy. Businesses offering professional services require separate professional liability insurance (Errors and Omissions insurance or E&O insurance). This is a vital exclusion for professionals who could face lawsuits due to mistakes in their services.

7. Liquor Liability:

This exclusion specifically addresses claims stemming from alcohol-related incidents. Bars, restaurants, and other businesses serving alcohol often need to purchase a separate liquor liability policy due to this common exclusion. This type of coverage helps protect against claims arising from the serving of alcohol to intoxicated individuals leading to injury or property damage.

8. Damage to Insured's Property:

CGL policies do not cover damage to the insured’s own property. This is logical because the purpose of CGL is to protect against claims from third parties. Damage to a business's own premises or equipment would usually be handled under a property insurance policy.

9. War or Terrorism:

Coverage for damages resulting from acts of war or terrorism is often excluded, as these are typically covered under specialized policies or government programs.

Understanding Policy Language: The Importance of Specific Wording

It's critical to understand that the exact wording of these exclusions can vary significantly between insurance policies. Therefore, relying solely on generalized descriptions is insufficient. Always carefully review your specific policy documents to understand the precise scope of coverage and the limitations imposed by the exclusions.

Consult with an experienced insurance professional to ensure your policy adequately addresses your business's unique risks. They can help you decipher complex policy language and identify any potential gaps in your coverage.

Mitigating Risks and Avoiding Gaps in Coverage

While CGL exclusions are unavoidable, businesses can take proactive steps to minimize their exposure to uncovered liabilities:

-

Comprehensive Risk Assessment: Regularly assess your operations to identify potential risks and liabilities. This process should include considering potential scenarios and their likelihood of occurring.

-

Targeted Insurance Coverage: Secure supplementary insurance policies to address the liabilities excluded by your CGL policy. This might include professional liability insurance, pollution liability insurance, or workers’ compensation insurance, tailored to your specific business needs.

-

Contractual Review: Carefully review all contracts to ensure you are not unknowingly assuming liabilities that would not be covered by your existing insurance. Consult legal counsel if needed.

-

Risk Management Procedures: Implement robust risk management practices to minimize the likelihood of incidents that could lead to liability claims. This includes regular safety training for employees and adherence to industry best practices.

-

Regular Policy Review: Review your CGL policy annually with your insurance broker to ensure that it continues to meet your evolving needs and adequately covers your risks. Changes in your business operations or the regulatory environment may necessitate adjustments to your coverage.

-

Accurate Record Keeping: Maintain thorough and accurate records of your business operations, including safety procedures, employee training, and incident reports. This documentation can be critical in defending against liability claims.

-

Consult with Professionals: Seek guidance from insurance professionals and legal counsel when dealing with complex insurance matters or potential liability issues.

Conclusion: Proactive Management is Key

While a CGL policy provides essential protection for businesses, it's crucial to recognize its inherent limitations. The exclusions outlined above highlight the critical need for a comprehensive understanding of your policy's scope. By actively managing risks, obtaining supplementary insurance where necessary, and engaging with knowledgeable professionals, businesses can significantly reduce their exposure to uncovered liabilities and protect their financial stability. Ignoring these exclusions can lead to devastating consequences in the event of a liability claim, making proactive management and a thorough understanding of your insurance coverage absolutely paramount. This is not just about compliance; it's about responsible business practice and the long-term sustainability of your enterprise. Remember, proactive risk management is always cheaper and less stressful than reactive damage control.

Latest Posts

Latest Posts

-

Vicente Es De Costa Rica El Es De

Mar 28, 2025

-

Explain The Reciprocal Relationship Between Human Society And Limiting Factors

Mar 28, 2025

-

The Organization Of Beats Into Regular Groupings Is Called

Mar 28, 2025

-

Which Of The Following Would Represent A Referendum

Mar 28, 2025

-

As It Pertains To Group Health Insurance Cobra Stipulates That

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Cgl Always Excludes Liability Arises Out Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.