Commercial Banks Create Money When They Quizlet

Breaking News Today

Mar 30, 2025 · 6 min read

Table of Contents

Do Commercial Banks Create Money? A Deep Dive into Fractional Reserve Banking

The question of whether commercial banks create money is a complex one, often debated among economists. The simple answer is: yes, but not in the way most people think. Commercial banks don't conjure money out of thin air; instead, they expand the money supply through a process linked to fractional reserve banking and credit creation. This article will explore this process in detail, addressing common misconceptions and examining the implications for monetary policy and economic stability.

Understanding Fractional Reserve Banking: The Foundation of Money Creation

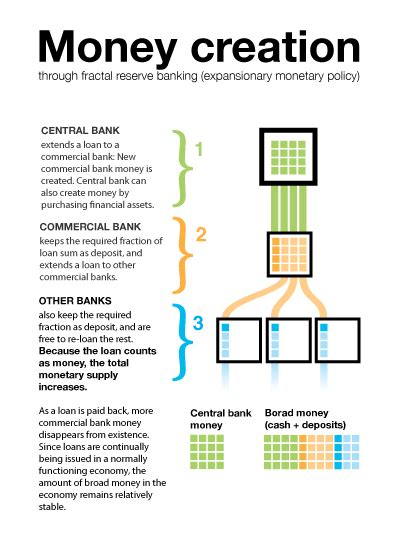

At the heart of this debate lies fractional reserve banking. This system requires banks to hold only a fraction of their deposits in reserve, a percentage mandated by the central bank (like the Federal Reserve in the US or Bank Negara Malaysia). This reserve requirement is crucial for ensuring banks can meet immediate withdrawal demands. The remaining portion of the deposits can be lent out, forming the basis for money creation.

The Money Multiplier Effect: Turning Deposits into Loans

Let's illustrate with an example. Suppose a customer deposits $1000 into Bank A, and the reserve requirement is 10%. Bank A must keep $100 (10% of $1000) in reserve but can lend out the remaining $900. This $900 loan is now new money in the system. The borrower likely deposits this $900 into Bank B. Bank B then keeps $90 (10% of $900) in reserve and lends out $810. This process continues, creating a chain reaction known as the money multiplier effect.

The money multiplier is calculated as 1 / reserve requirement. In our example, with a 10% reserve requirement, the money multiplier is 10 (1/0.1 = 10). Theoretically, the initial $1000 deposit could lead to a total of $10,000 in new money circulating in the economy ($1000 x 10).

Limitations of the Simple Money Multiplier Model

It's crucial to understand that the simple money multiplier model is a simplification. Several factors affect the actual money creation process, including:

-

Excess Reserves: Banks may choose to hold more reserves than legally required, reducing the amount available for lending. This is influenced by factors like economic uncertainty, perceived risk, and regulatory changes.

-

Demand for Loans: The money creation process relies on the demand for loans. If businesses and individuals are unwilling to borrow, the multiplier effect will be muted, even if banks have excess reserves. Economic downturns often see a decrease in loan demand.

-

Leakages: Not all money lent out will be redeposited into the banking system. Some may be held as cash, invested outside the banking system, or used for international transactions. These leakages reduce the effectiveness of the money multiplier.

-

Capital Adequacy Ratios: Banks are subject to capital adequacy ratios, which dictate the minimum amount of capital they must hold relative to their assets. These regulations aim to maintain the stability of the banking system and prevent excessive risk-taking. This can limit lending capacity independent of the reserve requirement.

The Role of the Central Bank in Money Creation

The central bank plays a vital role in influencing money creation. Through various monetary policy tools, it can impact the amount of reserves in the banking system and subsequently the amount of money created:

-

Reserve Requirements: Adjusting the reserve requirement directly impacts the money multiplier. A lower reserve requirement allows for more lending and money creation, while a higher requirement does the opposite.

-

Open Market Operations: The central bank can buy or sell government securities (like treasury bonds) in the open market. Buying securities injects money into the banking system, increasing reserves and expanding the money supply. Selling securities has the opposite effect.

-

Discount Rate: The discount rate is the interest rate at which commercial banks can borrow money directly from the central bank. A lower discount rate encourages banks to borrow more, increasing their reserves and lending capacity.

-

Inflation Targeting: Central banks often have an inflation target. If inflation is above the target, they may implement contractionary monetary policies to curb money creation and reduce inflationary pressures. Conversely, if inflation is below target, they may pursue expansionary policies.

Debunking Myths about Money Creation

Several misconceptions surround how commercial banks create money. Let's address some common ones:

-

Myth 1: Banks lend out existing deposits: While banks use deposits as the basis for lending, the act of lending creates new money, not just reallocating existing funds. The money multiplier demonstrates how an initial deposit can lead to a significantly larger increase in the money supply.

-

Myth 2: Money creation is solely dependent on the central bank: While the central bank significantly influences the money supply, commercial banks play a critical role in the money creation process through their lending activities. It's a collaborative process, not solely controlled by the central bank.

-

Myth 3: Money creation is unlimited: The money creation process is not unlimited. Factors like reserve requirements, capital adequacy ratios, loan demand, and the central bank's monetary policy all constrain the extent of money creation.

-

Myth 4: All loans create money: Only loans made by commercial banks that result in increased deposits within the banking system contribute directly to money creation. Loans that are used to pay off existing loans or that remain outside the banking system don't necessarily lead to a net increase in the money supply.

The Implications for Economic Stability and Monetary Policy

The ability of commercial banks to create money has significant implications for economic stability and monetary policy:

-

Economic Growth: The creation of money through bank lending can stimulate economic activity. Increased credit availability can facilitate investment, consumption, and job creation, promoting economic growth.

-

Inflation: Excessive money creation can lead to inflation, as the increased money supply chases a limited amount of goods and services. Central banks carefully monitor money supply growth to manage inflation risks.

-

Financial Crises: Rapid expansion of credit and excessive money creation can contribute to the formation of asset bubbles and increase the vulnerability of the financial system to crises. Careful regulation and supervision of banks are crucial to mitigating these risks.

-

Monetary Policy Effectiveness: The effectiveness of central bank monetary policy depends, in part, on the response of commercial banks to changes in interest rates and reserve requirements. Understanding the money creation process is critical for predicting the impact of monetary policy actions.

Conclusion: A Dynamic and Complex Process

The process by which commercial banks create money is intricate and dynamic, going beyond the simplistic notion of simply lending out existing deposits. Fractional reserve banking, the money multiplier effect, and the actions of the central bank all interact to shape the money supply. Understanding this process is crucial for anyone seeking to grasp the complexities of monetary policy, economic growth, and financial stability. While commercial banks play a crucial role in money creation, it's not a limitless process, and effective regulation and careful monetary policy management are essential for maintaining a healthy and stable economy. The interplay between commercial banks and the central bank is a continuous dance aimed at balancing economic growth with the risk of inflation and financial instability.

Latest Posts

Latest Posts

-

Hartmans Nursing Assistant Care Workbook Answer Key

Apr 01, 2025

-

Developing A Strategic Vision For A Company Entails

Apr 01, 2025

-

A Coworker Didnt Clean His Work Area Walmart

Apr 01, 2025

-

The Ames Reflective Meter Was One Of The First

Apr 01, 2025

-

What Context Clue Provides An Antonym For The Word Secular

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Commercial Banks Create Money When They Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.