Consumption Investment Government Spending Exports And Imports Are

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Consumption, Investment, Government Spending, Exports, and Imports: The Pillars of Economic Growth

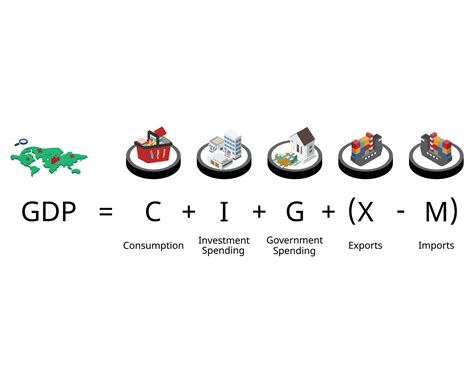

The economy, in its simplest form, is a complex interplay of various sectors working in tandem. Understanding this intricate dance requires a grasp of its fundamental components: consumption, investment, government spending, exports, and imports. These five elements, often represented by the acronym C + I + G + (X-M), constitute the aggregate demand (AD) within a country's Gross Domestic Product (GDP). This article delves into each component, exploring its role in economic growth, its influence on other sectors, and the potential challenges associated with each.

Consumption: The Engine of Economic Growth

Consumption represents the total spending by households on goods and services within a given period. It is by far the largest component of GDP in most economies, reflecting the purchasing power and consumer confidence of the population. Factors influencing consumption include:

-

Disposable Income: The higher the disposable income (income after taxes and transfers), the greater the potential for consumption. Increases in wages, employment rates, and government transfer payments (like unemployment benefits) generally boost consumption. Conversely, tax increases or job losses can lead to a decline in consumption.

-

Consumer Confidence: Consumer sentiment, reflecting optimism or pessimism about the future economy, plays a significant role. High consumer confidence encourages spending, while low confidence may lead to saving rather than spending.

-

Interest Rates: Higher interest rates increase the cost of borrowing, making it more expensive to finance purchases like homes and cars. This can lead to a decrease in consumption, particularly for durable goods. Conversely, low interest rates can stimulate consumption.

-

Wealth Effect: An increase in household wealth (e.g., rising house prices or stock market gains) can lead to increased consumption, as individuals feel more financially secure.

The Importance of Consumption: Consumption drives demand, leading to increased production and employment. Businesses respond to higher demand by investing in capacity expansion and hiring more workers. A robust consumption sector is vital for sustainable economic growth. However, excessive consumption, particularly when fueled by debt, can lead to economic instability and financial crises.

Investment: Fueling Future Growth

Investment, in the macroeconomic context, refers to spending by businesses on capital goods – equipment, machinery, factories, and other assets used to produce goods and services. It also includes residential investment (building of new homes) and changes in inventories (stock of goods held by businesses). Factors driving investment include:

-

Profit Expectations: Businesses invest when they anticipate higher future profits. Positive economic forecasts, technological advancements, and favourable government policies can all stimulate investment.

-

Interest Rates: As with consumption, interest rates play a significant role. Low interest rates make borrowing cheaper, making investments more attractive. High interest rates, on the other hand, discourage investment.

-

Technological Advancements: Technological progress can significantly boost investment as businesses seek to adopt new technologies to improve efficiency and productivity.

-

Government Policies: Tax incentives, subsidies, and regulations can significantly influence investment decisions. Government support for research and development can also stimulate investment in innovation.

The Impact of Investment: Investment is crucial for long-term economic growth. It enhances productivity, creates jobs, and improves the overall productive capacity of the economy. A lack of investment can lead to stagnant economic growth and a decline in living standards.

Government Spending: A Powerful Economic Tool

Government spending encompasses all expenditures by various levels of government on goods and services, including infrastructure projects (roads, bridges, schools), social welfare programs (healthcare, education), and defense spending. Government spending can significantly influence the economy:

-

Fiscal Policy: Governments use fiscal policy (changes in government spending and taxation) to manage the economy. During economic downturns, increased government spending can stimulate demand and create jobs (expansionary fiscal policy). During periods of high inflation, reduced government spending can help cool down the economy (contractionary fiscal policy).

-

Multiplier Effect: Government spending has a multiplier effect. An increase in government spending not only directly increases aggregate demand but also indirectly stimulates further spending through job creation and increased income.

-

Infrastructure Investment: Investing in infrastructure creates jobs, improves productivity, and enhances the overall quality of life. It can also attract private investment and stimulate economic activity in the long run.

-

Social Welfare Programs: Government spending on social programs provides crucial support for vulnerable populations, reducing inequality and improving overall societal well-being.

The Challenges of Government Spending: While government spending can be a powerful tool for economic management, it also presents challenges. Excessive government spending can lead to large budget deficits and increase national debt, potentially crowding out private investment. Efficient allocation of government funds and effective fiscal management are critical.

Exports and Imports: The International Dimension

Exports represent the sale of domestically produced goods and services to foreign countries, while imports represent the purchase of foreign-produced goods and services. The difference between exports and imports is known as the net export (X-M), which can be positive (trade surplus) or negative (trade deficit). Factors influencing exports and imports include:

-

Exchange Rates: The exchange rate (value of a country's currency relative to other currencies) significantly affects exports and imports. A stronger domestic currency makes exports more expensive for foreigners and imports cheaper for domestic consumers. A weaker currency has the opposite effect.

-

Global Demand: Global economic growth influences demand for exports. Strong global growth increases demand for exports, while weak global growth reduces demand.

-

Trade Policies: Tariffs (taxes on imports), quotas (limits on the quantity of imports), and other trade policies can affect the volume of exports and imports.

-

Comparative Advantage: Countries specialize in producing goods and services in which they have a comparative advantage (ability to produce a good at a lower opportunity cost than another country). This leads to international trade and specialization.

The Role of Net Exports: Net exports contribute to aggregate demand. A trade surplus (positive net export) adds to aggregate demand, while a trade deficit (negative net export) subtracts from aggregate demand. A persistent trade deficit can lead to a decline in a country's foreign exchange reserves and potentially increase its national debt.

Interdependence of the Components

It's crucial to understand that these five components are not independent. They are intricately linked and influence one another. For example:

-

Consumption and Investment: Higher consumption can lead to higher investment as businesses respond to increased demand.

-

Government Spending and Consumption: Government spending on infrastructure can stimulate consumption through job creation and increased income.

-

Exports and Production: Strong export demand boosts domestic production and employment, leading to higher incomes and consumption.

Conclusion: A Balanced Approach for Sustainable Growth

Understanding the interplay between consumption, investment, government spending, exports, and imports is essential for policymakers and businesses alike. Sustainable economic growth requires a balanced approach. Excessive reliance on any single component can lead to instability. For instance, over-reliance on consumption fuelled by debt can lead to financial crises. Over-dependence on exports makes the economy vulnerable to global economic fluctuations. A balanced approach that fosters sustainable consumption patterns, encourages productive investment, employs prudent fiscal policy, and promotes international trade based on comparative advantage is crucial for achieving long-term economic prosperity and stability. This requires careful monitoring of economic indicators, proactive policy adjustments, and a focus on fostering a dynamic and resilient economy. The future of any economy hinges on this intricate balance.

Latest Posts

Latest Posts

-

Many Different Types Of Personnel Work With Classified Information

Mar 14, 2025

-

Which Of The Following Scenarios Describe A Potential Insider Threat

Mar 14, 2025

-

After A Classified Document Is Leaked Online

Mar 14, 2025

-

Which Of The Following Represents Critical Information

Mar 14, 2025

-

Fundamentals Of Physics 12 Edition Instructors Solutions Manual Pdf

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Consumption Investment Government Spending Exports And Imports Are . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.