Credit Scores And Monitoring Quick Check Quizlet

Breaking News Today

Mar 31, 2025 · 7 min read

Table of Contents

Credit Scores and Monitoring: A Quick Check Quizlet and Beyond

Understanding your credit score is crucial for navigating the financial world. Whether you're applying for a loan, renting an apartment, or even getting a job, your credit score plays a significant role. This comprehensive guide will delve into the intricacies of credit scores, the importance of monitoring them, and dispel common myths. We'll also touch upon resources like "Quizlet" to aid your understanding and provide you with a robust understanding of this vital financial metric.

What is a Credit Score?

A credit score is a three-digit numerical representation of your creditworthiness. Lenders use it to assess the risk involved in lending you money. A higher score indicates a lower risk, making you a more attractive borrower. Scores typically range from 300 to 850, with higher numbers signifying better credit health. Several different scoring models exist, including FICO and VantageScore, each with its own nuances. However, the core principles remain consistent across all models.

Key Factors Affecting Your Credit Score:

Several factors contribute to your credit score. Understanding these factors is the first step towards improving your creditworthiness:

-

Payment History (35%): This is the single most important factor. Consistent on-time payments demonstrate your reliability as a borrower. Late or missed payments significantly hurt your score.

-

Amounts Owed (30%): This refers to your credit utilization ratio – the amount of credit you're using compared to your total available credit. Keeping your credit utilization low (ideally below 30%) is vital for a healthy credit score. This shows lenders you manage your debt responsibly.

-

Length of Credit History (15%): The longer your credit history, the better. This shows lenders a track record of responsible credit management. Avoid closing old accounts unnecessarily, as this can shorten your credit history.

-

New Credit (10%): Opening many new credit accounts in a short period can negatively impact your score. Lenders may view this as increased risk. It's best to apply for credit only when necessary.

-

Credit Mix (10%): Having a variety of credit accounts (e.g., credit cards, installment loans, mortgages) can positively affect your score, demonstrating your ability to manage different types of credit.

The Importance of Credit Score Monitoring

Regularly monitoring your credit score is essential for several reasons:

-

Early Detection of Errors: Mistakes happen. Monitoring your credit report allows you to catch and correct any errors promptly, preventing them from negatively impacting your score.

-

Identify Potential Fraud: Credit monitoring can alert you to unauthorized accounts or suspicious activity, allowing you to take immediate action to protect your identity and finances.

-

Track Your Progress: Monitoring your score helps you track your progress as you work towards improving your creditworthiness. You can see the impact of your efforts and make adjustments as needed.

-

Proactive Financial Planning: Knowing your credit score empowers you to make informed financial decisions. You can better assess your eligibility for loans, mortgages, and other credit products.

-

Negotiate Better Terms: A high credit score can help you negotiate better interest rates and loan terms, potentially saving you significant money over time.

Credit Score Monitoring Tools and Resources:

Several tools and resources are available to help you monitor your credit score effectively:

-

Credit Bureaus: The three major credit bureaus – Equifax, Experian, and TransUnion – offer credit monitoring services, often for a fee. These services typically provide access to your credit reports and scores.

-

Credit Card Companies: Many credit card companies provide free credit score monitoring as a benefit to their cardholders.

-

Financial Institutions: Some banks and other financial institutions offer credit monitoring services to their customers.

-

Online Services: Numerous online services specialize in credit monitoring and reporting. Research and compare features and pricing before choosing a service.

Note: Remember to always choose reputable services to avoid scams.

Dispelling Common Credit Score Myths:

Several myths surround credit scores. Let's clarify some of the most prevalent misconceptions:

Myth 1: Checking your credit score hurts your credit score. False. Checking your own credit score through authorized channels (like annualcreditreport.com) does not affect your score. However, multiple hard inquiries (when a lender checks your credit) within a short period can negatively impact your score.

Myth 2: Paying off debt immediately will drastically improve your score overnight. Partially True. While paying down debt is crucial for improving your credit score, the impact isn't immediate. Credit scoring models take time to reflect changes in your credit profile. However, the reduction in your credit utilization ratio will start contributing positively to your score as soon as the change is reflected in your credit report.

Myth 3: Only loans affect your credit score. False. Credit card usage, payment history on utilities, rent payments (if reported to credit bureaus), and even cell phone bills can affect your credit score if reported.

Myth 4: You need a credit card to build credit. False. While credit cards are a common way to build credit, you can build credit through other methods, such as secured credit cards, installment loans, and authorized user status on someone else's account.

Myth 5: A single late payment ruins your credit. False. While a late payment negatively affects your score, it doesn't necessarily "ruin" it. The impact depends on several factors, including the severity and frequency of late payments. You can recover from a late payment by establishing a pattern of on-time payments going forward.

How Credit Score Monitoring Can Help You Prepare for Large Purchases:

Monitoring your credit score isn’t just about reacting to problems; it’s about proactively preparing for major financial decisions. This preparation significantly impacts your ability to secure favorable terms on loans for significant purchases, such as:

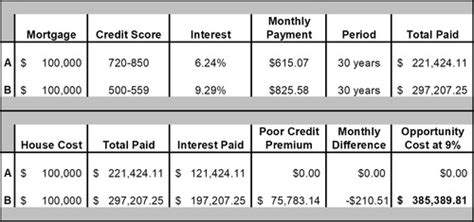

1. Mortgages: A strong credit score is paramount when applying for a mortgage. A higher score will likely qualify you for a better interest rate, reducing the overall cost of your mortgage over its lifetime. Monitoring your score ensures you know where you stand and allows time for improvement if needed.

2. Auto Loans: Similar to mortgages, your credit score heavily influences your auto loan interest rate. A higher score will mean lower monthly payments and less interest paid over the loan term. Monitoring helps you maintain a credit score that will secure you the best possible rate.

3. Personal Loans: Whether it's for home renovations, debt consolidation, or unexpected expenses, a good credit score will get you a lower interest rate on a personal loan. Regular monitoring allows for timely intervention if there are any negative trends, preventing the need for higher-interest financing.

4. Credit Cards: Your credit score influences the credit limits and interest rates offered on credit cards. A higher score allows you to potentially qualify for cards with better benefits and lower APRs. Tracking your credit score will help you gauge your eligibility for the best cards available.

Using Quizlet and Other Learning Tools to Understand Credit Scores:

Educational platforms like Quizlet can be valuable tools in learning about credit scores and credit management. While Quizlet may not offer in-depth analysis, it can reinforce core concepts and provide a structured learning environment. You can create your flashcards covering key terms like:

- Credit Report: A detailed history of your credit activity.

- Credit Utilization: The percentage of your available credit you're using.

- Hard Inquiry: A credit check performed by a lender.

- Soft Inquiry: A credit check that doesn't affect your credit score.

- FICO Score: A widely used credit scoring model.

- VantageScore: Another popular credit scoring model.

- Debt-to-Income Ratio: The percentage of your income that goes towards debt payments.

You can also search for pre-made Quizlet sets on credit scores to supplement your learning. Remember to always cross-reference information from multiple reliable sources to ensure accuracy.

Conclusion:

Understanding and monitoring your credit score is not merely a financial chore; it's a critical skill for building a secure financial future. By actively monitoring your credit report, addressing errors promptly, and making responsible financial decisions, you can cultivate a strong credit history, access favorable loan terms, and achieve your financial goals. Utilize the resources available, including educational tools like Quizlet, to enhance your understanding and make informed decisions about your financial well-being. Remember that building good credit is a marathon, not a sprint, requiring consistent effort and responsible financial behavior. Your future self will thank you for the proactive steps you take today.

Latest Posts

Latest Posts

-

Property And Casualty Insurance Exam Questions And Answers

Apr 02, 2025

-

Surgical Suturing Of A Stomach Wound Is Known As

Apr 02, 2025

-

The Racial Term African American Can Refer To

Apr 02, 2025

-

What Page Is Chapter 13 In Ground Zero

Apr 02, 2025

-

Which Of The Following Is Not True Of Online Communication

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Credit Scores And Monitoring Quick Check Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.