Difference Between Cash Sales And Account Sales

Breaking News Today

Mar 20, 2025 · 5 min read

Table of Contents

Cash Sales vs. Account Sales: A Comprehensive Guide for Businesses

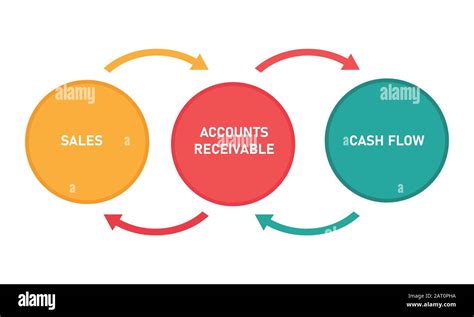

Understanding the difference between cash sales and account sales is fundamental for any business, regardless of size or industry. These two distinct sales methods significantly impact cash flow, financial reporting, and overall business strategy. This comprehensive guide will delve into the nuances of each, highlighting their advantages and disadvantages to help you make informed decisions for your business.

What are Cash Sales?

Cash sales, as the name suggests, are transactions where payment is received immediately upon the sale of goods or services. This immediate payment can be in various forms, including:

- Physical cash: Traditional currency exchanged directly.

- Debit cards: Funds are immediately deducted from the customer's bank account.

- Credit cards: Although the payment isn't immediate to the business, the processing time is usually swift, and the funds are received within a few business days. The speed of receipt largely qualifies credit card transactions as effectively cash sales.

- Digital wallets: Mobile payment systems like Apple Pay or Google Pay provide instant transfers.

Advantages of Cash Sales:

- Immediate cash flow: This is the most significant advantage. Cash sales instantly boost your working capital, enabling you to meet immediate expenses, invest in growth opportunities, and maintain a healthy financial position.

- Reduced risk of bad debts: Since payment is received upfront, there's no risk of customers defaulting on their payments. This significantly reduces accounting complexities and potential financial losses.

- Simplified accounting: Tracking cash sales is generally simpler than managing accounts receivable. Less bookkeeping is needed, reducing the administrative burden.

- Improved profitability (potentially): While not directly linked, the immediate cash flow can be strategically used to secure better deals from suppliers or invest in promotions to enhance profitability.

Disadvantages of Cash Sales:

- Lower sales volume (potentially): Requiring immediate payment can deter some customers, especially larger clients who might prefer credit terms. This could lead to lost sales opportunities.

- Increased risk of theft or loss: Handling large amounts of physical cash increases the risk of theft or loss, requiring robust security measures.

- Limited customer base: Cash transactions might exclude customers who prefer non-cash payment options, limiting your potential market reach.

- Difficulties tracking sales: Though accounting is simpler, tracking individual sales can become challenging with high transaction volume, especially if a point-of-sale (POS) system isn't used.

What are Account Sales (or Credit Sales)?

Account sales, also known as credit sales, involve selling goods or services with payment deferred to a future date. The customer receives the goods or services upfront but agrees to pay at a later date, typically within a specified credit period (e.g., 30, 60, or 90 days).

Advantages of Account Sales:

- Increased sales volume: Offering credit terms can attract more customers, especially businesses or individuals making large purchases. This can significantly boost sales and revenue.

- Enhanced customer relationships: Extending credit shows trust and builds stronger relationships with customers, leading to customer loyalty and repeat business.

- Competitive advantage: In many industries, offering credit terms is a necessity to compete effectively, particularly for larger-ticket items.

- Improved cash flow management (potentially): Carefully managed account sales can enhance cash flow through better forecasting and planning. This allows businesses to manage expenses more effectively.

Disadvantages of Account Sales:

- Delayed cash flow: The most significant drawback is the delay in receiving payment, which can strain cash flow and liquidity.

- Risk of bad debts: There's a considerable risk that customers might fail to pay, resulting in financial losses and increased administrative costs for debt recovery.

- Increased accounting complexity: Managing accounts receivable (money owed to the business) requires meticulous record-keeping, invoicing, and follow-up. This increases the administrative burden and the need for robust accounting software.

- Higher costs associated with credit risk: Businesses often incur costs associated with credit checks, debt collection agencies, and potential write-offs of bad debts.

- Potential for disputes: Discrepancies between invoices and payments can lead to disputes and additional administrative overhead.

Key Differences Summarized:

| Feature | Cash Sales | Account Sales |

|---|---|---|

| Payment | Immediate upon sale | Deferred to a future date |

| Cash Flow | Immediate increase | Delayed increase, potential strain |

| Risk of Bad Debts | Minimal | Significant |

| Accounting | Simpler | More complex, accounts receivable involved |

| Sales Volume | Potentially lower | Potentially higher |

| Customer Base | Potentially smaller | Potentially larger |

| Customer Relations | Potentially less impactful | Potentially more impactful |

Choosing the Right Sales Method:

The optimal sales method depends heavily on your specific business circumstances, including:

- Industry: Some industries rely heavily on credit sales (e.g., wholesale, B2B), while others predominantly use cash sales (e.g., retail, some service sectors).

- Customer profile: Understanding your customer base's financial capabilities and payment preferences is crucial.

- Business size and financial resources: Larger businesses with robust financial management systems can better handle the risks associated with account sales. Smaller businesses might prioritize the immediate cash flow of cash sales.

- Competitive landscape: Observe your competitors' sales practices to assess market trends and adapt your strategy accordingly.

- Risk tolerance: The willingness to accept the risk of bad debts plays a significant role in choosing between cash and account sales.

Strategies for Managing Account Sales Effectively:

If you opt for account sales, implementing strategies to mitigate the risks is crucial:

- Credit checks: Conduct thorough credit checks on potential customers to assess their creditworthiness.

- Credit terms: Establish clear and concise credit terms, including payment deadlines and penalties for late payments.

- Invoice promptly: Issue invoices promptly and accurately to avoid delays and disputes.

- Follow-up diligently: Follow up on overdue payments promptly and professionally.

- Debt collection procedures: Develop robust debt collection procedures to recover outstanding payments effectively.

- Account receivables management: Use accounting software to efficiently manage and track accounts receivable.

- Insurance: Consider trade credit insurance to mitigate the risk of non-payment.

Conclusion:

Both cash sales and account sales have their own unique advantages and disadvantages. The best approach depends on a thorough evaluation of your business's specific needs and circumstances. A balanced approach, possibly incorporating both methods, often proves most effective. Effective management of account sales, particularly through diligent credit checks and robust collection procedures, is vital for mitigating the risks associated with extending credit. By carefully considering these factors, you can choose the sales method that optimizes cash flow, increases sales, and strengthens your overall business performance. Remember to regularly review and adapt your sales strategy based on performance and changing market conditions.

Latest Posts

Latest Posts

-

Post Test The Early And Mid Nineteenth Century Romanticism

Mar 21, 2025

-

According To Evolutionary Psychology Natural Selection Favors Behaviors That

Mar 21, 2025

-

Every Motor Vehicle Must Be Equipped With

Mar 21, 2025

-

Which Generalization About Business Writing Should You Follow

Mar 21, 2025

-

The More Alcohol Concentrated A Beverage Is The

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about Difference Between Cash Sales And Account Sales . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.