Economic Cost Can Best Be Defined As

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

Economic Cost: A Comprehensive Guide

Understanding economic cost is crucial for making sound business decisions and comprehending the complexities of economic systems. While the layman might equate cost with simply the monetary outlay, economists employ a far more nuanced definition that incorporates both explicit and implicit costs. This article will delve deep into the concept of economic cost, exploring its various components, its implications for businesses, and its broader relevance in economic analysis.

What is Economic Cost? A Definition

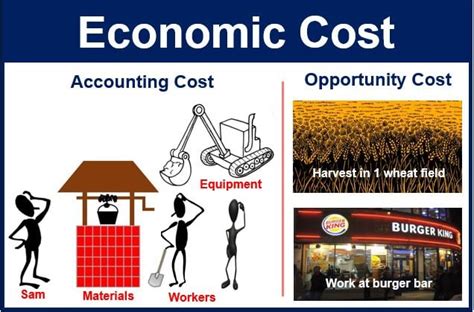

Economic cost, also known as opportunity cost, represents the total cost of using resources in production. Unlike accounting cost, which focuses solely on explicit, out-of-pocket expenses, economic cost considers both explicit and implicit costs. This broader perspective is critical for accurate decision-making because it accounts for the potential benefits forgone when choosing a particular course of action.

In essence, economic cost is the value of the best alternative forgone when making a choice. This emphasizes the scarcity of resources and the need to make trade-offs. Every decision involves sacrificing potential gains from alternative uses of resources.

Explicit Costs vs. Implicit Costs: Understanding the Components of Economic Cost

To fully grasp economic cost, we must differentiate between its two primary components:

Explicit Costs: The Tangible Expenses

Explicit costs are the direct, out-of-pocket payments made by a firm for the use of its resources. These are easily identifiable and quantifiable. Examples include:

- Raw materials: The cost of purchasing the inputs necessary for production.

- Wages and salaries: Payments to employees for their labor.

- Rent: Payments for the use of land or buildings.

- Utilities: Expenses on electricity, water, and other essential services.

- Interest payments: Costs associated with borrowing capital.

- Advertising and marketing: Expenses incurred in promoting products or services.

These are the costs typically recorded in a company's financial statements. They are the tangible, measurable expenses that directly reduce a firm's cash flow.

Implicit Costs: The Opportunity Costs

Implicit costs, often referred to as opportunity costs, represent the forgone returns from the next best alternative use of resources. These are not reflected in accounting statements but are crucial for evaluating the true cost of a decision. Examples include:

- Forgone salary: If an entrepreneur uses their own savings to start a business, the implicit cost includes the salary they could have earned by working elsewhere.

- Return on investment: If an entrepreneur invests their savings in their business, the implicit cost includes the potential return they could have earned by investing that money elsewhere, such as in stocks or bonds.

- Depreciation of assets: While accounting cost might consider depreciation, the implicit cost considers the potential value of selling the asset instead of using it in the business.

- Use of owner’s resources: Using personal equipment or property in a business incurs an implicit cost equal to the rental value of those resources.

Calculating Economic Cost: A Practical Example

Let's consider a simple example to illustrate the calculation of economic cost:

Imagine Sarah is considering opening a bakery.

Explicit Costs:

- Rent for the bakery: $1,000 per month

- Salaries for employees: $3,000 per month

- Raw materials (flour, sugar, etc.): $2,000 per month

- Utilities: $500 per month

Total Explicit Costs: $1,000 + $3,000 + $2,000 + $500 = $6,500 per month

Implicit Costs:

- Forgone salary (Sarah could earn $4,000 per month as a project manager): $4,000 per month

- Return on investment (Sarah invested $50,000 savings that could have earned 5% annually, or $417 per month): $417 per month

Total Implicit Costs: $4,000 + $417 = $4,417 per month

Economic Cost: Total Explicit Costs + Total Implicit Costs = $6,500 + $4,417 = $10,917 per month

This demonstrates that the true cost of running Sarah's bakery is significantly higher than the explicit costs alone. Ignoring implicit costs would lead to an inaccurate assessment of the bakery's profitability.

Economic Cost and Business Decisions

Understanding economic cost is paramount for making informed business decisions. Here's how it plays a crucial role:

- Profitability Analysis: Accurately calculating economic profit (revenue minus economic cost) provides a more realistic picture of a business's profitability compared to accounting profit (revenue minus explicit costs).

- Resource Allocation: Economic cost helps businesses allocate resources efficiently by considering the opportunity cost of each decision. It guides resource allocation towards the options offering the highest returns relative to their costs.

- Investment Decisions: Businesses use economic cost to evaluate the feasibility of investments by comparing the expected return to the total economic cost, encompassing both explicit and implicit costs.

- Pricing Strategies: Understanding economic cost informs pricing decisions. Businesses need to price their products or services at a level that covers not only explicit but also implicit costs, ensuring profitability.

- Production Decisions: Economic cost analysis helps determine the optimal level of production by comparing marginal cost (the cost of producing one more unit) to marginal revenue (the revenue generated from selling one more unit).

Economic Cost in Different Economic Models

The concept of economic cost finds application in various economic models:

- Perfect Competition: In a perfectly competitive market, firms earn zero economic profit in the long run, meaning their revenue covers both explicit and implicit costs. This stems from the free entry and exit of firms.

- Monopoly: Monopolies can earn positive economic profit in the long run due to barriers to entry. However, the concept of economic cost still applies in analyzing their resource allocation and pricing strategies.

- Production Function: Economic cost is integrated into production functions to determine the cost-minimizing combination of inputs for a given level of output.

- Cost Curves: Economic cost analysis generates cost curves (average total cost, marginal cost) which are fundamental in understanding a firm's behavior in the market.

The Broader Implications of Economic Cost

Beyond business decisions, understanding economic cost has broader implications:

- Government Policy: Governments use economic cost analysis to evaluate the efficiency of public projects and programs. This involves assessing both the direct costs and the opportunity costs of alternative uses of public funds.

- Environmental Economics: Economic cost analysis plays a critical role in environmental decision-making by incorporating the environmental externalities (costs or benefits that affect third parties) into the calculations. This helps in making informed decisions regarding pollution control and resource conservation.

- Personal Finance: Applying the concept of opportunity cost in personal finance improves decision-making regarding spending, saving, and investment choices.

Conclusion: The Importance of a Holistic View

Economic cost provides a comprehensive perspective on the true cost of resource utilization, encompassing both explicit and implicit costs. Unlike accounting cost, it incorporates the opportunity cost, reflecting the value of the best alternative forgone. This holistic approach is vital for rational decision-making in various contexts, from business operations to government policies and personal finance. By considering both explicit and implicit costs, businesses can make sound decisions, allocate resources efficiently, and achieve sustainable profitability. Ignoring implicit costs can lead to flawed analyses and suboptimal outcomes. A thorough understanding of economic cost is, therefore, indispensable for navigating the complexities of the economic world.

Latest Posts

Latest Posts

-

The Estimated Economic Loss Of All Motor

Mar 19, 2025

-

Brokers Agents Can Access And Download Enrollment Materials Through Custompoint

Mar 19, 2025

-

Which Of The Following Products Helps Prevent Nails From Splitting

Mar 19, 2025

-

A 62 Year Old Man Suddenly Experienced Difficulty Speaking

Mar 19, 2025

-

Artist Is To Paintbrush As Chef Is To

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Economic Cost Can Best Be Defined As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.