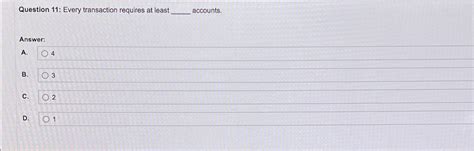

Every Transaction Requires At Least _____ Accounts.

Breaking News Today

Mar 13, 2025 · 6 min read

Table of Contents

Every Transaction Requires at Least Two Accounts: A Deep Dive into Double-Entry Bookkeeping

The fundamental principle underlying all accounting systems is the double-entry bookkeeping method. This core concept dictates that every financial transaction affects at least two accounts. This seemingly simple rule is the bedrock of accurate financial reporting and provides a powerful mechanism for ensuring that the accounting equation remains balanced. Understanding this principle is crucial for anyone involved in finance, accounting, or business management. This article will explore the "two accounts" rule in detail, examining its implications and applications across various accounting scenarios.

The Accounting Equation: The Foundation of Double-Entry Bookkeeping

Before diving into the specifics of transactions, it's essential to understand the accounting equation: Assets = Liabilities + Equity. This equation represents the fundamental relationship between a company's resources (assets), its obligations to others (liabilities), and the owners' stake in the business (equity). Every transaction must maintain the balance of this equation. If one side increases, the other side must increase by the same amount, or one side increases while the other side decreases by the same amount. This is where the "two accounts" rule comes into play.

Why Two Accounts? Maintaining the Balance

The requirement of at least two accounts for every transaction stems directly from the need to maintain the balance of the accounting equation. A single-entry system, where only one account is affected, would inevitably lead to inconsistencies and inaccuracies. The two accounts involved in a transaction always represent opposing sides of the accounting equation.

Examples of Transaction Types and Account Impacts

Let's examine some common transaction types and see how they affect at least two accounts:

1. Purchasing Supplies with Cash:

- Action: A company buys office supplies for $100 using cash.

- Accounts Affected:

- Decrease in Cash (Asset): The cash account decreases by $100. This is a debit to the cash account.

- Increase in Office Supplies (Asset): The office supplies account increases by $100. This is a credit to the office supplies account.

- Equation Balance: The decrease in one asset is offset by an increase in another, maintaining the balance of the accounting equation.

2. Borrowing Money from a Bank:

- Action: A company borrows $5,000 from a bank.

- Accounts Affected:

- Increase in Cash (Asset): The cash account increases by $5,000. This is a debit to the cash account.

- Increase in Loans Payable (Liability): The loans payable account increases by $5,000. This is a credit to the loans payable account.

- Equation Balance: The increase in an asset (cash) is balanced by an increase in a liability (loans payable).

3. Providing Services to a Customer:

- Action: A company provides services to a customer for $2,000 on credit.

- Accounts Affected:

- Increase in Accounts Receivable (Asset): The accounts receivable account increases by $2,000. This is a debit to the accounts receivable account.

- Increase in Service Revenue (Equity): The service revenue account increases by $2,000. This is a credit to the service revenue account.

- Equation Balance: The increase in an asset (accounts receivable) is balanced by an increase in equity (service revenue).

4. Paying Salaries:

- Action: A company pays its employees $3,000 in salaries.

- Accounts Affected:

- Decrease in Cash (Asset): The cash account decreases by $3,000. This is a debit to the salaries expense account.

- Increase in Salaries Expense (Equity): The salaries expense account increases by $3,000. This is a credit to the salaries expense account.

- Equation Balance: The decrease in an asset (cash) is balanced by an increase in an expense, which reduces equity.

5. Purchasing Equipment with a Down Payment and a Loan:

- Action: A company purchases equipment costing $10,000. They pay $2,000 down and finance the remaining amount.

- Accounts Affected:

- Increase in Equipment (Asset): The equipment account increases by $10,000.

- Decrease in Cash (Asset): The cash account decreases by $2,000.

- Increase in Notes Payable (Liability): The notes payable account increases by $8,000.

This transaction demonstrates that a single event can affect more than two accounts, showcasing the flexibility of the double-entry system. The combined effect still maintains the balance of the accounting equation.

Debits and Credits: The Language of Double-Entry Bookkeeping

The double-entry system utilizes debits and credits to record transactions. Debits increase the balance of asset, expense, and dividend accounts, while credits increase the balance of liability, equity, and revenue accounts. The opposite is true for decreases. The fundamental rule is that for every transaction, the total debits must equal the total credits. This ensures the accounting equation remains balanced.

Advanced Accounting Scenarios: More Than Two Accounts

While the fundamental principle states at least two accounts are affected, many transactions involve more than two. Consider these examples:

1. Sales with Sales Tax: When a company makes a sale, it must record the revenue, the sales tax payable (a liability), and potentially the cost of goods sold (an expense).

2. Bank Reconciliation: Reconciling a bank statement involves several accounts, including cash, bank charges, notes receivable, and others, depending on the transactions.

3. Depreciation: Recording depreciation involves at least three accounts: depreciation expense, accumulated depreciation (a contra-asset), and the asset itself.

The Importance of Accurate Record-Keeping

The accuracy of financial statements depends entirely on the correct application of the double-entry bookkeeping system. Errors in recording transactions can lead to misstated financial results, impacting decision-making, tax obligations, and investor confidence. Therefore, meticulous record-keeping is paramount.

Software and Automation in Double-Entry Bookkeeping

Modern accounting software automates many aspects of double-entry bookkeeping. However, understanding the underlying principles remains crucial for users to interpret reports, identify potential errors, and ensure accurate financial management.

The Evolution and Continued Relevance of Double-Entry Bookkeeping

Developed centuries ago, double-entry bookkeeping remains the cornerstone of modern accounting. Its enduring relevance is a testament to its effectiveness in providing a reliable and transparent framework for financial reporting. While technology has enhanced its application, the fundamental principles remain unchanged.

Conclusion: The Power of Two Accounts

The simple yet powerful principle that every transaction requires at least two accounts is the foundation of accurate and reliable financial reporting. Understanding this concept is crucial for anyone involved in finance, from small business owners to large corporation CFOs. The double-entry system, with its emphasis on balance and verification, provides a robust mechanism for ensuring financial transparency and accountability. By diligently applying this principle and maintaining accurate records, businesses can gain valuable insights into their financial health and make informed decisions for future success. The system's enduring relevance highlights its efficacy as a fundamental tool in the world of finance and accounting. The elegance of its simplicity, coupled with its power to ensure accuracy and balance, solidifies its position as a cornerstone of modern accounting practice.

Latest Posts

Latest Posts

-

A Disinfectant Is Used On Your Work Surface

May 09, 2025

-

The Kub Examination Looks For Defects In The

May 09, 2025

-

In Which Situation Would It Be Legal To Deliver Alcohol

May 09, 2025

-

What Is The Ability To Do Work

May 09, 2025

-

A Food Borne Parasite Found In Under Cooked Pork Is

May 09, 2025

Related Post

Thank you for visiting our website which covers about Every Transaction Requires At Least _____ Accounts. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.