Group Health Plans Typically Contain A Coordination Of Benefits Provision

Breaking News Today

Mar 22, 2025 · 7 min read

Table of Contents

- Group Health Plans Typically Contain A Coordination Of Benefits Provision

- Table of Contents

- Group Health Plans Typically Contain a Coordination of Benefits Provision

- Understanding Coordination of Benefits (COB)

- The Importance of COB in Group Health Plans

- Key Factors Determining Primary and Secondary Payer Status

- Understanding the Complexity of COB Rules

- The Role of the Plan Administrator

- Impact of COB on Individuals and Employers

- Practical Examples of COB in Action

- Navigating the COB Maze: Tips for Employees

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Group Health Plans Typically Contain a Coordination of Benefits Provision

Group health insurance plans are a cornerstone of employee benefits packages, offering crucial financial protection against healthcare costs. However, the complexities of these plans, particularly when multiple coverages exist, can be challenging to navigate. One crucial aspect often overlooked is the Coordination of Benefits (COB) provision. This article delves deep into the intricacies of COB clauses within group health plans, explaining their purpose, how they work, and their impact on individuals and employers.

Understanding Coordination of Benefits (COB)

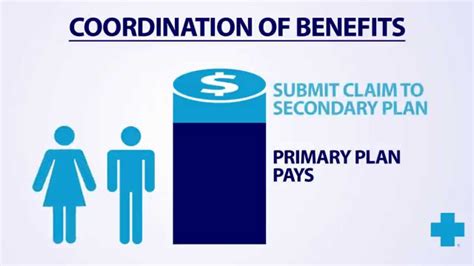

At its core, a COB provision is a clause designed to prevent individuals from receiving more than 100% reimbursement for their healthcare expenses. This is particularly relevant when an individual has coverage under more than one health insurance plan, such as a group plan through their employer and a spouse's plan. Without a COB provision, individuals could potentially profit from overlapping insurance, a scenario that would be unsustainable for insurance companies.

COB clauses dictate which plan is considered "primary" and which is "secondary." The primary payer is responsible for covering the majority of the medical expenses, while the secondary payer covers the remaining costs, up to their policy limits. The determination of primary and secondary status is usually based on a set of rules and priorities outlined within the plans.

The Importance of COB in Group Health Plans

The inclusion of COB provisions in group health plans is vital for several reasons:

- Preventing Overpayments: COB prevents insurance fraud and abuse by ensuring that individuals aren't reimbursed twice for the same expense. This protects the financial stability of insurance companies.

- Controlling Costs: By limiting overpayments, COB helps control healthcare costs for both employers and employees. This translates to lower premiums and more sustainable healthcare systems.

- Fairness and Equity: COB ensures fairness among plan members. It prevents individuals with multiple coverages from gaining an unfair advantage over those with only one plan.

- Compliance and Regulation: COB is frequently mandated by state and federal regulations to ensure transparency and equitable claim processing. Failure to comply can lead to significant penalties for insurance companies.

Key Factors Determining Primary and Secondary Payer Status

The determination of primary and secondary payer status under COB provisions is typically governed by a complex set of rules. These rules often involve factors like:

- Employee's Birthday: The plan of the person whose birthday comes first in the year is often designated as the primary payer.

- Order of Coverage: The plan that was obtained first may be designated as the primary payer.

- Group vs. Individual Coverage: Group plans are frequently designated as primary over individual plans.

- Dependent vs. Employee Coverage: The plan covering the employee is often primary, while dependent coverage is secondary.

- Gender of the Covered Person: In some instances, the gender of the covered individual can play a role in determining primary and secondary status, but this is less common now.

Understanding the Complexity of COB Rules

The intricacies of COB rules can be highly variable, depending on the specific terms of each insurance plan. These rules are often detailed in lengthy and complex policy documents. It's crucial for individuals to thoroughly review their policy documents and understand how COB will apply to their specific situation.

Furthermore, the rules can be inconsistent between different insurance companies and even between different plans offered by the same company. This lack of standardization contributes to the confusion surrounding COB.

The Role of the Plan Administrator

Plan administrators play a critical role in managing COB situations. They are responsible for:

- Interpreting COB rules: They must accurately interpret the intricate COB rules outlined in the plan documents.

- Determining primary and secondary payers: Based on the applicable rules, they must determine which plan is primary and which is secondary.

- Coordinating with other payers: They must communicate with other insurance plans involved to ensure that claims are processed correctly.

- Processing claims and payments: They are responsible for overseeing the claims process, ensuring payments are made according to the COB rules.

The expertise of plan administrators is essential in navigating the complex web of COB regulations and ensuring accurate and efficient claim processing. Their role contributes significantly to the smooth operation of the COB system.

Impact of COB on Individuals and Employers

COB provisions have significant implications for both individuals and employers.

For Individuals:

- Reduced Out-of-Pocket Costs: COB helps reduce the financial burden of healthcare expenses by ensuring that individuals don't have to pay the full cost themselves.

- Simplified Claims Processing: By coordinating benefits, COB simplifies the claims process, reducing the administrative burden on individuals.

- Potential for Gaps in Coverage: In certain scenarios, there might be gaps in coverage due to the limitations of the secondary payer. Understanding these limitations is crucial.

For Employers:

- Cost Savings: COB can contribute to cost savings by reducing the amount that employers have to pay in claims.

- Simplified Administration: COB simplifies the administrative burden related to claims processing.

- Employee Satisfaction: By ensuring that employees receive adequate coverage, COB can contribute to improved employee satisfaction.

However, it's important to acknowledge that COB can also lead to delays in payment and increased administrative complexity for both individuals and employers, highlighting the need for clear communication and efficient claim processing procedures.

Practical Examples of COB in Action

Let's illustrate with a few scenarios:

Scenario 1: John works for Company A and his wife, Mary, works for Company B. Both have group health plans. John's birthday is earlier in the year. If John incurs medical expenses, Company A's plan (John's primary plan) will process the claim first. Company B's plan (Mary's plan/secondary plan) will then process any remaining expenses after Company A has met its obligations.

Scenario 2: Sarah is covered under her employer's group plan (primary) and also has a separate individual health insurance policy (secondary). If Sarah needs medical care, her employer's plan will process the claim first, and the individual policy will cover any remaining expenses up to its policy limits.

Scenario 3: David is covered under his parent's group plan and also under his own student health insurance plan. Typically, the parent's plan would be considered primary, unless the student health plan is specifically designed to be primary in such instances.

Navigating the COB Maze: Tips for Employees

Understanding your COB provisions is crucial for navigating the healthcare system effectively. Here's how employees can better manage their COB situation:

- Review your policy documents: Understand the specific COB rules and how they apply to your situation.

- Contact your plan administrator: Seek clarification on any confusing aspects of your COB provisions.

- Provide accurate information: Ensure that all claims are submitted with complete and accurate information to facilitate smooth processing.

- Keep records: Maintain a detailed record of all your medical expenses, claims, and payments.

- Understand your out-of-pocket maximums: Be aware of the maximum amount you're responsible for paying out-of-pocket, even with multiple plans.

The complexity of COB requires diligent effort and attention to detail. Proactive engagement in understanding your coverage is essential for smooth and efficient claim processing.

Conclusion

The coordination of benefits provision is an integral component of group health plans, designed to control costs and prevent overpayments. While its complexity can be daunting, understanding its key principles and how it impacts your specific situation is essential. By proactively engaging with your plan documents, administrators, and providers, you can navigate the COB landscape effectively and ensure that you receive the maximum benefits possible from your insurance coverage. The goal is not to exploit the system but to ensure your healthcare expenses are managed fairly and efficiently within the framework of your respective insurance plans. Ultimately, the COB provision aims for equitable cost distribution and prevents unsustainable overpayments, thereby ensuring the long-term viability of group health insurance systems.

Latest Posts

Latest Posts

-

A Good Man Is Hard To Find Quizlet

Mar 24, 2025

-

What Did The Warren Commission Determine Quizlet

Mar 24, 2025

-

How Often Should Female Patients Have A Gynecological Exam Quizlet

Mar 24, 2025

-

Population Genetics Is The Study Of Quizlet

Mar 24, 2025

-

Ati Rn Med Surg Proctored Exam 2023 Quizlet

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Group Health Plans Typically Contain A Coordination Of Benefits Provision . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.