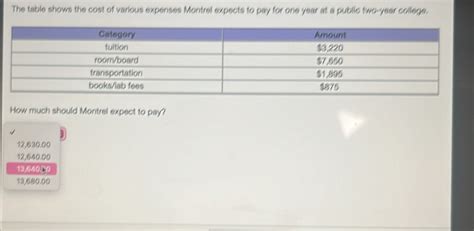

How Much Should Montrel Expect To Pay

Breaking News Today

Mar 26, 2025 · 6 min read

Table of Contents

How Much Should Montrealers Expect to Pay? A Comprehensive Guide to the City's Cost of Living

Montreal, a vibrant city renowned for its European charm, rich culture, and stunning architecture, attracts residents from across the globe. However, before making the move, understanding the cost of living is crucial. This comprehensive guide delves into the various expenses Montrealers face, providing a realistic picture of what to expect financially in this captivating Canadian city.

Housing: The Biggest Expense in Montreal

Housing is undeniably the most significant expense for anyone living in Montreal. The cost varies dramatically based on location, type of accommodation, and size.

Rent: A Breakdown of Rental Costs

Rent in Montreal ranges considerably. Expect to pay significantly less in less central neighbourhoods and more in popular, central areas.

-

Apartments: A one-bedroom apartment in a less central area might cost around $1,000 CAD per month, while a similar apartment in a desirable neighbourhood like Mile End or Plateau Mont-Royal could easily reach $1,500 CAD or more. Two-bedroom apartments naturally command higher prices.

-

Condos: Condo rentals are generally more expensive than apartments, often surpassing $1,800 CAD per month for a one-bedroom unit in prime locations.

-

Shared Accommodation: Sharing a house or apartment can significantly reduce housing costs. Room rentals can range from $700 CAD to $1,200 CAD per month, depending on location and amenities.

Factors Influencing Rental Costs:

- Location: Proximity to downtown, universities, and public transportation significantly impacts rent prices.

- Size: Larger apartments and condos naturally command higher rent.

- Amenities: Features like in-suite laundry, parking, balconies, and modern appliances increase rental costs.

- Building Condition: Newer buildings with updated amenities typically have higher rental rates.

Tips for Finding Affordable Housing:

- Explore less central neighbourhoods: Consider areas slightly further from the city centre for more affordable options.

- Use online rental platforms: Websites and apps dedicated to rental listings provide a vast selection of properties.

- Network: Tap into your personal network; word-of-mouth can sometimes lead to hidden gems.

- Be patient: Finding the right place takes time. Don't rush into a decision.

Transportation: Navigating Montreal's Transit System

Montreal boasts a comprehensive public transportation system, making car ownership less essential than in many other North American cities.

Public Transit Costs:

-

Monthly Pass: An unlimited monthly pass for the entire public transit network (STM) is a cost-effective option, typically around $90 CAD. This provides access to buses and the metro.

-

Single Fares: Individual fares are more expensive in the long run.

-

BIXI Bikes: Montreal's bike-sharing program, BIXI, provides a convenient and affordable way to get around, especially during warmer months.

Car Ownership Costs:

While not strictly necessary, car ownership adds considerable expenses:

- Insurance: Car insurance premiums vary based on age, driving record, and car type.

- Parking: Parking in Montreal can be expensive, particularly in central areas.

- Maintenance: Regular maintenance and repairs add to the overall cost of car ownership.

- Fuel: Gas prices fluctuate, adding another variable to the equation.

Choosing Between Public Transit and Car Ownership:

Consider your lifestyle and commute when deciding whether to own a car. If you work downtown or near well-served public transit routes, a car may be unnecessary.

Groceries and Food: Eating in Montreal

Food costs in Montreal are comparable to other major Canadian cities, but choices significantly impact your overall spending.

Grocery Shopping:

- Supermarkets: Major grocery chains offer a range of options, from budget-friendly to premium brands.

- Farmers' Markets: Buying locally sourced produce at farmers' markets can be more expensive but offers fresher, higher-quality options.

- Ethnic Grocery Stores: These stores frequently offer more affordable choices than mainstream supermarkets.

Eating Out:

- Casual Dining: A casual meal can range from $15 CAD to $30 CAD per person.

- Fine Dining: Expect to pay significantly more for fine dining experiences.

- Coffee Shops: Coffee is a staple in Montreal, with prices similar to other major cities.

Utilities: Essential Services in Montreal

Utilities encompass electricity, heating, water, internet, and phone services. These costs vary depending on your lifestyle and apartment size.

- Electricity: Hydro-Québec is the main electricity provider. Costs depend on consumption.

- Heating: Heating costs are influenced by the building type and energy efficiency.

- Water: Water bills are usually included in rent or are a relatively small additional expense.

- Internet: Numerous providers offer various internet plans, with prices ranging from around $50 CAD to $100 CAD per month for high-speed options.

- Phone: Mobile phone plans vary widely in pricing depending on the provider and data usage.

Healthcare: Navigating the Canadian Healthcare System

Canada has a universal healthcare system, meaning most essential medical services are covered. However, there are still some costs to consider:

- Prescription Drugs: Prescription drugs are not universally covered, and costs can vary considerably.

- Dental Care: Dental care is typically not included in the public healthcare system and is an additional expense.

- Vision Care: Similar to dental care, vision care is usually a separate cost.

Entertainment and Leisure: Enjoying Montreal's Culture

Montreal offers a rich array of cultural activities and entertainment options. Costs vary dramatically based on personal preferences.

- Museums and Galleries: Many museums offer discounted admission for students and seniors.

- Festivals: Montreal hosts numerous festivals throughout the year, with varying ticket prices.

- Sporting Events: Tickets to sporting events range from affordable to very expensive, depending on the event and seating.

- Nightlife: Costs for nightlife depend on your choices, from affordable bars to upscale clubs.

Taxes: Understanding Montreal's Tax System

Taxes in Quebec and Canada are a significant consideration.

- Federal Income Tax: Federal income taxes are progressive, meaning higher earners pay a larger percentage.

- Provincial Income Tax: Quebec has its own provincial income tax system.

- Goods and Services Tax (GST): A national sales tax applied to most goods and services.

- Quebec Sales Tax (QST): Quebec's provincial sales tax.

Tips for Saving Money in Montreal

- Utilize public transport: Avoid car ownership if possible.

- Cook at home: Eating out regularly can significantly increase your expenses.

- Take advantage of free activities: Explore Montreal's parks, festivals, and free museum days.

- Shop around for utilities and insurance: Compare prices from different providers.

- Consider roommates: Sharing accommodation significantly reduces housing costs.

Conclusion: Budgeting for Life in Montreal

The cost of living in Montreal varies greatly depending on individual lifestyle and choices. While housing is the most significant expense, careful budgeting and planning can help you manage your finances effectively. By understanding the different cost components outlined in this guide, prospective residents can better anticipate their financial needs and make informed decisions about their move to this beautiful and dynamic city. Remember that this guide provides a general overview; individual expenses will vary depending on your specific circumstances. Careful planning and budgeting are key to a financially comfortable life in Montreal.

Latest Posts

Latest Posts

-

Which Sentence Describes A Characteristic Of A Poetry Slam

Mar 29, 2025

-

Which Idea Was Supported By Both Plato And Aristotle

Mar 29, 2025

-

Which Of The Following Is Involved In Translation

Mar 29, 2025

-

25 Words Or Less Word List Pdf

Mar 29, 2025

-

Describe The Benefits Of Ceremonies In The Grieving Process

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about How Much Should Montrel Expect To Pay . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.