How Should Students Pay For Monthly Expenses

Breaking News Today

Mar 22, 2025 · 5 min read

Table of Contents

How Should Students Pay for Monthly Expenses? A Comprehensive Guide

Navigating the financial landscape of student life can be daunting. Juggling academics, social life, and the ever-present need for funds can feel overwhelming. This comprehensive guide explores various avenues for students to manage their monthly expenses effectively, ensuring a financially stable and fulfilling student experience. We’ll delve into budgeting, income generation, financial aid options, and responsible spending habits, equipping you with the knowledge to conquer your financial challenges head-on.

Budgeting: The Cornerstone of Financial Success

Before diving into income streams, mastering the art of budgeting is paramount. A well-structured budget acts as a roadmap, guiding your spending and ensuring you stay within your financial limits.

Creating a Realistic Budget:

-

Track your spending: For at least a month, meticulously record every expense, no matter how small. This will reveal spending patterns and highlight areas where you can cut back. Use budgeting apps, spreadsheets, or even a simple notebook – find a method that suits you.

-

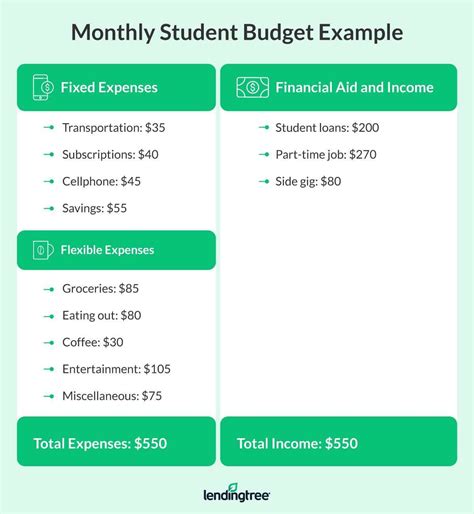

Categorize your expenses: Divide your spending into essential categories like rent/housing, groceries, transportation, tuition, books, and utilities. Also include non-essential categories such as entertainment, dining out, and personal care.

-

Calculate your income: List all sources of income, including part-time jobs, scholarships, financial aid, and any money from family.

-

Identify the gap: Compare your total expenses to your total income. If expenses exceed income, you need to either increase your income or reduce your expenses.

-

Set realistic goals: Don't strive for perfection overnight. Set achievable goals, like reducing your dining-out expenses by 10% this month. Gradually refine your budget as you become more comfortable.

Budgeting Apps and Tools:

Several user-friendly apps and tools can streamline your budgeting process:

-

Mint: This popular app automatically tracks your transactions, categorizes your spending, and provides personalized financial insights.

-

YNAB (You Need A Budget): YNAB employs a zero-based budgeting approach, ensuring every dollar is assigned a purpose.

-

Personal Capital: This comprehensive platform offers budgeting, investment tracking, and retirement planning tools.

-

Spreadsheet Software (Excel, Google Sheets): For those who prefer a more hands-on approach, spreadsheets provide customizable budgeting templates.

Generating Income: Smart Strategies for Students

While budgeting helps you manage your existing funds, generating additional income provides a safety net and contributes to financial independence.

Part-Time Jobs:

-

On-campus jobs: Many universities offer part-time positions in libraries, dining halls, student centers, and administrative offices. These jobs often provide flexible hours and work experience.

-

Off-campus jobs: Explore opportunities in retail, restaurants, customer service, tutoring, or freelance work. Choose roles that align with your skills and schedule.

-

Internships: While often unpaid, internships provide valuable experience and can lead to full-time employment opportunities after graduation. Consider internships that offer stipends or expense reimbursements.

Freelancing:

The gig economy offers numerous freelance opportunities:

-

Online tutoring/teaching: Share your knowledge by tutoring students online in subjects you excel in. Platforms like Chegg and Skooli connect tutors with students.

-

Writing and editing: If you're a strong writer, offer your services for content creation, proofreading, or editing. Websites like Upwork and Fiverr connect freelancers with clients.

-

Graphic design and web development: If you possess design or coding skills, you can offer your services to businesses or individuals.

-

Virtual assistant services: Provide administrative, technical, or creative assistance to clients remotely.

Financial Aid and Scholarships: Exploring Funding Options

Financial aid and scholarships are invaluable resources for covering educational and living expenses.

Financial Aid:

-

Federal Student Aid (FAFSA): This application is crucial for accessing federal grants, loans, and work-study programs. Complete the FAFSA as early as possible to maximize your chances of receiving aid.

-

Institutional aid: Many colleges and universities offer their own financial aid packages based on financial need and merit. Check with your college's financial aid office for details.

Scholarships:

-

Merit-based scholarships: Awarded based on academic achievement, extracurricular activities, or talent.

-

Need-based scholarships: Awarded based on financial need.

-

Specific scholarships: Search for scholarships tailored to your major, interests, or background. Utilize online scholarship search engines to find suitable opportunities.

Responsible Spending Habits: Making Every Dollar Count

Smart spending habits complement budgeting and income generation, maximizing your financial resources.

Prioritize Needs over Wants:

Distinguish between essential expenses (needs) and non-essential expenses (wants). Focus your spending on needs first, reserving funds for wants only after essential expenses are covered.

Reduce Recurring Expenses:

Examine recurring subscriptions (streaming services, gym memberships) and identify areas where you can cut back or consolidate services.

Utilize Student Discounts:

Take advantage of student discounts offered by various businesses, including software, transportation, and entertainment venues.

Cook at Home:

Eating out frequently can drain your budget. Prepare meals at home to significantly reduce food costs.

Utilize Public Transportation or Carpool:

Public transport or carpooling can be significantly cheaper than driving your own vehicle.

Avoid Impulse Purchases:

Before making a purchase, take time to consider its necessity and affordability. Avoid impulsive buys that strain your budget.

Track Your Progress Regularly:

Review your budget and spending regularly to ensure you’re staying on track. Make adjustments as needed to maintain financial stability.

Beyond the Basics: Long-Term Financial Planning

While focusing on immediate expenses, it's crucial to think about long-term financial well-being.

Saving and Investing:

Start saving early, even if it's a small amount each month. Explore options like high-yield savings accounts or low-fee index funds for long-term investment growth.

Building Credit:

Establish good credit habits early on by paying bills on time and using credit responsibly. A good credit score will be essential for future financial endeavors.

Financial Literacy:

Continuously enhance your financial literacy by reading books, attending workshops, and utilizing online resources. Understanding personal finance empowers you to make informed decisions.

Conclusion: Financial Success Within Reach

Managing monthly expenses as a student requires careful planning, resourcefulness, and disciplined spending habits. By implementing a robust budget, exploring income generation strategies, utilizing financial aid opportunities, and practicing responsible spending, students can navigate their financial journeys with confidence and achieve financial stability. Remember that financial success is a continuous process of learning and adaptation. Embrace the challenges, seek guidance when needed, and celebrate your progress along the way. The knowledge and skills you gain now will serve you well throughout your life.

Latest Posts

Latest Posts

-

What Tactics Were Used To Disenfranchise Black Voters Quizlet

Mar 23, 2025

-

Naloxone Is Not Effective In Reverse The Effects Of Quizlet

Mar 23, 2025

-

What Defines The Trigone Of The Urinary Bladder Quizlet

Mar 23, 2025

-

The Social Contract Theory States That Quizlet

Mar 23, 2025

-

What Is The Main Function Of Glucagon Quizlet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about How Should Students Pay For Monthly Expenses . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.