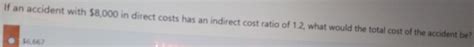

If An Accident With 8000 In Direct Costs

Breaking News Today

Mar 13, 2025 · 5 min read

Table of Contents

The High Cost of Accidents: Navigating the Aftermath of an $8,000 Incident

Accidents happen. Whether it's a fender bender, a workplace mishap, or a household incident, unexpected events can quickly lead to significant financial burdens. This article delves into the multifaceted impact of an accident resulting in $8,000 in direct costs, exploring the immediate consequences, long-term implications, and strategies for mitigation and recovery. We'll examine everything from insurance claims and legal considerations to emotional stress and preventative measures.

Understanding the $8,000 Direct Cost: A Breakdown

An $8,000 direct cost represents the immediate, tangible expenses associated with the accident. This figure could encompass a variety of items, depending on the nature of the incident. Let's consider some potential scenarios:

Scenario 1: Car Accident

- Vehicle Repair: $5,000 for bodywork, parts replacement, and mechanical repairs.

- Medical Bills: $2,000 for emergency room visits, diagnostic tests, and follow-up care.

- Towing Fees: $500

- Lost Wages: $500 due to time off work for recovery and appointments.

Scenario 2: Workplace Accident

- Medical Expenses: $6,000 for treatment of injuries, physical therapy, and medication.

- Property Damage: $1,000 for repairs to damaged equipment or the work environment.

- Lost Wages: $1,000 due to time off for recovery.

Scenario 3: Home Accident

- Property Damage Repair: $7,000 to fix damaged appliances, furniture, or structural components.

- Emergency Services: $1,000 for ambulance fees and other emergency medical services.

It's crucial to meticulously document all expenses, keeping receipts, medical bills, and any other relevant paperwork. This documentation is vital for insurance claims and potential legal proceedings.

Beyond Direct Costs: The Ripple Effect of an Accident

The $8,000 figure only represents the tip of the iceberg. Accidents often trigger a chain reaction of indirect costs that can significantly amplify the overall financial burden:

Indirect Costs: A Broader Perspective

- Increased Insurance Premiums: Expect a rise in your car, homeowner's, or renter's insurance premiums following an accident, even if you weren't at fault. This increase can persist for several years, adding considerable expense over time.

- Legal Fees: If the accident involves legal action, whether you're filing a claim or defending against one, legal representation can be exceptionally expensive. Even seemingly straightforward cases can rapidly escalate in cost.

- Lost Productivity and Earning Potential: Injuries sustained in an accident can lead to prolonged periods of absence from work, resulting in significant lost wages. The severity of the injury directly impacts the duration and magnitude of this loss. In severe cases, long-term disability or even permanent job loss might occur.

- Emotional and Psychological Distress: The emotional toll of an accident should not be underestimated. Stress, anxiety, and depression are common consequences, potentially requiring therapy and impacting overall well-being.

- Future Medical Expenses: Injuries may require ongoing medical care, physiotherapy, or medication, adding to the long-term financial burden. These unforeseen expenses can quickly escalate, particularly in the case of chronic pain or long-term disability.

- Property Value Diminution: In cases of significant property damage (e.g., a car accident resulting in extensive repairs), the vehicle's resale value might be negatively impacted.

Navigating the Aftermath: Insurance Claims and Legal Action

Effectively managing the aftermath of an $8,000 accident involves several key steps:

1. Report the Accident:

Immediately report the accident to the relevant authorities (police, your insurance company) and obtain a police report if applicable. This documentation is crucial for establishing liability and supporting insurance claims.

2. Seek Medical Attention:

Even if injuries seem minor, seek prompt medical attention. Delayed treatment can exacerbate injuries and complicate future claims. Obtain detailed medical records and keep accurate track of all medical expenses.

3. Contact Your Insurance Company:

Inform your insurance company about the accident as soon as possible. Cooperate fully with their investigation and follow their instructions regarding filing a claim. Maintain clear communication and keep detailed records of all interactions.

4. Gather Evidence:

Collect all relevant evidence, including photos of the accident scene, damage to property or vehicles, medical records, repair bills, and witness statements. This evidence will support your insurance claim and protect your interests if legal action becomes necessary.

5. Consider Legal Counsel:

If the accident involves significant injuries, property damage, or disputes over liability, seeking legal counsel is highly recommended. An attorney can advise you on your legal rights, negotiate settlements, and represent you in court if necessary.

Preventing Future Accidents: A Proactive Approach

While accidents can't always be prevented, taking proactive steps can significantly reduce the risk:

Preventive Measures:

- Defensive Driving Techniques: Practice safe driving habits, including maintaining a safe following distance, avoiding distractions, and obeying traffic laws.

- Workplace Safety Protocols: Adhere strictly to workplace safety regulations and report any potential hazards immediately.

- Home Safety Checks: Regularly inspect your home for potential hazards and address any safety concerns promptly.

- Regular Vehicle Maintenance: Ensure your vehicle is properly maintained to prevent mechanical failures that could lead to accidents.

- Insurance Coverage Review: Regularly review your insurance policies to ensure they provide adequate coverage for potential accidents.

Financial Recovery Strategies: Minimizing the Long-Term Impact

Recovering from an $8,000 accident and its associated costs requires a well-defined financial strategy:

Financial Recovery Strategies:

- Budgeting and Expense Tracking: Create a detailed budget to track income and expenses, allowing you to prioritize essential payments and manage debt effectively.

- Debt Consolidation: Explore options for consolidating high-interest debts to reduce overall interest payments.

- Emergency Fund: Build an emergency fund to cover unexpected expenses and reduce the financial stress associated with future unforeseen events.

- Negotiating Medical Bills: Negotiate with healthcare providers to reduce medical bills or establish payment plans.

- Financial Counseling: Consider seeking guidance from a financial counselor or advisor to develop a personalized financial recovery plan.

Conclusion: The Long Shadow of Unforeseen Events

An $8,000 accident, while seemingly manageable in its initial direct cost, can cast a long shadow, triggering a cascade of indirect expenses and long-term consequences. By understanding the potential ramifications, meticulously documenting expenses, promptly seeking medical attention, engaging with insurance companies effectively, and proactively addressing potential hazards, individuals and businesses can minimize the impact of such incidents and navigate the recovery process more successfully. Remember, preventative measures and proactive financial planning play a crucial role in mitigating the financial and emotional burden of unforeseen accidents. The key lies in preparedness and a strategic approach to managing both the immediate and long-term effects.

Latest Posts

Latest Posts

-

Stone And Brick Are Substitutes In Home Construction

Mar 14, 2025

-

A Packet Analyzer Is Called A Sniffer Because

Mar 14, 2025

-

Sporting Officials Are Typically Responsible For

Mar 14, 2025

-

Managers At Amazon Are Usingdecentralized Control To Manage These Employees

Mar 14, 2025

-

The Effects Of Inflation Are Seen In

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about If An Accident With 8000 In Direct Costs . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.