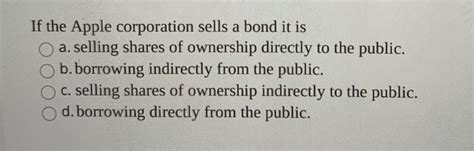

If The Apple Corporation Sells A Bond It Is

Breaking News Today

Mar 29, 2025 · 6 min read

Table of Contents

If Apple Corporation Sells a Bond, It Is... An Investment Opportunity? A Deep Dive into Apple Bonds

Apple Corporation, a name synonymous with innovation and technological prowess, is not just a tech giant; it's also a significant player in the bond market. When Apple sells a bond, it's not just another financial transaction; it's a complex event with significant implications for investors, the company itself, and the broader financial landscape. This in-depth analysis will explore what happens when Apple sells a bond, examining the reasons behind these issuances, the types of bonds offered, and the factors that influence their appeal to investors.

Why Does Apple Issue Bonds?

Apple, despite its enormous cash reserves, regularly issues bonds. This might seem counterintuitive, but there are several compelling reasons:

1. Access to Low-Cost Funding:

Apple's excellent credit rating allows it to borrow money at incredibly low interest rates. Issuing bonds provides a cost-effective way to finance operations, acquisitions, share buybacks, or even simply to manage its cash flow more strategically. Borrowing at low rates allows them to maintain a strong balance sheet while investing in future growth initiatives without significantly impacting its profitability.

2. Diversification of Funding Sources:

Reliance on solely internal cash reserves can be limiting. By issuing bonds, Apple diversifies its funding sources, reducing dependence on bank loans or other forms of short-term credit. This diversification mitigates financial risk and enhances the company's overall financial flexibility.

3. Strategic Financial Management:

Issuing bonds is a sophisticated financial strategy. Apple might strategically use bond sales to manage its tax liabilities, to take advantage of specific market conditions, or to adjust its capital structure to optimize its financial performance. These are complex decisions informed by detailed financial modeling and forecasting.

4. Shareholder Value:

Apple's bond issuances are often intertwined with its strategy to maximize shareholder value. By using borrowed funds for share buybacks, for example, it can potentially increase earnings per share and boost the stock price, benefiting existing shareholders. This is a highly debated strategy but a significant driver behind many corporate bond issuances.

Types of Bonds Issued by Apple:

Apple typically issues a variety of bonds, each catering to different investor preferences and risk tolerances:

1. Corporate Bonds:

These are the most common type of bond issued by Apple. They represent a promise to repay the principal amount along with regular interest payments (coupon payments) over a specified period. Apple's corporate bonds are generally considered to be of very high quality (investment grade) due to the company's strong financial position and consistent profitability.

2. Senior Unsecured Bonds:

These bonds are unsecured, meaning they are not backed by specific assets of the company. However, they are senior in the capital structure, meaning they have priority over other types of debt in case of bankruptcy. This makes them relatively low-risk investments, although the risk is still higher than government bonds.

3. Notes:

Apple also issues notes, which are similar to bonds but often have shorter maturities. Notes can be a more attractive option for investors looking for shorter-term investments and less exposure to interest rate risk.

4. Green Bonds:

In recent years, Apple has also begun issuing green bonds, specifically earmarked for projects with environmental benefits. These bonds appeal to investors interested in Environment, Social, and Governance (ESG) investing, and they often command slightly higher demand and pricing than traditional corporate bonds.

What Makes Apple Bonds Attractive to Investors?

Several factors contribute to the attractiveness of Apple bonds in the investment market:

1. High Credit Rating:

Apple consistently maintains a top credit rating from major rating agencies such as Moody's, S&P, and Fitch. This reflects its exceptional financial strength and low risk of default, making its bonds highly sought after by investors seeking secure, low-risk investment opportunities.

2. Relatively High Yield:

While the yield on Apple bonds might be lower than some higher-risk corporate bonds, they still offer a competitive return compared to government bonds or other low-risk investment options. This makes them an attractive alternative for investors looking to diversify their portfolios and achieve a balance between risk and return.

3. Liquidity:

Apple bonds are highly liquid, meaning they can be easily bought and sold in the secondary market. This liquidity reduces the risk for investors who might need to quickly convert their investment back into cash. The large size of the Apple bond market contributes to this high liquidity.

4. Brand Recognition and Trust:

The strong brand reputation and trust associated with Apple provide an additional layer of confidence for investors. Apple's consistent financial performance and innovation track record make its bonds a relatively safe haven in uncertain markets.

Risks Associated with Investing in Apple Bonds:

Despite their appeal, investing in Apple bonds is not without risk:

1. Interest Rate Risk:

As with all fixed-income securities, Apple bonds are susceptible to interest rate risk. If interest rates rise, the value of existing bonds will fall, potentially leading to capital losses for investors.

2. Inflation Risk:

High inflation can erode the real return on Apple bonds, especially if the coupon rate does not keep pace with inflation. This risk is significant in an inflationary environment.

3. Default Risk:

Although Apple has a very low probability of default, the risk is never entirely eliminated. Unforeseen circumstances or major economic downturns could theoretically impact Apple's ability to meet its debt obligations. However, given its current financial position, this is considered a very low probability event.

4. Market Risk:

The value of Apple bonds can fluctuate depending on overall market conditions, investor sentiment, and the credit ratings agencies' assessments of Apple's financial health. These market forces can impact bond prices independently of the company's actual performance.

Apple Bonds and the Broader Financial Landscape:

Apple's bond issuances have a ripple effect throughout the broader financial system. They influence interest rates, affect investor behavior, and even provide a benchmark for other corporate bond issuances. The sheer size of Apple’s bond offerings often provides a reference point for pricing and credit risk assessment in the broader corporate bond market.

Conclusion:

When Apple Corporation sells a bond, it's engaging in a strategic financial maneuver with far-reaching consequences. For investors, these bonds offer an opportunity to gain exposure to a financially strong and reputable company with a proven track record. However, it is crucial to understand the associated risks, including interest rate risk, inflation risk, and market risk, before investing. A thorough understanding of the nuances of Apple's financial strategy, the specific types of bonds issued, and the broader financial environment is essential for making informed investment decisions. Therefore, while Apple bonds can represent a compelling investment opportunity, a balanced perspective considering both potential returns and risks is essential. Remember to always conduct thorough due diligence and, if necessary, seek professional financial advice before making any investment decisions.

Latest Posts

Latest Posts

-

In An Active Shooter Incident Involving Firearms You Should

Apr 01, 2025

-

Explain How The Terms Of A Sponsorship Are Agreed Upon

Apr 01, 2025

-

The Concept Of Limited Government Holds That

Apr 01, 2025

-

A Drawback Of Planning Is That It

Apr 01, 2025

-

Which Of The Following Is Not True About Fake News

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about If The Apple Corporation Sells A Bond It Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.