If The Canadian Dollar Is Strengthening Then

Breaking News Today

Mar 22, 2025 · 6 min read

Table of Contents

If the Canadian Dollar is Strengthening: Implications and Opportunities

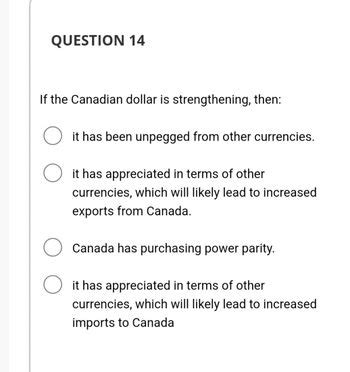

The Canadian dollar, often referred to as the loonie, is a floating currency, meaning its value fluctuates based on various economic factors. When the Canadian dollar strengthens against other major currencies like the US dollar, it presents both opportunities and challenges for various sectors of the Canadian economy. Understanding these implications is crucial for businesses, investors, and individuals alike. This comprehensive guide will delve into the various ramifications of a strengthening Canadian dollar, exploring its impact on different aspects of the Canadian landscape.

Understanding a Strengthening Canadian Dollar

A strengthening Canadian dollar means it takes fewer Canadian dollars to purchase one unit of another currency. For example, if the CAD/USD exchange rate moves from 1.30 to 1.20, it signifies the Canadian dollar has appreciated, meaning it now buys more US dollars. This appreciation can stem from several factors:

Factors Contributing to a Stronger Loonie:

-

Increased Demand for Canadian Goods and Services: Strong exports of Canadian commodities like oil, lumber, and agricultural products increase the demand for the Canadian dollar, pushing its value upwards. A global boom in these sectors directly benefits the Canadian economy and strengthens its currency.

-

Higher Interest Rates: When the Bank of Canada raises interest rates, it makes Canadian investments more attractive to foreign investors seeking higher returns. This increased inflow of foreign capital boosts demand for the Canadian dollar, leading to appreciation.

-

Increased Foreign Investment: Significant foreign direct investment into Canadian businesses and assets increases the demand for Canadian dollars, thereby strengthening the currency. This influx can be driven by various factors, including a stable political climate and a positive economic outlook.

-

Weakening of Other Currencies: The Canadian dollar's strength can be relative. If other major currencies, such as the US dollar or the Euro, weaken, the Canadian dollar might appear stronger in comparison, even without significant internal changes.

-

Positive Economic Indicators: Strong economic data, such as robust GDP growth, low unemployment rates, and increasing consumer confidence, can bolster investor sentiment and increase demand for the Canadian dollar.

Impacts of a Strengthening Canadian Dollar

The consequences of a strengthening Canadian dollar are far-reaching and affect numerous sectors:

Impact on Canadian Exports:

-

Reduced Competitiveness: A stronger Canadian dollar makes Canadian exports more expensive for foreign buyers. This reduced competitiveness can lead to a decline in export volumes, particularly impacting industries heavily reliant on international markets, such as manufacturing and agriculture.

-

Pressure on Export-Oriented Businesses: Businesses that heavily depend on exports face significant challenges. They might need to adjust their pricing strategies, cut costs, or explore new markets to maintain profitability in the face of reduced demand. This can lead to job losses and business closures in severely affected sectors.

-

Shifting Global Market Share: Competitors in countries with weaker currencies gain a price advantage, potentially capturing a larger share of the global market. This necessitates innovative strategies and diversification to mitigate the negative effects.

Impact on Canadian Imports:

-

Increased Purchasing Power: Conversely, a stronger Canadian dollar makes imports cheaper. Consumers benefit from lower prices on foreign goods, boosting purchasing power and potentially stimulating domestic consumption.

-

Increased Competition for Domestic Businesses: Domestic businesses competing with imported goods face increased pressure. They might need to lower their prices to remain competitive, potentially impacting profit margins.

-

Potential for Inflationary Pressures: While cheaper imports benefit consumers, an over-reliance on imports can lead to a decline in domestic production, potentially creating inflationary pressures in the long run.

Impact on the Tourism Sector:

-

Reduced Tourist Arrivals: A stronger Canadian dollar makes Canada a more expensive destination for international tourists. This can lead to a decline in tourist arrivals, negatively impacting the tourism industry, particularly in regions heavily reliant on international tourism.

-

Shifting Tourism Patterns: The change in attractiveness can shift tourism patterns, potentially leading to a decline in revenue for certain businesses, while others may experience a growth in domestic tourism. Adaptation strategies become key to survival.

Impact on the Canadian Stock Market:

-

Mixed Effects: A strengthening Canadian dollar's impact on the stock market is complex and multifaceted. While export-oriented companies may experience declining share prices, companies focused on the domestic market or those with significant international operations (and hedging strategies) might benefit.

-

Increased Volatility: Currency fluctuations can introduce increased volatility into the stock market, making it challenging for investors to predict market trends and manage their portfolios effectively. Risk management becomes crucial during periods of exchange rate uncertainty.

Impact on the Investment Landscape:

-

Attracting Foreign Investment: A stronger Canadian dollar can attract foreign investment as it provides higher returns when converted back to the investor's home currency. This can stimulate economic growth but also increase reliance on external factors.

-

Challenges for Canadian Investors Abroad: Canadian investors looking to invest in foreign markets will see their returns diminished when converted back to Canadian dollars. This might make foreign investments less appealing.

Strategies for Navigating a Strengthening Canadian Dollar

Businesses and individuals can employ various strategies to mitigate the risks and capitalize on the opportunities presented by a strengthening Canadian dollar:

For Businesses:

-

Diversification of Markets: Reducing reliance on a single export market by expanding into new international markets or focusing more on the domestic market can cushion the impact of a strong loonie.

-

Cost Reduction Strategies: Implementing efficient cost-cutting measures can help businesses maintain profitability even with reduced export revenue.

-

Pricing Strategies: Adjusting pricing strategies to remain competitive in the global market is crucial. This may involve accepting lower profit margins or finding ways to increase value for customers.

-

Hedging Strategies: Using financial instruments like forward contracts or options can help businesses hedge against currency fluctuations and protect themselves from losses due to a strong Canadian dollar.

For Investors:

-

Diversification of Investments: Spreading investments across different asset classes and geographic regions can reduce overall risk and protect against currency fluctuations.

-

Currency Hedging: Investors can use currency hedging strategies to minimize losses from currency fluctuations when investing in foreign markets.

-

Focus on Domestic Investments: Investing in Canadian companies that primarily serve the domestic market can help mitigate the impact of a strong Canadian dollar.

Conclusion: Embracing the Fluctuations

The strengthening of the Canadian dollar is a dynamic process with varied and complex consequences. While it presents challenges for certain sectors, particularly those reliant on exports, it also creates opportunities for others, including those focused on domestic markets or importing goods. Understanding these implications is paramount for businesses, investors, and individuals to navigate this dynamic economic landscape effectively. Proactive adaptation, strategic planning, and diversification are key elements in harnessing the benefits and mitigating the risks associated with a strong Canadian dollar. Staying informed about economic indicators, market trends, and government policies will help navigate the ever-changing terrain of currency fluctuations and seize opportunities that arise. The key is to adapt and innovate, turning challenges into opportunities for growth and sustained success.

Latest Posts

Latest Posts

-

What Is The Purpose Of Privacy Impact Assessment Quizlet

Mar 23, 2025

-

Kristallnacht The Beginning Of The Holocaust Quizlet

Mar 23, 2025

-

Teas 7 English And Language Usage Quizlet

Mar 23, 2025

-

What Is The Internet Of Things Quizlet

Mar 23, 2025

-

Treatment Options For Parasites Like Scabies Include Quizlet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about If The Canadian Dollar Is Strengthening Then . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.