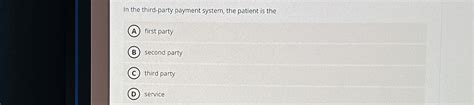

In The Third Party Payment System The Patient Is The

Breaking News Today

Mar 25, 2025 · 6 min read

Table of Contents

In the Third-Party Payment System, the Patient Is the… What? Decoding the Patient's Role in Healthcare Finance

The healthcare landscape is complex, particularly when it comes to financing. Third-party payment systems, where an entity other than the patient and the provider directly pays for healthcare services, have become the dominant model. But understanding the patient's role within this system is crucial, not just for patients themselves, but for healthcare providers and payers alike. This article will delve deep into the multifaceted role of the patient in third-party payment systems, exploring their responsibilities, rights, and the often-confusing financial implications.

The Patient's Shifting Role: From Sole Payer to Informed Consumer

Historically, patients were primarily responsible for the full cost of their healthcare. This direct payment model was simple, but it often placed an undue burden on individuals, particularly during unexpected illnesses or emergencies. The rise of third-party payers—insurance companies, government programs like Medicare and Medicaid, and managed care organizations—fundamentally altered this dynamic.

However, the patient's role didn't simply disappear. Instead, it shifted from being a purely financial one to a more complex blend of:

- Consumer of Healthcare Services: Patients actively choose their healthcare providers, services, and treatments. This requires them to be informed consumers, capable of understanding their options and making informed decisions about their care.

- Navigator of the Payment System: Patients must navigate the complexities of insurance plans, deductibles, co-pays, and out-of-pocket expenses. This involves understanding their coverage, submitting claims, and resolving billing discrepancies.

- Advocate for Their Own Care: Patients have a crucial role in advocating for their own needs and ensuring they receive appropriate and timely care. This includes communicating effectively with their providers and proactively managing their health.

Understanding the Different Types of Third-Party Payers

Understanding the patient's role requires understanding the various types of third-party payers:

1. Private Insurance Companies:

Private insurance companies offer various plans, each with different levels of coverage, deductibles, co-pays, and out-of-pocket maximums. The patient's responsibility often involves:

- Paying Premiums: Regular payments to maintain coverage.

- Meeting Deductibles: Paying a set amount out-of-pocket before insurance coverage kicks in.

- Paying Co-pays and Co-insurance: Paying a fixed amount at the time of service (co-pay) and a percentage of the remaining cost (co-insurance).

- Understanding Exclusions and Limitations: Being aware of services not covered by their plan.

Understanding Your Policy: Knowing the specifics of your policy is paramount. Pay attention to the explanation of benefits (EOB) you receive after each visit. Understanding these details will help you budget for your out-of-pocket expenses and avoid unexpected bills.

2. Government Programs: Medicare and Medicaid

Medicare: A federal health insurance program for individuals 65 and older and certain younger people with disabilities. The patient's role still involves:

- Paying Premiums (for some parts): While Medicare Part A is generally premium-free, Parts B, C, and D have premiums.

- Meeting Deductibles and Co-pays: Medicare has deductibles and co-pays for various services.

- Understanding Part A, B, C, and D: Navigating the different parts of Medicare can be challenging, requiring patients to understand which services are covered under each part.

Medicaid: A joint state and federal program providing healthcare coverage to low-income individuals and families. While Medicaid covers a broader range of services, the patient’s responsibility may include:

- Meeting Co-pays: Depending on the specific state plan, patients may still have co-pays for certain services.

- Understanding Eligibility Requirements: Maintaining eligibility can require regular updates to the relevant authorities.

3. Managed Care Organizations (MCOs): HMOs and PPOs

MCOs manage healthcare costs and quality through various mechanisms, including provider networks and utilization management. Patients in these systems must:

- Choose from Network Providers: Typically, only services from in-network providers are covered.

- Obtain Referrals: HMOs often require referrals from a primary care physician to see specialists.

- Understand Pre-authorization Requirements: Some procedures require pre-authorization before coverage is granted.

Choosing the Right Plan: Carefully considering your healthcare needs and the specifics of each plan is crucial before enrolling in an MCO.

The Patient's Financial Responsibilities: Navigating the Maze

Even within third-party payment systems, patients often bear significant financial responsibilities. These include:

- Premiums: Monthly payments for insurance coverage.

- Deductibles: Out-of-pocket expenses before insurance coverage begins.

- Co-pays: Fixed amounts paid at the time of service.

- Co-insurance: Percentage of costs paid after the deductible is met.

- Out-of-pocket Maximum: The maximum amount a patient is responsible for paying in a given year. Once this is reached, the insurance company covers 100% of the remaining costs.

- Non-Covered Services: Expenses for services not included in the insurance plan.

Protecting Yourself: Patient Rights and Responsibilities

Understanding your rights as a patient is equally important as understanding your financial responsibilities. These rights include:

- The right to receive a clear explanation of your medical condition and treatment options: Providers should explain your diagnoses, treatment plans, and potential risks in a way you can understand.

- The right to access your medical records: You have the right to review and obtain copies of your medical records.

- The right to make informed decisions about your care: You can refuse treatment or request alternative options.

- The right to confidentiality: Your medical information should be protected and kept private.

- The right to file a complaint: If you feel your rights have been violated, you have the right to file a complaint with the relevant authorities.

Strategies for Managing Healthcare Costs

Managing healthcare costs effectively requires proactive steps:

- Choose a plan that suits your needs and budget: Carefully compare different plans and select one that offers appropriate coverage at a price you can afford.

- Understand your benefits: Familiarize yourself with your insurance policy's details, including coverage limits, deductibles, and co-pays.

- Use in-network providers: Using in-network providers usually results in lower out-of-pocket costs.

- Practice preventive care: Regular checkups and preventive measures can help avoid costly illnesses later.

- Ask questions: Don't hesitate to ask your provider or insurance company about billing issues or unclear information.

- Negotiate medical bills: You can often negotiate lower prices for medical services, especially for larger bills.

- Explore financial assistance programs: Many organizations and programs provide financial assistance to individuals struggling with medical bills.

The Future of the Patient's Role: Technological Advancements and Data Transparency

Technological advancements are transforming the healthcare landscape, impacting the patient's role in third-party payment systems. These advancements include:

- Telemedicine: Expanding access to care and potentially lowering costs.

- Patient portals: Providing online access to medical records and billing information.

- Data analytics: Utilizing data to personalize treatment plans and improve efficiency.

Increased transparency in healthcare pricing and billing is also gaining momentum. This trend aims to empower patients with more information to make informed decisions about their care and costs.

Conclusion: Empowered Patients, Efficient Systems

The patient's role in third-party payment systems is multifaceted and increasingly complex. However, by understanding their rights, responsibilities, and the intricacies of different payment models, patients can become informed consumers and advocates for their own healthcare. Proactive engagement, coupled with technological advancements and increased transparency, promises a more efficient and equitable healthcare system where patients are truly empowered participants in their own care. The journey to navigating this system requires continuous learning and vigilance, but ultimately, an informed patient is a healthier and more financially secure patient.

Latest Posts

Latest Posts

-

A Student Is Given Two 10g Samples

Mar 26, 2025

-

The Term Aerotolerant Anaerobe Refers To An Organism That

Mar 26, 2025

-

With Regard To Facility Safety Nfpa 1500

Mar 26, 2025

-

In Cultural Anthropology The Term Belief Refers To

Mar 26, 2025

-

Rn Targeted Medical Surgical Endocrine Online Practice 2019

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about In The Third Party Payment System The Patient Is The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.