Insurance Is Not Characterized As Which Of The Following

Breaking News Today

Mar 29, 2025 · 7 min read

Table of Contents

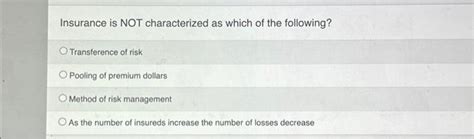

Insurance is NOT Characterized as Which of the Following? Deconstructing Common Misconceptions

Insurance, a cornerstone of modern financial stability, is often misunderstood. While its core function—risk transfer and mitigation—is relatively straightforward, many misconceptions surround its nature and characteristics. This article delves into those misconceptions, clarifying what insurance is not, and providing a comprehensive understanding of its true essence. We will explore several key areas where common misunderstandings arise, debunking myths and offering a clearer picture of how insurance operates.

Insurance is NOT a Guaranteed Investment

One of the most pervasive misconceptions about insurance is that it's an investment vehicle. While some insurance products, such as whole life insurance, have a cash value component that grows over time, it’s crucial to understand that insurance’s primary purpose is not investment. The returns are often modest compared to other investment options, and the primary focus remains risk protection.

Key Differences:

- Investment Goal: Investments aim to generate returns and grow capital.

- Insurance Goal: Insurance aims to protect against financial loss due to unforeseen events.

- Risk Profile: Investments inherently carry risk, with potential for both significant gains and losses. Insurance is designed to mitigate risk, not profit from it. The premiums paid are essentially a cost to transfer risk, not an investment in a profit-making venture.

- Liquidity: Accessing investment funds is typically easier than accessing the cash value in most insurance policies. There are often penalties and restrictions involved in withdrawing from insurance policies.

Investing in insurance for investment returns is a misguided strategy. Consider dedicated investment vehicles such as stocks, bonds, mutual funds, or real estate for wealth building.

Insurance is NOT a Substitute for Responsible Risk Management

Insurance doesn't absolve you from the responsibility of managing risks. It's a tool to mitigate the financial impact of unfortunate events, not a license to engage in reckless behavior. Think of it as a safety net, not a trampoline.

Examples:

- Driving Recklessly: Having car insurance doesn't justify speeding or driving under the influence. While insurance will cover the financial consequences of an accident, it won't protect you from legal repercussions or the potential for injury.

- Neglecting Home Maintenance: Homeowners insurance protects against damage, but failing to maintain your property increases the likelihood of claims and potential penalties.

- Ignoring Safety Precautions: Business insurance covers losses, but neglecting safety protocols can lead to workplace accidents, higher premiums, and potential business closure.

Responsible Risk Management involves:

- Assessing potential risks.

- Implementing preventative measures.

- Mitigating those risks as far as possible.

- Utilizing insurance as a financial safety net for the risks that remain.

Insurance is NOT a Guarantee of Payment

While insurance aims to provide financial protection, it's not a guarantee that every claim will be paid. There are specific conditions, exclusions, and limitations outlined in the policy that need to be carefully reviewed.

Factors affecting claim payments:

- Policy Terms and Conditions: The specific coverage offered, deductibles, and exclusions are critical. Reading and understanding your policy is vital.

- Fraudulent Claims: Submitting a false or exaggerated claim will result in claim denial.

- Failure to Meet Policy Requirements: Failing to fulfill necessary requirements, like timely notification or providing accurate information, can negatively impact claim processing.

- Acts of God (or exclusions): Many policies have limitations on specific events or circumstances. For example, flood damage may not be covered by standard homeowners insurance. Additional coverage is often necessary.

It's crucial to understand your insurance policy thoroughly and ensure it aligns with your specific risk exposures. Don't rely on assumptions; engage actively in understanding the details.

Insurance is NOT a One-Size-Fits-All Product

Different types of insurance cater to specific needs and risk profiles. There's no single insurance policy that adequately covers all potential risks. Choosing the right insurance requires careful assessment of your individual circumstances and exposures.

Types of Insurance and their Specific Coverage:

- Health Insurance: Covers medical expenses.

- Auto Insurance: Covers vehicle damage and injuries in accidents.

- Homeowners Insurance: Covers damage or loss to your home and belongings.

- Renters Insurance: Covers your personal belongings in a rented property.

- Life Insurance: Provides financial security for dependents after your death.

- Disability Insurance: Provides income replacement if you become disabled.

- Business Insurance: Protects your business from various risks.

Choosing the correct type and level of insurance requires careful consideration and may necessitate consulting with a qualified insurance professional.

Insurance is NOT Always Affordable

The cost of insurance varies depending on several factors, including your risk profile, coverage level, and the insurer's pricing. It's a significant financial commitment, and affordability should be a key consideration when choosing a policy.

Factors Affecting Insurance Costs:

- Age: Age often plays a role in premiums (e.g. health, life insurance).

- Health Status: Pre-existing conditions or health risks significantly influence health insurance premiums.

- Driving Record: Your driving history greatly impacts auto insurance costs.

- Location: Geographic location influences the risk of certain events, affecting home and auto insurance.

- Coverage Level: Higher coverage levels generally result in higher premiums.

Comparing quotes from multiple insurers is essential to finding the best value for your needs. Consider your budget constraints when choosing coverage levels and policy terms.

Insurance is NOT Just About the Premium Price

While the premium is a significant factor, focusing solely on price can be detrimental. Consider the coverage offered, the insurer's reputation for claim settlements, and the overall value proposition before selecting a policy.

Factors Beyond Price:

- Claims Process: A streamlined and efficient claims process is crucial when you need to file a claim. Research the insurer’s reputation for handling claims fairly and promptly.

- Financial Stability of the Insurer: Choose a financially sound insurer to ensure they can pay out claims when needed.

- Customer Service: Excellent customer service can make a significant difference in the overall insurance experience.

Choosing an insurer based solely on price without considering these crucial factors could lead to inadequate coverage or difficulties during claim processing.

Insurance is NOT a Replacement for Careful Planning

Insurance is a crucial component of a comprehensive financial plan, but it's not a substitute for responsible financial planning. Proper financial planning involves saving, budgeting, investing, and managing debt, in addition to securing appropriate insurance coverage.

Comprehensive Financial Planning Includes:

- Emergency Fund: Having sufficient savings to cover unexpected expenses reduces reliance on insurance for minor events.

- Retirement Planning: Retirement planning ensures financial security in later years.

- Debt Management: Responsible debt management reduces financial vulnerabilities.

- Estate Planning: Estate planning facilitates the orderly transfer of assets.

Insurance complements a well-structured financial plan by providing a safety net for unforeseen circumstances. It should not replace prudent financial management practices.

Insurance is NOT Static; It Requires Regular Review

Your insurance needs evolve over time, reflecting changes in your life circumstances, assets, and risk exposures. Regular review of your insurance policies ensures they remain adequately aligned with your evolving needs.

Reasons to Review Your Insurance:

- Life Changes: Marriage, having children, buying a home, or changing jobs significantly impact insurance needs.

- Increased Assets: Owning more valuable possessions necessitates increased coverage.

- Changes in Risk Profile: Changes in your occupation, driving habits, or health can alter your risk profile.

- Policy Renewal: Review your policy details at renewal, ensuring coverage still meets your needs.

Regularly reviewing your insurance policies and making necessary adjustments ensures you have adequate protection at all times.

Conclusion: Understanding the Nuances of Insurance

Understanding what insurance is not is as important as understanding what it is. Insurance is a powerful tool for mitigating financial risks, but it's crucial to approach it with a realistic and informed perspective. Avoid common misconceptions and ensure you choose policies that align with your specific needs and risk profile, contributing to a comprehensive and secure financial future. Remember that proactive risk management and comprehensive financial planning are essential complements to insurance coverage. By grasping the nuances of insurance and its role in financial well-being, you can make informed decisions and secure your financial future effectively.

Latest Posts

Latest Posts

-

Where Did Ajs Dad Find His Phone

Apr 01, 2025

-

Apes Unit 6 Progress Check Mcq Part A

Apr 01, 2025

-

A Project Network Provides The Basis For

Apr 01, 2025

-

A Food Safety Policy Is A Statement

Apr 01, 2025

-

A Cooking Company Wants To Identify A Target Market

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Insurance Is Not Characterized As Which Of The Following . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.