Life Insurance Exam Questions And Answers Pdf

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Life Insurance Exam Questions and Answers PDF: A Comprehensive Guide

Finding the right study materials is crucial for success in any exam, and the life insurance licensing exam is no exception. Many aspiring agents search for "life insurance exam questions and answers PDF" hoping to find a comprehensive resource to aid their preparation. While a single PDF containing all the answers might be elusive, this article aims to provide a structured and in-depth look at the types of questions you'll encounter, the key concepts you need to understand, and effective strategies to ace your exam.

Understanding the Life Insurance Exam

The life insurance licensing exam is a rigorous assessment designed to ensure prospective agents possess the necessary knowledge and understanding to serve clients ethically and competently. The exam's specific structure and content can vary slightly depending on your location and the licensing body, but generally covers key areas including:

Core Subjects Covered:

-

Insurance Principles: This section explores fundamental insurance concepts such as risk, underwriting, policy types, and the insurance cycle. Expect questions on the different types of insurance, including life insurance, health insurance, and property insurance. You'll need a solid grasp of how these products work and their underlying principles.

-

Life Insurance Products: This is a major component of the exam. You must be proficient in understanding various life insurance policy types—term life, whole life, universal life, variable universal life, variable life—their features, benefits, limitations, and suitability for different client needs. Be prepared to compare and contrast these products.

-

Sales Practices and Ethics: This section emphasizes the importance of ethical conduct and legal compliance in the insurance industry. Questions will test your understanding of suitability standards, disclosure requirements, and avoiding deceptive or misleading sales practices. Know the regulations and laws governing your area.

-

Applications and Underwriting: Understanding the application process, including gathering client information, completing applications accurately, and the underwriting process is crucial. You should be familiar with the factors underwriters consider and how they assess risk.

-

State-Specific Regulations: A portion of the exam will be dedicated to the specific regulations and laws governing the sale of life insurance in your jurisdiction. These can vary significantly, so thorough study of your state's insurance code is paramount.

-

Calculations and Illustrations: While not the entire exam, you will likely encounter questions involving basic calculations related to premiums, benefits, and policy values. Practice these calculations until they become second nature.

Types of Questions to Expect

The life insurance exam typically employs a variety of question formats, including:

-

Multiple Choice: These are the most common type of question, offering several answer choices, with only one being correct. Carefully read each option before selecting your answer.

-

True/False: These questions test your understanding of specific facts and concepts. Pay close attention to detail, as even a minor inaccuracy can make the statement false.

-

Matching: These questions require you to match terms or concepts with their corresponding definitions or descriptions. Organize your answers systematically to avoid errors.

-

Scenario-Based Questions: These present realistic scenarios and ask you to apply your knowledge to determine the best course of action. These questions test your problem-solving skills and judgment.

Effective Study Strategies

While a "life insurance exam questions and answers PDF" might seem like a shortcut, the most effective approach involves a structured and comprehensive study plan. Here's what to consider:

1. Utilize Reputable Study Materials:

Focus on high-quality study guides, textbooks, and practice exams specifically designed for the life insurance licensing exam in your state. Don't rely solely on free resources, as their accuracy and comprehensiveness can vary.

2. Create a Study Schedule:

Develop a realistic study schedule that allocates sufficient time to cover all exam topics. Break down the material into manageable chunks to avoid feeling overwhelmed. Regular, focused study sessions are more effective than cramming.

3. Active Recall and Practice:

Instead of passively rereading materials, actively test your knowledge through flashcards, practice questions, and self-testing. This strengthens your memory and helps identify areas needing further review.

4. Understand, Don't Memorize:

Focus on understanding the underlying concepts rather than rote memorization. Understanding why an answer is correct, rather than just knowing the answer, will improve your performance on scenario-based questions.

5. Seek Clarification:

Don't hesitate to seek clarification on concepts you find challenging. Discuss difficult topics with instructors, mentors, or colleagues.

6. Simulate Exam Conditions:

Take practice exams under timed conditions to simulate the actual exam environment. This helps manage your time effectively and reduce test anxiety.

7. Review Your Mistakes:

Carefully analyze your mistakes on practice exams. Identify the areas where you struggled and dedicate extra time to mastering those concepts.

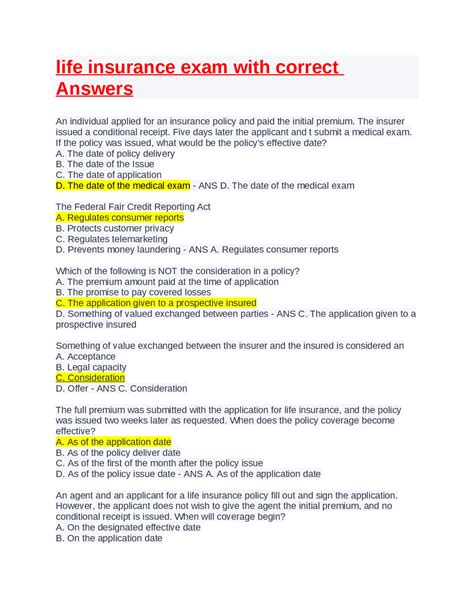

Sample Questions and Answers (Illustrative Purposes Only)

It's important to remember that these examples are for illustrative purposes and shouldn't be considered a complete representation of the exam content. Always consult official study materials for accurate and up-to-date information.

1. Question: Which type of life insurance policy provides coverage for a specific period, after which it expires?

Answer: Term Life Insurance

2. Question: What is the primary purpose of underwriting in life insurance?

Answer: To assess the risk associated with insuring an applicant and determine the appropriate premium.

3. Question: Which of the following is NOT a characteristic of a whole life insurance policy?

**(a) Cash Value**

**(b) Level Premiums**

**(c) Coverage for a specific term**

**(d) Death Benefit**

Answer: (c) Coverage for a specific term (Whole life policies offer lifelong coverage.)

4. Question (Scenario-Based): A client, age 35, wants a policy that provides a substantial death benefit at a relatively low premium for the next 20 years. Which type of policy would be MOST suitable?

**(a) Whole Life**

**(b) Universal Life**

**(c) Term Life**

**(d) Variable Universal Life**

Answer: (c) Term Life (Term life offers high death benefit for a specific period at lower premium than permanent policies.)

5. Question: What is the importance of obtaining informed consent from a client before recommending a specific life insurance product?

Answer: It ensures the client understands the policy's features, benefits, and limitations and makes an informed decision based on their needs and circumstances. This is crucial for ethical and legal compliance.

Conclusion

Passing the life insurance exam requires dedication, thorough preparation, and a strategic approach. While the elusive "life insurance exam questions and answers PDF" might not exist in its entirety, this guide provides a structured framework for your studies. Remember to utilize reputable resources, create a focused study plan, practice actively, and simulate exam conditions to maximize your chances of success. Good luck! Remember to always check with your state's insurance department for the most current information and requirements.

Latest Posts

Latest Posts

-

The Image Seen In A Plane Mirror Is Located

Mar 18, 2025

-

Lokes Was Thrilled When She Found A Low Cost Airfare

Mar 18, 2025

-

Credit Accident And Health Plans Are Designed To

Mar 18, 2025

-

Group Life Insurance Policies Are Generally Written As

Mar 18, 2025

-

National Voter Registration Act Definition Ap Gov

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Life Insurance Exam Questions And Answers Pdf . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.