Life Insurance Replaces Lost Income Due To

Breaking News Today

Mar 22, 2025 · 7 min read

Table of Contents

Life Insurance Replaces Lost Income Due To… Unexpected Life Events

Life insurance is often misunderstood, perceived as a complicated and unnecessary expense. However, its core function is incredibly straightforward and vitally important: replacing lost income. While the specifics of coverage vary widely, the underlying principle remains consistent – providing financial security for your dependents in the event of your untimely death. This article delves deep into the crucial role life insurance plays in mitigating the financial fallout from unexpected life events, exploring various scenarios and highlighting the importance of adequate coverage.

The Unexpected: When Life Throws a Curveball

Life is unpredictable. While we plan for the future, unforeseen events can drastically alter our circumstances, leaving our loved ones vulnerable. These events, often resulting in lost income, underscore the critical need for life insurance:

1. Premature Death: The Most Obvious Scenario

The most common reason people purchase life insurance is to protect their families from the financial burden of their death. The loss of a primary income earner can have devastating consequences:

- Mortgage and Rent Payments: Without a steady income stream, maintaining a home becomes a significant challenge.

- Debt Repayment: Credit card debt, student loans, and other outstanding debts can quickly overwhelm surviving family members.

- Childcare Expenses: The cost of raising children is substantial, and the loss of one parent’s income can drastically impact their quality of life.

- Education Costs: Funding a child's education is a major financial undertaking. Life insurance can help ensure that educational goals remain achievable.

- Ongoing Living Expenses: Daily expenses like groceries, utilities, and transportation become difficult to manage without a regular income.

Adequate life insurance coverage ensures that these essential expenses can be met even after your death. The amount of coverage needed depends on your income, outstanding debts, and the number of dependents you have.

2. Terminal Illness & Long-Term Disability: Facing the Unexpected

Even if you don’t pass away unexpectedly, life-threatening illnesses and long-term disabilities can severely impact your earning potential. These events can leave your family financially vulnerable, highlighting the importance of alternative life insurance types:

-

Critical Illness Insurance: This type of insurance provides a lump-sum payment upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. This payout can help cover medical expenses, lost income, and other financial burdens associated with a critical illness. It's essential for maintaining financial stability during a difficult time, allowing focus on recovery rather than financial worries.

-

Disability Insurance: This type of insurance replaces a portion of your income if you become unable to work due to illness or injury. Unlike life insurance, which pays out upon death, disability insurance provides ongoing support during a period of incapacitation. This is crucial for covering everyday living expenses and preventing the depletion of savings.

Both critical illness and disability insurance work in conjunction with life insurance to offer comprehensive financial protection against the unexpected loss or significant reduction of income.

3. Accidental Death or Dismemberment (AD&D): Covering Unexpected Accidents

Accidents happen. Even the most cautious individuals can experience unforeseen accidents resulting in death or serious injury. AD&D insurance provides a benefit in the event of accidental death or loss of limbs or eyesight. This type of coverage is often a valuable supplement to a comprehensive life insurance policy, ensuring that your loved ones are protected from the financial implications of a sudden and unexpected tragedy. It offers an additional layer of security, addressing a specific type of event that can cause significant financial strain.

Determining the Right Coverage: A Personalized Approach

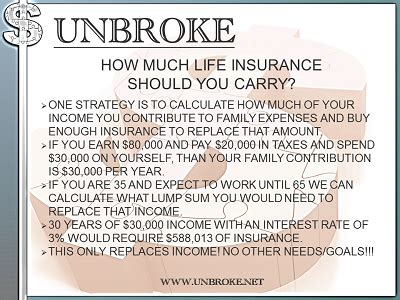

The amount of life insurance you need is highly individual and depends on several factors:

-

Income: Your annual income is a key factor in determining the appropriate coverage amount. Generally, you should aim for coverage that replaces several years' worth of income to provide long-term financial security.

-

Expenses: Consider all your ongoing expenses, including mortgage payments, debt repayments, childcare costs, and other living expenses. Your life insurance should be enough to cover these expenses for your dependents.

-

Debt: Outstanding debts, such as mortgages, student loans, and credit card debt, should be factored into your life insurance needs. The coverage should be sufficient to pay off these debts upon your death.

-

Dependents: The number and ages of your dependents significantly influence the amount of life insurance you need. Young children require extensive financial support, while older children may have more independent means.

-

Lifestyle: Your current lifestyle and future plans should also be considered. Do you have any significant financial goals, such as retirement savings or college funds for your children? Life insurance can help safeguard these goals.

Seeking professional advice from a financial advisor is strongly recommended. They can assess your individual circumstances and help you determine the optimal level of life insurance coverage.

Beyond Financial Security: The Emotional Peace of Mind

Life insurance offers more than just financial security; it also provides emotional peace of mind. Knowing that your loved ones are financially protected in the event of your death allows you to focus on living your life to the fullest without the constant worry of what might happen. This peace of mind is invaluable and contributes significantly to a healthier and more balanced life. The reduction in stress associated with financial security can improve overall well-being and relationships.

Choosing the Right Type of Life Insurance: A Closer Look

Several types of life insurance policies are available, each with its own features and benefits:

-

Term Life Insurance: This provides coverage for a specified period (term), offering affordability and simplicity. It's a cost-effective solution for those seeking temporary coverage.

-

Whole Life Insurance: This offers lifelong coverage and builds cash value over time. It’s a more expensive option, but the cash value can be accessed for various needs.

-

Universal Life Insurance: This combines the features of term and whole life insurance, offering flexibility in premium payments and death benefits.

-

Variable Life Insurance: This type allows you to invest the cash value in various investment options, offering potential for higher returns but also carrying higher risk.

-

Variable Universal Life Insurance: Combines the flexible premiums of universal life with the investment options of variable life, allowing for customized risk and return profiles.

The best type of life insurance policy depends on your individual financial goals, risk tolerance, and budget. Careful consideration and consultation with a financial advisor are crucial in selecting the most suitable option.

Life Insurance and Estate Planning: A Synergistic Approach

Life insurance plays a vital role in effective estate planning. It can:

-

Provide liquidity for estate taxes: Large estates may be subject to estate taxes, and life insurance proceeds can provide the necessary liquidity to cover these taxes.

-

Cover funeral and burial expenses: These expenses can be substantial, and life insurance can help alleviate the financial burden on the family.

-

Fund charitable donations: If you wish to leave a legacy to a charity, life insurance can be used to make a significant donation upon your death.

-

Protect business interests: For business owners, life insurance can help protect the business by providing funds to cover losses upon the death of a key partner or employee.

Incorporating life insurance into a comprehensive estate plan ensures that your assets are distributed according to your wishes and that your loved ones are financially protected.

Conclusion: Securing Your Family's Future

Life insurance, at its core, is a tool for replacing lost income stemming from unexpected life events. It offers more than financial protection; it provides emotional peace of mind, allowing you to live life to the fullest knowing your family is secure. Understanding the various types of life insurance, determining the right coverage amount, and integrating it into a comprehensive estate plan are crucial steps in securing your family's financial future. Remember, this isn't merely about financial security; it's about providing a safety net for those you cherish most, ensuring their well-being long after you are gone. The proactive step of securing life insurance is an investment not just in your family's financial future, but in their emotional well-being and peace of mind. Don't delay; take the necessary steps today to protect your loved ones.

Latest Posts

Latest Posts

-

Cardiac Arrest Is Often Due To A Blockage Quizlet

Mar 23, 2025

-

When A Woman Presents With Abdominal Pain Quizlet

Mar 23, 2025

-

What Was The Cuban Missile Crisis Quizlet

Mar 23, 2025

-

Postrenal Acute Kidney Injury May Be Caused By Quizlet

Mar 23, 2025

-

What Is A Sign Of Alcohol Overdose Quizlet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about Life Insurance Replaces Lost Income Due To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.