Manufacturing Costs Include Direct Materials Direct Labor And

Breaking News Today

Mar 30, 2025 · 7 min read

Table of Contents

Manufacturing Costs: A Deep Dive into Direct Materials, Direct Labor, and Manufacturing Overhead

Understanding manufacturing costs is crucial for any business involved in production. Accurate cost accounting provides the foundation for pricing strategies, profitability analysis, and informed decision-making. This article will delve into the three primary components of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We'll explore each element in detail, providing practical examples and insights to help you navigate the complexities of cost accounting.

Direct Materials: The Raw Ingredients of Production

Direct materials are the raw materials, components, and supplies that become an integral part of the finished product. They are directly traceable to the manufactured goods. Think of the flour, sugar, and eggs in a bakery, the wood and nails in a furniture factory, or the steel and aluminum in an automobile plant. These are all examples of direct materials.

Identifying Direct Materials

The key characteristic of direct materials is their traceability. You can easily and accurately track the cost of these materials to specific units produced. This contrasts with indirect materials, which we'll discuss later under manufacturing overhead. The cost of direct materials is a significant portion of the total manufacturing cost, often representing a substantial percentage of the final product's selling price.

Costing Methods for Direct Materials

Several methods exist for tracking and costing direct materials:

-

First-In, First-Out (FIFO): This method assumes that the oldest materials are used first. In times of fluctuating prices, FIFO can lead to a more accurate reflection of the current cost of goods sold.

-

Last-In, First-Out (LIFO): This method assumes that the newest materials are used first. LIFO can be beneficial during periods of inflation, as it matches current costs with current revenues. However, it's important to note that LIFO is not permitted under International Financial Reporting Standards (IFRS).

-

Weighted-Average Cost: This method calculates the average cost of all materials available during a specific period. It simplifies accounting but might not accurately reflect the cost of materials used in specific production runs.

Accurate inventory management is crucial for effective direct materials costing. Efficient inventory control minimizes waste, reduces storage costs, and ensures a smooth production process. Techniques like Just-in-Time (JIT) inventory management can significantly optimize direct materials usage.

Direct Labor: The Human Element in Manufacturing

Direct labor represents the wages, salaries, and benefits paid to workers directly involved in the production process. These are the individuals who physically transform raw materials into finished goods. Examples include assembly line workers, machinists, welders, and skilled craftspeople. Their labor is directly traceable to the manufactured goods.

Identifying Direct Labor Costs

Direct labor costs encompass more than just hourly wages. They also include:

- Overtime pay: Compensation for exceeding regular working hours.

- Employee benefits: Health insurance, retirement contributions, and paid time off.

- Payroll taxes: Employer contributions to social security and other taxes.

Accurate tracking of direct labor hours is essential. Time tracking systems, often integrated with payroll software, are commonly used to monitor employee hours spent on specific production tasks. This information is vital for calculating labor costs per unit and for evaluating labor efficiency.

Labor Efficiency and Productivity

Managing direct labor costs effectively involves focusing on labor efficiency and productivity. This can be achieved through:

- Training and development: Investing in employee training improves skills and reduces errors, leading to higher output and lower labor costs per unit.

- Process improvement: Streamlining production processes eliminates unnecessary steps and reduces the time required for production.

- Technological advancements: Automation and advanced machinery can significantly reduce the need for manual labor, lowering direct labor costs.

Manufacturing Overhead: The Indirect Costs of Production

Manufacturing overhead encompasses all costs associated with production that are not directly traceable to specific units of output. These are indirect costs, meaning they're not easily attributed to individual products. It's a significant cost component that needs careful consideration.

Key Components of Manufacturing Overhead

Manufacturing overhead includes a wide range of expenses, such as:

-

Indirect materials: These are materials used in the production process but are not directly incorporated into the finished product. Examples include lubricants, cleaning supplies, and small tools.

-

Indirect labor: This includes the wages and benefits of employees who are not directly involved in production but support the manufacturing process. Examples include supervisors, maintenance personnel, and quality control inspectors.

-

Factory rent and utilities: Costs associated with the manufacturing facility, including rent, electricity, gas, and water.

-

Depreciation of factory equipment: The allocation of the cost of factory equipment over its useful life.

-

Factory insurance: Insurance premiums for the manufacturing facility and equipment.

-

Factory supplies: Small tools, cleaning supplies, and other consumable items used in the factory.

Allocating Manufacturing Overhead

Because manufacturing overhead costs are indirect, they need to be allocated to individual products. Several methods are used for this allocation:

-

Machine hours: Allocating overhead based on the number of machine hours used in production. This is suitable for factories where machinery plays a significant role.

-

Direct labor hours: Allocating overhead based on the number of direct labor hours worked. This is suitable when labor is a significant driver of overhead costs.

-

Direct labor costs: Allocating overhead based on the total direct labor costs. This method is simpler but might not accurately reflect the relationship between overhead and production volume.

-

Activity-based costing (ABC): A more sophisticated method that assigns overhead costs based on specific activities that drive those costs. ABC provides a more accurate allocation, particularly in complex manufacturing environments.

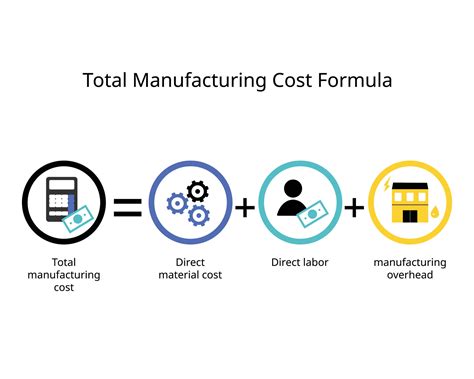

Calculating Total Manufacturing Costs

The total manufacturing cost is the sum of direct materials, direct labor, and manufacturing overhead. This figure is crucial for determining the cost of goods manufactured (COGM) and the cost of goods sold (COGS).

Total Manufacturing Cost = Direct Materials + Direct Labor + Manufacturing Overhead

Understanding the different cost elements and their accurate calculation is crucial for effective cost management. Businesses can use this information to set competitive prices, optimize production processes, and improve overall profitability.

Cost Control and Optimization Strategies

Effective cost control is essential for maintaining profitability in a competitive market. Several strategies can be implemented to optimize manufacturing costs:

-

Lean manufacturing: A systematic approach to eliminating waste and maximizing efficiency throughout the production process.

-

Value engineering: Analyzing product design and manufacturing processes to identify cost-saving opportunities without compromising quality.

-

Supply chain management: Optimizing the flow of materials and information throughout the supply chain to reduce costs and improve efficiency.

-

Inventory management: Implementing effective inventory control techniques to minimize storage costs and reduce waste.

-

Technology adoption: Utilizing automation, robotics, and other advanced technologies to improve efficiency and reduce labor costs.

-

Regular cost analysis: Periodically reviewing and analyzing manufacturing costs to identify areas for improvement and cost reduction.

The Importance of Accurate Cost Accounting

Accurate cost accounting is essential for informed decision-making in manufacturing. By accurately tracking and analyzing manufacturing costs, businesses can:

-

Set competitive prices: Understand the true cost of production to determine profitable pricing strategies.

-

Improve profitability: Identify areas for cost reduction and efficiency improvement.

-

Make informed investment decisions: Assess the financial viability of new equipment, technologies, or processes.

-

Evaluate product performance: Analyze the cost and profitability of individual products.

-

Meet regulatory requirements: Ensure compliance with accounting standards and regulations.

Conclusion

Understanding the components of manufacturing costs—direct materials, direct labor, and manufacturing overhead—is fundamental for successful manufacturing operations. Accurate cost accounting, coupled with effective cost control strategies, allows businesses to optimize production processes, set competitive prices, and achieve sustainable profitability. By carefully tracking and analyzing these costs, manufacturers can gain valuable insights into their operations and make informed decisions to enhance their competitive advantage in the market. The information provided here serves as a foundation for more in-depth exploration of specific cost accounting methods and techniques. Continuous learning and adaptation are crucial for staying ahead in the dynamic world of manufacturing.

Latest Posts

Latest Posts

-

You Should Not Attempt To Lift A Patient

Apr 01, 2025

-

What Is The Difference Between Biotic And Abiotic Factors

Apr 01, 2025

-

Which Of The Following Statements Regarding A Diaphragm Is True

Apr 01, 2025

-

The Central Dogma Describes Information Flow In Cells As

Apr 01, 2025

-

Vocabulary Workshop Level F Unit 2 Answers

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Manufacturing Costs Include Direct Materials Direct Labor And . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.