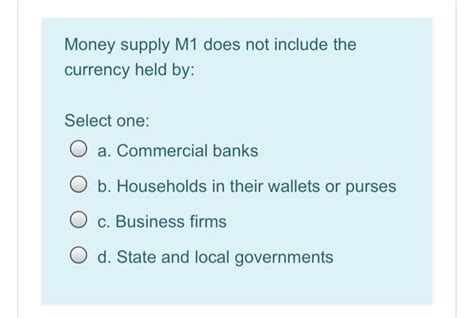

Money Supply M1 Does Not Include The Currency Held By

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

Money Supply M1: What It Includes and Excludes

The money supply is a crucial economic indicator, reflecting the total amount of money circulating within an economy. Understanding its components is vital for comprehending monetary policy and its impact on inflation, economic growth, and overall financial stability. One key measure of the money supply is M1, but what exactly does it encompass, and what crucial element doesn't it include? This comprehensive article delves deep into the definition of M1, exploring its components and, critically, why certain forms of currency are explicitly excluded.

Defining M1: The Narrowest Measure of Money Supply

M1 represents the narrowest definition of the money supply. It focuses on the most liquid forms of money – those most readily available for immediate transactions. This includes:

-

Currency in Circulation: This refers to physical cash (coins and banknotes) held by the non-bank public. This is the money in your wallet, purse, or your home safe, not the cash held by banks themselves.

-

Demand Deposits: These are funds held in checking accounts at commercial banks and other financial institutions. Demand deposits are essentially money that can be accessed immediately upon request by writing a check or using a debit card.

-

Traveler's Checks: These are pre-printed checks purchased from banks or other financial institutions that can be used as a substitute for cash, particularly for international travel. However, their usage has declined significantly in recent years due to the rise of more convenient digital payment methods.

-

Other Checkable Deposits: This category encompasses various other accounts that allow for immediate check writing and access to funds, such as negotiable order of withdrawal (NOW) accounts and automatic transfer service (ATS) accounts.

These components of M1 are highly liquid, meaning they can be easily converted into cash to make transactions. This characteristic is why M1 serves as a crucial indicator of short-term economic activity. A rapid increase in M1 might suggest increased economic activity, whereas a decrease could signal slowing economic growth. However, it's important to consider other factors alongside M1 to get a comprehensive economic picture.

What M1 Does Not Include: The Crucial Exclusion of Bank Reserves

The critical element excluded from M1 is currency held by commercial banks and other depository institutions. This is often misunderstood. While banks hold significant amounts of cash, this money is not considered part of the circulating money supply. This exclusion is based on the understanding that bank reserves aren't readily available for immediate transactions by the general public.

Banks are required to hold a certain percentage of their deposits as reserves – this is known as the reserve requirement, set by the central bank. These reserves are essential for meeting customer demands for withdrawals and maintaining the stability of the banking system. They act as a buffer, ensuring the banks can fulfill their obligations even during periods of financial stress.

Why Excluding Bank Reserves is Critical to Understanding M1

The exclusion of bank reserves from M1 is crucial for several reasons:

-

Maintaining Accuracy: Including bank reserves would significantly inflate the M1 figure, providing a distorted picture of the actual money available for transactions in the broader economy. The reserves are not actively circulating within the general economy; they are essentially held in reserve to ensure the banking system's stability and liquidity.

-

Preventing Double Counting: Including bank reserves in M1 would lead to double-counting. These reserves are already represented in the demand deposits held by individuals and businesses at those same institutions.

-

Reflecting Actual Purchasing Power: M1 seeks to reflect the purchasing power directly available to the non-bank public. Bank reserves, while representing potential purchasing power, are not directly used for transactions by individuals or businesses. Their inclusion would misrepresent the actual amount of money actively circulating in the economy.

-

Accuracy in Monetary Policy: Accurate measurement of M1 is essential for effective monetary policy. If bank reserves were included, the central bank's tools for managing the money supply would be less effective, leading to potentially harmful policy decisions.

M1 vs. Broader Measures of Money Supply (M2, M3, etc.)

While M1 provides a narrow view of money supply, economists also utilize broader measures such as M2 and M3. These incorporate less liquid forms of money that are still considered part of the overall money supply.

-

M2: Includes everything in M1, plus savings accounts, money market accounts, small-denomination time deposits, and balances in retail money market mutual funds. These are less liquid than M1 components but can still be relatively easily converted to cash.

-

M3: This is a broader measure (sometimes no longer officially reported) that includes M2 plus large-denomination time deposits, institutional money market mutual funds, and other larger, less liquid financial assets.

The inclusion of these less liquid assets in M2 and M3 provides a more comprehensive picture of the overall financial system's liquidity but at the cost of losing the precision of the immediate-transaction focus of M1.

The Significance of M1 in Economic Analysis

M1's relatively narrow scope makes it a highly sensitive indicator of short-term economic fluctuations. Changes in M1 can offer valuable insights into:

-

Inflation: A rapidly expanding M1, coupled with other factors like increased consumer demand, can contribute to inflationary pressures. Conversely, a contraction in M1 may signal a deflationary environment or slowing economic growth.

-

Economic Growth: An increasing M1 can indicate increased economic activity as businesses and consumers engage in more transactions. However, it's essential to consider other economic indicators to avoid misinterpreting this correlation.

-

Monetary Policy Effectiveness: Central banks closely monitor M1 to gauge the effectiveness of their monetary policy tools, such as interest rate adjustments and reserve requirements. Changes in M1 can indicate whether the central bank's policies are having the desired effect on the money supply and broader economy.

-

Predicting Recessions: While not a foolproof indicator, significant and prolonged declines in M1 can sometimes serve as an early warning sign of potential economic recessions.

Limitations of Using M1 as a Sole Economic Indicator

While M1 is a valuable tool for economic analysis, it's crucial to understand its limitations:

-

Velocity of Money: M1 only accounts for the amount of money in circulation, not how quickly that money changes hands (velocity). A slower velocity of money can dampen the impact of an increase in M1 on economic activity.

-

Technological Changes: The rise of digital payments and fintech innovations continues to reshape the financial landscape, potentially affecting the accuracy and relevance of traditional monetary aggregates like M1. The increasing use of digital currencies and mobile payment systems complicates the precise measurement of the money supply.

-

Other Economic Factors: M1 should not be viewed in isolation. Other macroeconomic factors, such as consumer confidence, investment levels, government spending, and international trade, significantly influence overall economic performance.

-

Global Interdependence: In an increasingly interconnected global economy, international capital flows and exchange rate fluctuations can impact the money supply and influence the interpretation of M1 data.

Conclusion: M1's Role in a Complex Economic Landscape

M1, excluding bank reserves, provides a crucial snapshot of the most liquid portion of the money supply. Its focus on immediately available funds makes it a sensitive indicator of short-term economic activity. However, it's vital to remember that M1 is only one piece of a much larger economic puzzle. Analyzing M1 in conjunction with other economic indicators, considering the velocity of money, and accounting for ongoing technological changes is essential for a comprehensive and accurate understanding of economic trends and the overall health of an economy. Understanding why bank reserves are specifically excluded is paramount to correctly interpreting the data and avoiding misinterpretations of economic performance. M1 provides valuable insights, but it should never be used as the sole predictor or indicator of economic health.

Latest Posts

Latest Posts

-

Letrs Unit 1 Session 7 Check For Understanding

Mar 20, 2025

-

What Should Be Prioritized When Creating A Budget Everfi

Mar 20, 2025

-

Nihss Certification Nihss Answer Key Group B

Mar 20, 2025

-

Which Best Describes A Drama Written In An Experimental Style

Mar 20, 2025

-

Children And Adults Can Both Benefit From Having A Dietician

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Money Supply M1 Does Not Include The Currency Held By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.