Mrs Roswell Is A New Medicare Beneficiary

Breaking News Today

Mar 16, 2025 · 7 min read

Table of Contents

- Mrs Roswell Is A New Medicare Beneficiary

- Table of Contents

- Mrs. Roswell is a New Medicare Beneficiary: A Comprehensive Guide

- Understanding Medicare's Parts: A Foundation for Mrs. Roswell

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part C: Medicare Advantage Plans

- Part D: Prescription Drug Coverage

- Enrolling in Medicare: The Initial Steps for Mrs. Roswell

- Initial Enrollment Period (IEP):

- Special Enrollment Periods (SEPs):

- General Enrollment Period (GEP):

- Choosing the Right Medicare Plan for Mrs. Roswell: A Personalized Approach

- Health Status and Medical Needs:

- Prescription Drug Usage:

- Budget and Financial Considerations:

- Provider Networks:

- Maximizing Medicare Benefits for Mrs. Roswell: Tips and Strategies

- Annual Wellness Visits:

- Preventative Care:

- Appealing Claims:

- Medicare Savings Programs:

- Staying Informed: Resources for Mrs. Roswell

- Medicare.gov:

- State Health Insurance Assistance Programs (SHIPs):

- Medicare Rights Center:

- Conclusion: Empowering Mrs. Roswell for a Successful Medicare Journey

- Latest Posts

- Latest Posts

- Related Post

Mrs. Roswell is a New Medicare Beneficiary: A Comprehensive Guide

Navigating the complexities of Medicare can be daunting, especially for new beneficiaries. This comprehensive guide will walk you through the Medicare system, focusing on the experience of Mrs. Roswell, a newly eligible individual. We’ll cover everything from initial enrollment to understanding her coverage options and maximizing her benefits. This guide is designed to empower Mrs. Roswell and others in similar situations to confidently manage their Medicare journey.

Understanding Medicare's Parts: A Foundation for Mrs. Roswell

Medicare is a federal health insurance program primarily for individuals 65 and older, or younger people with certain disabilities. It's comprised of four main parts:

Part A: Hospital Insurance

Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some types of home healthcare. Most people don't pay a premium for Part A because they or their spouse paid Medicare taxes while working. However, there are usually cost-sharing requirements like deductibles and coinsurance. For Mrs. Roswell, understanding her Part A coverage is crucial for managing potential hospital stays and rehabilitation needs. She should familiarize herself with the details of her coverage to avoid unexpected expenses. Knowing the deductible and coinsurance amounts is vital for budgeting.

Part B: Medical Insurance

Part B covers physician services, outpatient care, medical supplies, and preventative services. Most people pay a monthly premium for Part B, which can vary depending on their income. Part B also has a yearly deductible and coinsurance requirements. For Mrs. Roswell, this part of Medicare will be essential for covering routine checkups, specialist visits, and managing ongoing health conditions. Understanding the coverage limits and cost-sharing aspects of Part B will be critical to financial planning.

Part C: Medicare Advantage Plans

Medicare Advantage (Part C) plans are offered by private insurance companies and provide all the coverage of Part A and Part B, often with additional benefits like vision, hearing, and dental. They typically have a monthly premium and may have different cost-sharing arrangements than Original Medicare. Part C can offer a streamlined approach to healthcare for Mrs. Roswell, potentially reducing her out-of-pocket expenses depending on the specific plan. It’s important for her to compare different plans offered in her area, considering factors like the network of providers, premiums, and out-of-pocket maximums.

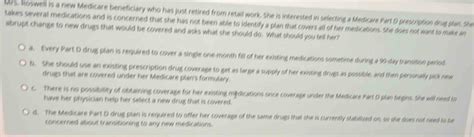

Part D: Prescription Drug Coverage

Part D is the prescription drug coverage part of Medicare. It's administered through private insurance companies and requires a monthly premium. Part D plans have different formularies (lists of covered drugs), and it is crucial for Mrs. Roswell to carefully examine the formulary to ensure her necessary medications are covered. This ensures that her prescription costs are manageable and that she has access to the drugs she needs. She should understand the plan's deductible, copayments, and the coverage gap (also known as the "donut hole"). Understanding the nuances of Part D is vital for managing prescription drug expenses effectively.

Enrolling in Medicare: The Initial Steps for Mrs. Roswell

The enrollment process can feel overwhelming, but it's essential to understand the timelines and options available to Mrs. Roswell.

Initial Enrollment Period (IEP):

Mrs. Roswell likely has an Initial Enrollment Period (IEP), typically a seven-month period centered around her 65th birthday. Understanding the exact timing of her IEP is crucial, as missing the window can result in penalties. This period allows her to enroll in Part A and Part B. Failing to enroll during the IEP can lead to higher premiums later.

Special Enrollment Periods (SEPs):

There are circumstances that qualify Mrs. Roswell for a Special Enrollment Period (SEP). These periods allow enrollment outside the IEP if she experiences qualifying life events, such as job loss that eliminates employer-sponsored health coverage. Understanding these options is vital in case of unforeseen changes in her employment or life circumstances.

General Enrollment Period (GEP):

If Mrs. Roswell misses her IEP, she can enroll during the General Enrollment Period (GEP), which runs from January 1st to March 31st each year. However, she will likely face penalties for delayed enrollment.

Choosing the Right Medicare Plan for Mrs. Roswell: A Personalized Approach

Selecting the best Medicare plan is highly personalized and depends on several factors unique to Mrs. Roswell's situation.

Health Status and Medical Needs:

Mrs. Roswell's current health status and anticipated future healthcare needs are significant considerations. If she has chronic conditions requiring frequent medical care or specialty medications, a Medicare Advantage plan with robust coverage might be beneficial. If she is generally healthy and prefers the flexibility of Original Medicare, that might be a better fit.

Prescription Drug Usage:

Her prescription drug needs will directly impact her Part D selection. She should carefully review formularies from different Part D plans to ensure her medications are covered at an affordable price. Understanding the plan's cost-sharing structure, including deductibles, copays, and the coverage gap, is crucial.

Budget and Financial Considerations:

The premiums, deductibles, and copayments associated with each plan vary significantly. Mrs. Roswell should consider her budget and financial resources when comparing different plans. A lower-premium plan might have higher out-of-pocket costs, while a higher-premium plan could provide more comprehensive coverage and potentially lower out-of-pocket expenses in the long run.

Provider Networks:

Medicare Advantage plans have specific provider networks. Mrs. Roswell should ensure that her preferred doctors and specialists are in the plan's network to avoid higher costs or limited access to care. For Original Medicare, access is generally broader, but it's still important to check that her doctors accept Medicare assignment.

Maximizing Medicare Benefits for Mrs. Roswell: Tips and Strategies

Several strategies can help Mrs. Roswell maximize her Medicare benefits and manage her healthcare costs effectively.

Annual Wellness Visits:

Mrs. Roswell should take advantage of her annual wellness visit, a free preventative service covered by Medicare Part B. These visits can help identify potential health problems early, preventing more costly interventions later.

Preventative Care:

Medicare covers a range of preventative services, such as screenings for cancer, diabetes, and heart disease. Utilizing these services can help maintain good health and prevent costly treatments down the line. She should be proactive in scheduling these screenings.

Appealing Claims:

If Mrs. Roswell disagrees with a Medicare claim denial, she has the right to appeal. Understanding the appeals process and diligently pursuing appeals for legitimate reasons can save her significant amounts of money.

Medicare Savings Programs:

Mrs. Roswell should investigate whether she qualifies for Medicare Savings Programs (MSPs). These programs help low-income Medicare beneficiaries with their Part A and Part B premiums, deductibles, and copayments. These programs can significantly reduce her healthcare expenses.

Staying Informed: Resources for Mrs. Roswell

Staying updated on Medicare changes and options is crucial. Several resources are available to help Mrs. Roswell navigate the complexities of Medicare.

Medicare.gov:

The official Medicare website, Medicare.gov, provides comprehensive information on all aspects of the program, including eligibility, enrollment, and benefits.

State Health Insurance Assistance Programs (SHIPs):

SHIPs are local programs that offer free, unbiased counseling to Medicare beneficiaries. They can provide personalized assistance with plan selection and other Medicare-related issues.

Medicare Rights Center:

The Medicare Rights Center is a national non-profit organization that provides information and advocacy for Medicare beneficiaries. They can answer questions and help resolve disputes with Medicare providers and plans.

Conclusion: Empowering Mrs. Roswell for a Successful Medicare Journey

Navigating Medicare can be challenging, but understanding the system's intricacies is crucial for making informed decisions and maximizing benefits. By understanding the different parts of Medicare, carefully selecting a plan, and utilizing available resources, Mrs. Roswell can confidently manage her healthcare needs and enjoy peace of mind knowing she has access to quality and affordable medical care. This guide provides a comprehensive starting point for Mrs. Roswell's Medicare journey, equipping her with the knowledge and tools to make informed decisions and live a healthier, more financially secure retirement. Remember, proactive engagement and ongoing education are key to navigating the complexities of Medicare successfully.

Latest Posts

Latest Posts

-

One Disadvantage Of Infrared Thermometers Is That They

Mar 17, 2025

-

The Effectiveness Of Pit Crew Cpr Is Dependent On

Mar 17, 2025

-

Punitive Damages Are Often Awarded In Contracts Cases

Mar 17, 2025

-

Changes To Can Be Ascribed To Glacial Melting

Mar 17, 2025

-

Which Of The Following Is Not True Of Relief Sculpture

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Mrs Roswell Is A New Medicare Beneficiary . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.