One Advantage Of The Corporate Form Of Organization Is The:

Breaking News Today

Mar 22, 2025 · 5 min read

Table of Contents

One Advantage of the Corporate Form of Organization Is the: Limited Liability

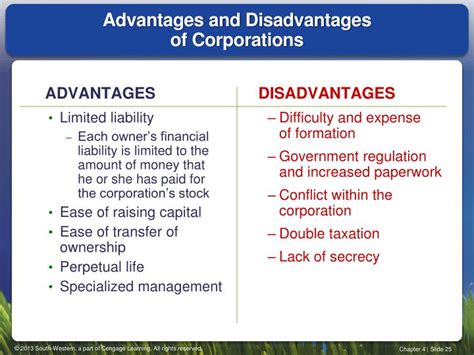

The corporate form of organization, while complex and demanding, offers numerous advantages over sole proprietorships and partnerships. One of the most significant benefits is limited liability. This single advantage often outweighs the complexities and costs associated with forming and maintaining a corporation. This article will delve deep into the concept of limited liability, exploring its implications for shareholders, the nuances of its protection, and the situations where it may not be absolute. We'll also compare it to the unlimited liability faced by owners of other business structures.

Understanding Limited Liability: A Shield for Shareholders

Limited liability, in its essence, means that the personal assets of the shareholders are protected from the debts and liabilities of the corporation. This is a fundamental difference from sole proprietorships and partnerships, where the owners are personally liable for business debts. If the business incurs debt or faces lawsuits, creditors can only pursue the corporation's assets. They cannot seize the personal assets of the shareholders to satisfy these obligations.

This protection is crucial for several reasons:

Protecting Personal Wealth: The Core Benefit

The primary advantage of limited liability is its safeguarding effect on personal wealth. Imagine a scenario where a small corporation, involved in manufacturing, experiences a product liability lawsuit. A customer is injured due to a defective product, and the lawsuit results in a significant judgment against the corporation. With limited liability, the shareholders' personal homes, cars, savings accounts, and other assets are safe from seizure. Only the corporation's assets are at risk. This protection is invaluable, particularly for entrepreneurs taking significant financial risks in starting a new venture.

Encouraging Investment and Growth

Limited liability plays a critical role in attracting investors. Investors are far more willing to invest in a corporation than in a sole proprietorship or partnership because their risk is significantly limited. Knowing their personal wealth is protected encourages investment, enabling businesses to secure the capital necessary for expansion, research and development, and other growth initiatives. This fosters economic growth and job creation.

Facilitating Access to Credit

Limited liability also makes it easier for corporations to secure loans and credit from financial institutions. Lenders are more comfortable extending credit to a corporation knowing that their risk is confined to the corporation's assets. This access to credit is vital for corporations to finance their operations, undertake new projects, and manage cash flow effectively.

Nuances and Exceptions to Limited Liability

While limited liability offers robust protection, it's important to understand that it's not absolute. There are certain situations where the corporate veil, the legal separation between the corporation and its shareholders, can be pierced, resulting in personal liability for shareholders.

Piercing the Corporate Veil: When Personal Liability Applies

Piercing the corporate veil is a legal action taken by creditors when a corporation fails to maintain the proper formalities or acts fraudulently. Several factors can lead to this action:

-

Undercapitalization: If a corporation is deliberately undercapitalized at its inception, meaning it lacks sufficient assets to cover potential liabilities, courts may find the shareholders personally liable. This suggests a lack of genuine intent to operate as a separate legal entity.

-

Commingling of Assets: If the corporation and its shareholders mix personal and corporate funds or assets, blurring the lines between the two entities, it can weaken the protection of limited liability. Maintaining strict separation of assets is crucial.

-

Fraud or Illegal Activities: If the corporation engages in fraudulent or illegal activities, shareholders may be held personally liable for the resulting damages. This is especially true if they were actively involved in the wrongdoing.

-

Failure to Follow Corporate Formalities: Neglecting to maintain proper corporate records, holding regular shareholder meetings, or adhering to other legal requirements can make it easier for courts to pierce the corporate veil. This suggests a lack of serious intent to separate the corporation from the shareholders' personal affairs.

-

Alter Ego Theory: If the corporation is merely viewed as an alter ego or extension of the shareholder, the court may disregard the corporate structure and hold the shareholder personally responsible. This often occurs in situations where the corporation is heavily controlled by a single individual who fails to treat it as a separate entity.

Other Considerations

It’s important to remember that directors and officers of a corporation, while benefiting from limited liability as shareholders, can be held personally liable for certain actions. Breach of fiduciary duty, negligence, and other misconduct can result in personal lawsuits and financial consequences.

Comparing Limited Liability to Other Business Structures

To fully appreciate the significance of limited liability, it's beneficial to contrast it with other business structures:

Sole Proprietorship: Unlimited Liability

In a sole proprietorship, the owner and the business are legally indistinguishable. The owner is personally liable for all business debts and obligations. This means personal assets are at risk if the business incurs debt or faces legal action. Creditors can pursue the owner's personal assets to recover debts.

Partnership: Unlimited Liability (Generally)

Similarly, in a general partnership, partners share unlimited liability for business debts and obligations. Each partner is personally liable for the actions and debts of the entire partnership. Limited liability partnerships (LLPs) are an exception, providing some protection to partners but not eliminating personal liability entirely. The protection in LLPs is typically limited to specific types of liabilities, such as those arising from the negligence of other partners.

Conclusion: The Power of Limited Liability in Corporate Success

Limited liability is a powerful tool that facilitates business growth, attracts investment, and protects the personal assets of shareholders. While not an absolute guarantee against all forms of liability, it provides a crucial shield against many common business risks. Understanding the nuances of limited liability, including the potential for piercing the corporate veil, is essential for anyone considering forming a corporation. By adhering to corporate formalities and maintaining a clear separation between personal and corporate assets, businesses can maximize the benefits of this fundamental advantage of the corporate form of organization. The ability to separate personal and business risk is a major factor in the success and growth of many businesses, making it a cornerstone of corporate strategy and a key driver of economic activity. The peace of mind afforded by limited liability allows entrepreneurs to focus on building their businesses, secure in the knowledge that their personal assets are protected from potential business setbacks. This ultimately contributes to a more stable and robust business environment.

Latest Posts

Latest Posts

-

The Suns Apparent Path Around The Celestial Sphere Is Called

May 09, 2025

-

Most Legal Issues Faced By Counselors Involve

May 09, 2025

-

What Happens In The Stratum Germinativum Milady

May 09, 2025

-

The Manager Is Responsible For Knowing The Food Sanitation Rules

May 09, 2025

-

Which Of The Following Is Not A Neurotransmitter

May 09, 2025

Related Post

Thank you for visiting our website which covers about One Advantage Of The Corporate Form Of Organization Is The: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.