Q Is Looking To Buy A Life Insurance Policy

Breaking News Today

Mar 21, 2025 · 5 min read

Table of Contents

Q is Looking to Buy a Life Insurance Policy: A Comprehensive Guide

Q, like many individuals, is considering purchasing a life insurance policy. This is a significant financial decision, and understanding the various types of policies, factors to consider, and the process involved is crucial. This comprehensive guide will walk Q (and you!) through everything needed to make an informed choice.

Understanding Your Needs: The Foundation of Life Insurance

Before diving into policy specifics, Q needs to determine his insurance needs. This involves several key questions:

1. What are Q's financial goals and responsibilities?

- Debt coverage: Does Q have outstanding debts like a mortgage, loans, or credit card balances? Life insurance can ensure these debts are paid off upon his death, preventing financial hardship for his loved ones.

- Family support: Does Q have dependents, such as a spouse, children, or elderly parents? Life insurance provides financial security for them, covering expenses like living costs, education, and healthcare.

- Estate planning: Does Q want to leave a legacy or provide for specific financial goals, such as funding a child's college education or establishing a trust? Life insurance can be a valuable tool in estate planning.

- Business needs: If Q owns a business, life insurance can protect his business partners or provide funds for business continuity in case of his death.

2. What is Q's risk tolerance and financial situation?

- Income and savings: Q's current income, savings, and overall financial stability will influence the type and amount of insurance he can afford.

- Health status: Q's health will affect the cost of premiums. Pre-existing conditions may impact eligibility or increase premiums.

- Age: Younger individuals generally qualify for lower premiums than older individuals.

3. What is Q's time horizon?

- Short-term needs: Q might need coverage for a specific period, like paying off a mortgage within 15 years. A term life insurance policy would suffice.

- Long-term needs: Q may require lifelong coverage to provide for his family's needs indefinitely. A whole life or universal life insurance policy might be suitable.

Types of Life Insurance Policies: A Detailed Overview

Several life insurance policies cater to diverse needs and financial situations. Understanding these options is critical for Q to choose the most appropriate policy.

1. Term Life Insurance:

- Definition: Provides coverage for a specified period (term), such as 10, 20, or 30 years. If Q dies within the term, the death benefit is paid to his beneficiaries. If he survives the term, the policy expires.

- Pros: Generally affordable, particularly for younger, healthy individuals. Simple and straightforward.

- Cons: Provides coverage only for a limited time. No cash value accumulation. Premiums may increase if renewed.

2. Whole Life Insurance:

- Definition: Provides lifelong coverage, offering a guaranteed death benefit and cash value accumulation. The cash value grows tax-deferred and can be borrowed against or withdrawn.

- Pros: Lifelong coverage, cash value component, potential for tax-deferred growth.

- Cons: Higher premiums compared to term life insurance, cash value growth may be slower than other investments.

3. Universal Life Insurance:

- Definition: Offers flexible premiums and death benefits. Policyholders can adjust premiums and death benefit amounts within certain limits. Also offers a cash value component.

- Pros: Flexibility in premiums and death benefit, cash value component.

- Cons: More complex than term life insurance, premiums may fluctuate depending on market conditions.

4. Variable Life Insurance:

- Definition: Combines a death benefit with an investment component. Policyholders can choose how their cash value is invested in various sub-accounts, offering the potential for higher returns but also higher risk.

- Pros: Potential for higher returns compared to other life insurance policies.

- Cons: Involves investment risk, more complex than other policies.

5. Variable Universal Life Insurance (VUL):

- Definition: Combines features of universal and variable life insurance, offering flexibility in premiums, death benefits, and investment options.

- Pros: Flexibility in premiums, death benefits, and investment choices.

- Cons: Complex, higher risk due to investment component.

Factors Affecting Life Insurance Premiums: What Q Needs to Know

Several factors influence the cost of life insurance premiums:

- Age: Younger individuals generally receive lower premiums.

- Health: Individuals with pre-existing health conditions or unhealthy lifestyle choices will likely pay higher premiums.

- Gender: Historically, women have paid lower premiums than men.

- Smoking status: Smokers typically pay significantly higher premiums than non-smokers.

- Occupation: Some high-risk occupations may result in higher premiums.

- Policy type: Whole life insurance generally has higher premiums than term life insurance.

- Death benefit amount: Higher death benefit amounts mean higher premiums.

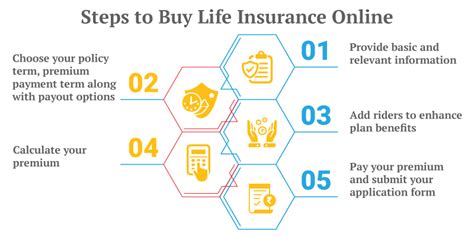

Choosing the Right Policy: A Step-by-Step Guide for Q

Choosing the right life insurance policy is a crucial decision. Q should follow these steps:

- Assess his needs: Determine his financial responsibilities, goals, and risk tolerance.

- Compare policy types: Understand the features, benefits, and drawbacks of different types of life insurance.

- Get quotes from multiple insurers: Compare premiums and policy features from different insurance companies.

- Review policy documents carefully: Understand the terms, conditions, and exclusions of the policy.

- Consider professional advice: Consult with a financial advisor or insurance broker to discuss his needs and options.

Beyond the Policy: Important Considerations for Q

Several additional considerations are vital for Q as he navigates the life insurance process:

- Beneficiary designation: Q should carefully choose his beneficiaries and ensure the designations are current and accurate.

- Policy riders: These optional additions can enhance policy benefits, such as providing coverage for accidental death or critical illness.

- Regular review: Life insurance needs change over time, so Q should periodically review his policy to ensure it aligns with his evolving financial situation and family needs.

- Understanding the application process: Q should be prepared to provide comprehensive information about his health and lifestyle during the application process. This may involve medical exams and questionnaires.

Conclusion: Securing Q's Future with the Right Life Insurance

Purchasing life insurance is a responsible financial decision that demonstrates care and planning for the future. By carefully considering his needs, researching policy options, and seeking professional advice, Q can choose a life insurance policy that provides adequate protection for his loved ones and secures his financial legacy. Remember, the process involves careful consideration and understanding of individual circumstances, making it crucial to thoroughly evaluate all options before committing to a policy. This detailed guide provides Q with a strong foundation for making an informed and appropriate decision. With diligent research and planning, he can confidently navigate the complexities of life insurance and find the right coverage to meet his unique needs.

Latest Posts

Latest Posts

-

Which Of The Following Are Functions Of Water

Mar 22, 2025

-

The Map Above Shows The United States Immediately Following The

Mar 22, 2025

-

Vine Charcoal Is Made From Burned Hardwood Or Twigs

Mar 22, 2025

-

A General Definition Of Media Is Methods For Communicating Information

Mar 22, 2025

-

For 2025 Wellcare Has 43 New Plans Going To Market

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Q Is Looking To Buy A Life Insurance Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.