Receivables Not Expected To Be Collected Should

Breaking News Today

Mar 22, 2025 · 6 min read

Table of Contents

Receivables Not Expected to Be Collected: A Comprehensive Guide

Businesses, regardless of size or industry, inevitably face the challenge of bad debts. Accounts receivable (AR) that are deemed uncollectible represent a significant loss, impacting profitability and financial stability. Understanding how to identify, manage, and account for these receivables is crucial for maintaining a healthy financial position. This comprehensive guide delves into the intricacies of receivables not expected to be collected, exploring the reasons behind their creation, the accounting implications, and strategies for mitigation.

Understanding Uncollectible Accounts

Uncollectible accounts, also known as bad debts, are accounts receivable that a business determines it is unlikely to ever collect. These represent outstanding invoices or payments owed by customers that have become irrecoverable. The inability to collect these debts stems from various factors, which we'll explore in detail below.

Reasons for Uncollectible Accounts

Several factors contribute to the creation of uncollectible accounts. Understanding these root causes is vital for implementing preventative measures:

-

Customer Bankruptcy: A customer's bankruptcy filing renders their outstanding debt legally uncollectible. This is often a significant factor in large bad debt write-offs.

-

Business Closure: If a customer's business ceases operations, the likelihood of recovering outstanding invoices diminishes significantly. Liquidation proceedings might offer partial recovery, but this is not guaranteed.

-

Dishonest Customers: Intentional non-payment or fraudulent activities contribute to uncollectible accounts. This often involves customers who have no intention of fulfilling their payment obligations.

-

Poor Credit Risk Assessment: Failure to adequately assess a customer's creditworthiness before extending credit can result in a higher percentage of uncollectible accounts. This highlights the importance of robust credit checks and risk management procedures.

-

Economic Downturns: During periods of economic recession or instability, businesses are more likely to experience an increase in uncollectible accounts as customers face financial hardship.

-

Insufficient Collection Efforts: A lack of proactive and persistent debt collection procedures can lead to an accumulation of uncollectible receivables. This emphasizes the need for a well-defined collection policy.

-

Changes in Customer Circumstances: Unexpected events like job loss, illness, or natural disasters can significantly impact a customer's ability to pay, resulting in uncollectible debt.

-

Poor Record Keeping: Insufficient or disorganized record-keeping can make it difficult to track outstanding payments, leading to delays in collection efforts and ultimately, uncollectible accounts.

Accounting for Uncollectible Accounts

The accounting treatment of uncollectible accounts is critical for maintaining accurate financial statements. Generally accepted accounting principles (GAAP) require businesses to estimate and account for bad debts using either the direct write-off method or the allowance method.

The Direct Write-Off Method

This method is simpler but less accurate. It recognizes bad debts only when they are deemed completely uncollectible. This means that the expense is recognized only when the account is written off. The drawback is that it doesn't accurately reflect the potential for bad debts during the period in which credit sales are made. It also distorts the accounts receivable balance and the net income figure for the periods affected. This method is generally not allowed under GAAP for larger businesses.

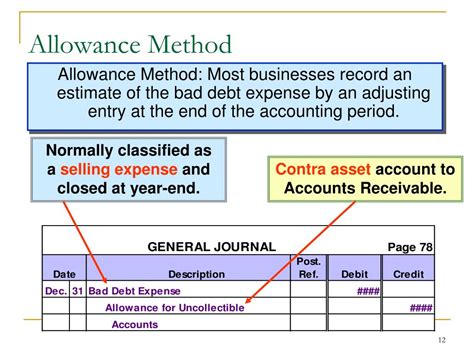

The Allowance Method

The allowance method is the preferred method under GAAP and provides a more accurate portrayal of a company's financial position. It involves estimating the amount of uncollectible accounts at the end of each accounting period and creating an allowance for doubtful accounts. This allowance is a contra-asset account that reduces the value of accounts receivable on the balance sheet.

Estimating Bad Debts: Estimating the amount of uncollectible accounts typically involves analyzing historical data, considering current economic conditions, and assessing the creditworthiness of individual customers. Common methods for estimating include:

-

Percentage of Sales Method: This method estimates bad debts as a percentage of credit sales. The percentage is determined based on past experience and industry benchmarks.

-

Percentage of Receivables Method: This method estimates bad debts as a percentage of outstanding accounts receivable. This method is beneficial as it directly addresses the existing receivables. Ageing analysis of receivables can further refine this estimation. Older receivables are generally considered to have a higher probability of being uncollectible.

-

Aging of Accounts Receivable Method: This detailed approach categorizes outstanding receivables based on their age (e.g., 0-30 days, 31-60 days, 61-90 days, etc.). Different percentages are applied to each aging category reflecting the increasing likelihood of non-payment as the accounts age.

Minimizing Uncollectible Accounts

Proactive measures are crucial to minimizing the occurrence of bad debts. A comprehensive strategy includes:

-

Thorough Credit Checks: Implementing a robust credit approval process is paramount. This involves conducting thorough background checks on potential customers, reviewing credit reports, and assessing their payment history.

-

Effective Collection Policies: Establish clear payment terms and a well-defined collection policy. This involves timely invoicing, regular follow-up on overdue payments, and escalating collection efforts as needed. This might involve sending reminder notices, making phone calls, and eventually employing collection agencies for persistent delinquencies.

-

Strong Customer Relationships: Building strong and positive relationships with customers can foster trust and encourage timely payments. Open communication and proactive engagement can address potential payment issues before they escalate.

-

Prompt Invoicing: Issuing invoices promptly and accurately minimizes confusion and delays in payment. Clear and detailed invoices reduce the chances of disputes.

-

Regular Account Monitoring: Regularly monitor accounts receivable to identify potential problems early on. This allows for timely intervention and minimizes the likelihood of debts becoming uncollectible.

-

Utilize Technology: Leverage accounting software and credit scoring systems to streamline the credit approval process, automate billing, and monitor accounts receivable effectively. These tools significantly improve efficiency and accuracy.

-

Offer Payment Incentives: Providing discounts for early payment or offering flexible payment plans can encourage timely payments and reduce the risk of bad debts.

The Write-Off Process

Once an account is deemed uncollectible, it needs to be formally written off. This involves removing the account from the accounts receivable balance and recognizing the loss as an expense. The specific accounting entries depend on whether the allowance method or the direct write-off method is used. Under the allowance method, the write-off reduces the allowance for doubtful accounts rather than directly impacting net income. This is a crucial difference from the direct write-off method, where a direct debit to bad debt expense and credit to accounts receivable is recorded.

Recovery of Previously Written-Off Accounts

While an account is written off, it doesn't automatically mean it's unrecoverable. Sometimes, previously written-off accounts are unexpectedly collected. When this happens, the accounting treatment reverses the initial write-off. The recovery of a written-off account involves reinstating the receivable, recognizing the cash received, and adjusting the bad debt expense or allowance for doubtful accounts accordingly.

Conclusion: Proactive Management is Key

Managing receivables and minimizing bad debts requires a proactive and comprehensive approach. By implementing robust credit policies, employing effective collection procedures, and utilizing appropriate accounting methods, businesses can significantly reduce the impact of uncollectible accounts on their financial health. Regular monitoring, analysis, and adaptation of strategies are vital for staying ahead of potential losses and maintaining a strong financial position. Remember that a well-defined strategy focusing on prevention is far more effective and cost-efficient than trying to recover debts after they’ve become uncollectible. The key is proactive management, leveraging technology, and fostering strong customer relationships.

Latest Posts

Latest Posts

-

What Is The Ground Game In Politics Quizlet

Mar 23, 2025

-

If You Are Denied Credit Then Quizlet

Mar 23, 2025

-

When Caring For Terminally Ill Patients You Should Quizlet

Mar 23, 2025

-

Starting A New Business As A Sole Proprietorship Quizlet

Mar 23, 2025

-

Risk Factors For Hemorrhagic Stroke Include Quizlet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about Receivables Not Expected To Be Collected Should . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.