Required Borrowings On A Cash Budget Is Calculated By

Breaking News Today

Apr 07, 2025 · 7 min read

Table of Contents

Required Borrowings on a Cash Budget: A Comprehensive Guide

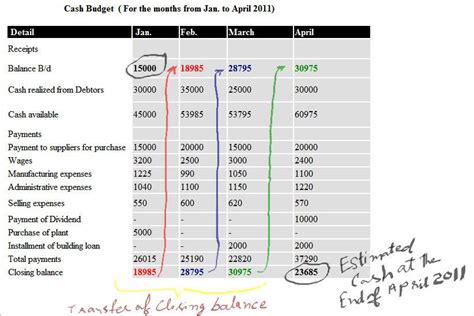

Creating a robust cash budget is crucial for any business, regardless of size. A key component of this budget is calculating the required borrowings. This figure represents the amount of external financing needed to cover shortfalls in cash flow and ensure the business can meet its obligations. Understanding how to calculate required borrowings is essential for maintaining financial stability and making informed financial decisions. This comprehensive guide will break down the process step-by-step, providing insights and practical examples.

Understanding the Cash Budget and its Components

Before diving into the calculation of required borrowings, it's vital to understand the structure of a cash budget. A cash budget is a financial forecast that projects a company's cash inflows and outflows over a specific period, typically monthly or quarterly. It provides a clear picture of the company's expected cash position and helps identify potential cash surpluses or deficits.

The key components of a cash budget include:

1. Beginning Cash Balance:

This represents the cash on hand at the start of the budgeting period. It's the starting point for all subsequent calculations.

2. Cash Receipts (Inflows):

These are the anticipated cash inflows during the budgeting period. This can include:

- Sales Revenue: Cash collected from customers. This is often the largest component of cash inflows.

- Investment Income: Returns on investments.

- Loan Proceeds: Funds received from loans.

- Other Receipts: Any other anticipated cash inflows, such as the sale of assets.

Accurate forecasting of cash receipts is critical for an accurate cash budget. Consider historical data, sales projections, and anticipated payment patterns from customers.

3. Cash Disbursements (Outflows):

These are the anticipated cash outflows during the budgeting period. This includes:

- Cost of Goods Sold (COGS): Payments for raw materials, labor, and manufacturing expenses.

- Operating Expenses: Rent, salaries, utilities, marketing expenses, and other day-to-day operating costs.

- Capital Expenditures (CAPEX): Investments in fixed assets such as equipment and property.

- Loan Repayments: Principal and interest payments on outstanding loans.

- Taxes: Income tax payments and other tax liabilities.

- Dividends: Payments to shareholders.

Accurate forecasting of cash disbursements is just as important as forecasting cash receipts. Analyzing historical data and upcoming commitments are key steps in this process.

Calculating Required Borrowings: A Step-by-Step Approach

The calculation of required borrowings is based on the difference between cash inflows and outflows. If cash inflows exceed outflows, the company has a cash surplus. Conversely, if outflows exceed inflows, the company has a cash deficit, necessitating borrowing.

Here's a step-by-step guide:

Step 1: Prepare a Cash Budget:

The first step is to create a comprehensive cash budget, detailing all expected cash inflows and outflows for the budgeting period. This budget should be detailed enough to provide a clear picture of the company's anticipated cash position.

Step 2: Calculate Net Cash Flow:

Subtract the total cash disbursements (outflows) from the total cash receipts (inflows). This gives you the net cash flow for each period within the budget. A positive net cash flow indicates a surplus, while a negative net cash flow indicates a deficit.

Step 3: Calculate Cumulative Cash Flow:

For each period, calculate the cumulative cash flow by adding the net cash flow for that period to the cumulative cash flow from the previous period. The beginning cumulative cash flow is the beginning cash balance. This calculation helps identify the point where the company's cash balance falls below zero, signaling a need for borrowing.

Step 4: Determine Required Borrowings:

If the cumulative cash flow becomes negative at any point during the budgeting period, the company will need to borrow money to cover the shortfall. The required borrowing amount is the absolute value of the lowest cumulative cash flow during the period. This ensures the company has enough cash to meet its obligations.

Step 5: Consider Repayment Schedule:

Once the required borrowings are determined, the company needs to develop a repayment schedule. This outlines how the borrowed funds will be repaid, typically over a specific period, with interest. The repayment schedule should be realistic and aligned with the company's anticipated cash flow.

Example: Calculating Required Borrowings

Let's illustrate the calculation with a simplified example. Suppose a company has the following projected cash flows for the next three months:

| Month | Cash Receipts | Cash Disbursements | Net Cash Flow | Cumulative Cash Flow |

|---|---|---|---|---|

| January | $10,000 | $12,000 | -$2,000 | -$2,000 |

| February | $15,000 | $11,000 | $4,000 | $2,000 |

| March | $12,000 | $9,000 | $3,000 | $5,000 |

Beginning Cash Balance: $1,000

In this example:

- January: The company experiences a net cash outflow of $2,000, resulting in a cumulative cash flow of -$2,000 (Beginning balance $1000 - $2000).

- February: A net cash inflow of $4,000 brings the cumulative cash flow to $2,000.

- March: Another net cash inflow of $3,000 raises the cumulative cash flow to $5,000.

Required Borrowings: In January, the cumulative cash flow is -$1000. Therefore, the required borrowing is $1000 to cover the deficit. This ensures the company can meet its obligations in January.

Factors Influencing Required Borrowings

Several factors can influence the amount of required borrowings:

-

Sales Projections: Inaccurate sales forecasts can significantly impact cash inflows and, consequently, the required borrowing amount. Conservative sales projections may lead to overestimation of required borrowings, while overly optimistic projections can lead to underestimation and potential cash flow problems.

-

Operating Expenses: Unexpected increases in operating expenses, such as higher energy costs or increased material prices, can reduce net cash flow and increase the need for borrowing. Effective cost management is crucial in minimizing this risk.

-

Capital Expenditures: Significant capital investments can create a substantial cash outflow, requiring additional borrowing to maintain sufficient liquidity. Careful planning and budgeting of CAPEX is essential.

-

Economic Conditions: External economic factors, such as recessions or changes in interest rates, can influence sales and expenses, thereby affecting the cash flow and the need for borrowing. Businesses need to consider potential economic scenarios when preparing the cash budget.

-

Seasonality: Many businesses experience seasonal fluctuations in sales and cash flow. Accurate forecasting of seasonal variations is crucial in determining required borrowings. Companies might need to borrow during slow seasons to cover expenses and maintain operations.

Importance of Accurate Cash Budget Forecasting

The accuracy of the cash budget is critical in determining the required borrowings. An inaccurate budget can lead to either:

-

Underestimation of Borrowings: This results in a cash shortage, potentially leading to missed payments, penalties, and financial distress.

-

Overestimation of Borrowings: This ties up unnecessary funds in borrowing, incurring unnecessary interest expenses and limiting investment opportunities.

Therefore, meticulous planning and realistic forecasting are essential for preparing an accurate cash budget. Regular monitoring and adjustments to the budget are crucial to account for unexpected events and maintain financial stability.

Refinancing and Debt Management Strategies

Once the company has secured the required borrowings, it's crucial to consider debt management strategies. This includes:

-

Refinancing: Exploring options to refinance existing loans at lower interest rates can reduce the overall borrowing cost.

-

Debt Consolidation: Consolidating multiple loans into a single loan can simplify debt management and potentially lower interest rates.

Effective debt management ensures the company can meet its financial obligations while minimizing the cost of borrowing.

Conclusion: Proactive Cash Management is Key

Calculating required borrowings is a critical aspect of financial planning. A well-prepared cash budget, coupled with accurate forecasting, allows businesses to anticipate potential cash shortfalls and secure the necessary financing to maintain operations and achieve their financial goals. Proactive cash management, incorporating regular monitoring and adjustments, is crucial for ensuring financial stability and long-term success. Remember, the process is iterative; regular review and updates are vital to keep the budget relevant and responsive to changing circumstances. By understanding and implementing these strategies, businesses can navigate financial challenges effectively and build a strong financial foundation.

Latest Posts

Latest Posts

-

According To The Food Code Proper Labels Should Not Contain

Apr 08, 2025

-

A Reason That Countries Trade With Each Other Is

Apr 08, 2025

-

The Speed Limit At An Uncontrolled Crossing Is

Apr 08, 2025

-

A Researcher Would Test The Foot In The Door Phenomenon By Randomly

Apr 08, 2025

-

Which Graph Shows A Function Where F 2 4

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Required Borrowings On A Cash Budget Is Calculated By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.