The Balance In The Accumulated Depreciation Account Represents The

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

The Balance in the Accumulated Depreciation Account Represents the Total Depreciation Taken on Assets

The accumulated depreciation account is a crucial element of a company's financial statements. Understanding its balance and what it represents is vital for accurate financial reporting, effective asset management, and informed decision-making. This article delves deep into the meaning of the accumulated depreciation balance, exploring its implications for various stakeholders and offering practical examples to enhance comprehension.

What is Accumulated Depreciation?

Accumulated depreciation is a contra-asset account, meaning it reduces the value of an asset on the balance sheet. It doesn't represent cash or a physical quantity; instead, it reflects the total depreciation expense recognized on a particular asset or group of assets since their acquisition. In simpler terms, it shows the cumulative amount of an asset's cost that has been allocated as an expense over its useful life.

This allocation is based on the principle of matching, a fundamental accounting concept that dictates that expenses should be recognized in the same period as the revenues they help generate. Since an asset contributes to revenue generation over its lifespan, its cost isn't expensed all at once but gradually over time through depreciation.

The Difference Between Depreciation and Accumulated Depreciation

It's crucial to differentiate between depreciation expense and accumulated depreciation.

-

Depreciation Expense: This is the portion of an asset's cost expensed in a single accounting period. It's a current expense that appears on the income statement.

-

Accumulated Depreciation: This is the cumulative sum of all depreciation expense recognized on an asset since its acquisition until the reporting date. It's a balance sheet account that shows the total depreciation charged to date.

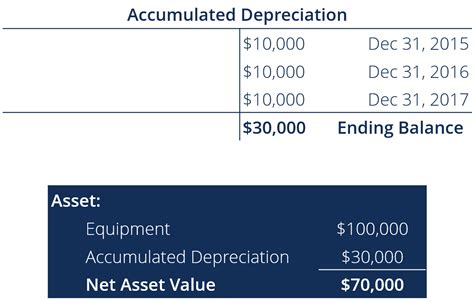

Let's illustrate this with an example:

Imagine a company purchased a machine for $100,000 with a useful life of 10 years and no salvage value. Using the straight-line method, the annual depreciation expense is $10,000 ($100,000 / 10 years).

| Year | Depreciation Expense | Accumulated Depreciation | Book Value |

|---|---|---|---|

| 1 | $10,000 | $10,000 | $90,000 |

| 2 | $10,000 | $20,000 | $80,000 |

| 3 | $10,000 | $30,000 | $70,000 |

| ... | ... | ... | ... |

| 10 | $10,000 | $100,000 | $0 |

As you can see, the accumulated depreciation grows each year, reflecting the increasing portion of the asset's cost that has been expensed. The book value (the asset's net value) decreases correspondingly.

Why is Accumulated Depreciation Important?

The balance in the accumulated depreciation account provides critical information for various stakeholders, including:

-

Investors and Creditors: They use it to assess a company's asset management practices and the overall health of its assets. A high accumulated depreciation might indicate aging assets and potential future capital expenditure needs. Conversely, lower accumulated depreciation might suggest a company is investing in newer assets.

-

Management: The accumulated depreciation balance helps in making informed decisions regarding asset replacement, upgrades, or disposal. It provides insights into the remaining useful life of assets and the potential need for future investments.

-

Tax Authorities: Depreciation is a tax-deductible expense, so the accumulated depreciation directly impacts a company's tax liability. Accurate calculation and recording of depreciation are crucial for compliance.

-

Auditors: They use the accumulated depreciation account to verify the accuracy of a company's financial statements and ensure compliance with accounting standards.

Factors Affecting Accumulated Depreciation

Several factors influence the balance in the accumulated depreciation account:

-

Depreciation Method: Different depreciation methods (straight-line, declining balance, units of production) will yield different accumulated depreciation balances over time. The choice of method depends on the asset's nature and how its value diminishes over its useful life.

-

Useful Life: The estimated useful life of an asset significantly impacts accumulated depreciation. A shorter useful life leads to higher annual depreciation expense and a faster accumulation of depreciation.

-

Salvage Value: This is the estimated value of an asset at the end of its useful life. A higher salvage value results in lower annual depreciation and a smaller accumulated depreciation balance.

-

Asset Acquisition Date: The date an asset is acquired determines the starting point for calculating depreciation. Assets acquired later in the year will have a smaller accumulated depreciation balance at year-end than those acquired at the beginning.

-

Asset Disposals: When an asset is disposed of, its accumulated depreciation is removed from the balance, reducing the overall accumulated depreciation.

Analyzing Accumulated Depreciation: Signs and Interpretations

Analyzing the accumulated depreciation balance requires a holistic approach. Simply looking at the raw number isn't sufficient; it should be considered in relation to other financial data:

-

High Accumulated Depreciation: While a high balance might seem negative, it doesn't necessarily indicate a problem. It could simply reflect a company's long-term asset base and mature asset portfolio. However, it also could indicate a need for significant capital expenditures in the near future to replace aging assets.

-

Low Accumulated Depreciation: A low balance might suggest a company is actively investing in newer assets or that its assets have exceptionally long useful lives. However, it could also signify a limited asset base.

-

Comparison to Industry Benchmarks: Comparing a company's accumulated depreciation to its industry peers provides valuable context. This helps determine whether the balance is in line with industry norms or significantly deviates, suggesting potential areas for investigation.

-

Relationship to Revenue and Profitability: Analyzing the relationship between accumulated depreciation and revenue or profitability can provide insights into asset utilization efficiency.

-

Review of Depreciation Policies: It's critical to examine the company's depreciation policies and ensure consistency and appropriateness in the method used. Changes in these policies can significantly affect the accumulated depreciation balance.

Potential Issues Related to Accumulated Depreciation

Inaccurate or improper recording of accumulated depreciation can lead to several problems:

-

Misleading Financial Statements: Incorrect calculations can misrepresent a company's financial health and profitability, affecting investor decisions and creditworthiness.

-

Tax Penalties: Errors in depreciation calculations can lead to tax penalties and disputes with tax authorities.

-

Impaired Asset Valuation: Incorrect accumulated depreciation can lead to an inaccurate assessment of an asset's net book value, impacting decision-making related to asset management.

-

Difficulty in Strategic Planning: An inaccurate understanding of accumulated depreciation can hinder effective planning for future investments and asset replacement.

Conclusion

The balance in the accumulated depreciation account is not merely a number; it's a critical indicator of a company's asset management practices, financial health, and future investment needs. Understanding what this balance represents and the factors influencing it is crucial for investors, creditors, management, and other stakeholders. By accurately calculating and analyzing accumulated depreciation, companies can make informed decisions, comply with accounting standards, and ensure the integrity of their financial reporting. Furthermore, a thorough understanding of accumulated depreciation allows for a better assessment of a company's long-term sustainability and overall financial performance. Regular review and reconciliation of depreciation calculations are essential for maintaining the accuracy and reliability of this critical account.

Latest Posts

Latest Posts

-

The Teachers Are Familiar With Different Countries In Spanish

Mar 19, 2025

-

Which Statement Describes A Disadvantage Of A Command Economy

Mar 19, 2025

-

The Most Effective Fuel Source For Producing Atp Is

Mar 19, 2025

-

What Is The Answer In Division Called

Mar 19, 2025

-

Which Of These Are Examples Of Business Analytics

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Balance In The Accumulated Depreciation Account Represents The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.