The Bank Secrecy Act Prevents Money Laundering By Quizlet

Breaking News Today

Mar 23, 2025 · 5 min read

Table of Contents

Does the Bank Secrecy Act (BSA) Prevent Money Laundering? A Deep Dive

The Bank Secrecy Act (BSA) is a cornerstone of the United States' fight against money laundering and financial crime. While it doesn't entirely prevent money laundering – no single law can completely eliminate a determined criminal's efforts – it significantly hinders it and provides crucial tools for detection and prosecution. This article will delve into the BSA's mechanisms, its effectiveness, its limitations, and its role in the broader landscape of anti-money laundering (AML) efforts.

Understanding the Bank Secrecy Act (BSA)

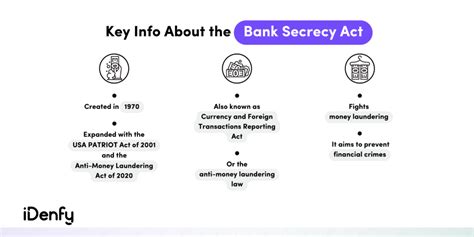

The BSA, enacted in 1970, aims to prevent the use of the U.S. financial system for illegal activities. It achieves this through a multifaceted approach focusing on transparency and reporting requirements. Key components include:

1. Currency Transaction Reporting (CTR):

This mandates financial institutions to file a CTR with the Financial Crimes Enforcement Network (FinCEN) for cash transactions exceeding $10,000. This seemingly simple requirement is a powerful tool. By tracking large cash inflows and outflows, investigators can identify suspicious patterns indicative of money laundering.

How it hinders money laundering: Large sums of illicit cash need to be "cleaned" – integrated into the formal financial system. The CTR requirement makes this process considerably riskier, forcing launderers to break down transactions into smaller amounts or use alternative, less convenient methods.

2. Suspicious Activity Reports (SARs):

This is arguably the most crucial aspect of the BSA. Financial institutions are obligated to file a SAR when they detect suspicious activity potentially related to money laundering, terrorist financing, or other financial crimes. These reports provide crucial intelligence for law enforcement agencies to investigate potential criminal activity.

How it hinders money laundering: SARs allow for proactive detection. Rather than relying solely on reactive measures, the BSA empowers financial institutions to identify and report suspicious activities before they escalate. This proactive approach disrupts money laundering schemes early in their lifecycle.

3. Customer Identification Program (CIP):

The CIP mandates that financial institutions verify the identity of their customers. This involves collecting and retaining information such as name, address, date of birth, and taxpayer identification number. This crucial element helps prevent criminals from using anonymous or fictitious identities to launder money.

How it hinders money laundering: By demanding identification, the CIP makes it significantly harder for criminals to conceal their identities and move illicit funds through the financial system undetected. It provides a vital trail for investigators to follow.

4. Recordkeeping and Reporting Requirements:

The BSA requires financial institutions to maintain detailed records of financial transactions and other relevant information. This allows for thorough audits and investigations, providing a valuable historical record for analyzing suspicious activity.

How it hinders money laundering: Comprehensive recordkeeping enables investigators to trace the flow of funds, identify the individuals involved, and reconstruct the laundering scheme. This makes it much more difficult for launderers to conceal their tracks.

The BSA's Effectiveness in Preventing Money Laundering

The BSA's effectiveness is a subject of ongoing debate. While it doesn't eliminate money laundering, it significantly hampers it by:

- Raising the barriers to entry: The reporting requirements and increased scrutiny make it harder and riskier for criminals to launder money through traditional financial institutions.

- Providing intelligence for investigations: SARs and CTRs provide law enforcement with crucial leads and intelligence, allowing them to build cases and dismantle criminal networks.

- Promoting a culture of compliance: The BSA has fostered a culture of compliance within financial institutions, encouraging them to implement robust AML programs and actively detect and report suspicious activity.

However, limitations exist:

- Technological advancements: Criminals are constantly evolving their methods, using new technologies and exploiting loopholes to circumvent the BSA's provisions. For example, the use of cryptocurrencies presents new challenges.

- Resource constraints: Law enforcement agencies often face resource constraints, limiting their ability to fully investigate all suspicious activity reported.

- Complexity and ambiguity: The BSA's regulations are complex, leading to potential inconsistencies in interpretation and enforcement.

The BSA's Role in a Broader AML Framework

The BSA is just one piece of the puzzle in the fight against money laundering. It works in conjunction with other domestic and international regulations, including:

- The USA PATRIOT Act: This significantly enhanced the BSA's provisions, expanding its scope and providing additional tools for combating terrorism financing.

- International cooperation: The BSA facilitates international cooperation by enabling the sharing of information with foreign law enforcement agencies. This collaborative approach is crucial in addressing transnational money laundering schemes.

- Financial Action Task Force (FATF) recommendations: The FATF sets international standards for combating money laundering and terrorist financing. The BSA aligns with these standards, ensuring consistency in AML efforts globally.

Emerging Challenges and Future Directions

The ever-evolving landscape of financial crime presents continuous challenges to the BSA's effectiveness. Key areas requiring attention include:

- Combating cryptocurrency-related money laundering: The anonymity and decentralized nature of cryptocurrencies pose significant challenges for AML efforts. Regulatory frameworks need to adapt to address these emerging threats.

- Enhancing technological capabilities: Advanced analytics and artificial intelligence can significantly improve the efficiency and effectiveness of AML compliance programs.

- Strengthening international cooperation: Increased collaboration between countries is crucial in dismantling transnational criminal networks.

- Improving transparency and accountability: Greater transparency in financial transactions and increased accountability for financial institutions can further strengthen AML efforts.

Conclusion: The BSA – A Vital but Imperfect Tool

The Bank Secrecy Act is a crucial tool in the fight against money laundering. While it doesn't provide a foolproof solution, its requirements significantly increase the difficulty and risk for criminals attempting to launder money through the U.S. financial system. The BSA's effectiveness is enhanced through continuous adaptation to emerging threats, stronger international cooperation, and improvements in technological capabilities. It is a vital component of a multifaceted approach, highlighting the need for ongoing vigilance and refinement to ensure the integrity of the financial system and the effectiveness of AML efforts. The future of the BSA's impact lies in its continued evolution and adaptation to the ever-changing strategies employed by those seeking to exploit the financial system for illicit gain. By understanding its mechanisms, limitations, and role within a broader global context, we can better appreciate its vital contribution to national security and the integrity of the financial system.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Property Of Carbon

Mar 24, 2025

-

Actual Or Rounded Ml Gallon For Naplex

Mar 24, 2025

-

Authorized Holders Must Meet The Requirements To Access

Mar 24, 2025

-

Good Operations Security Practices Do Not Include

Mar 24, 2025

-

How Is An Action Potential Propagated Along An Axon

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about The Bank Secrecy Act Prevents Money Laundering By Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.