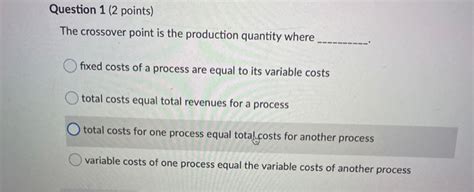

The Crossover Point Is That Production Quantity Where __________.

Breaking News Today

Mar 19, 2025 · 5 min read

Table of Contents

The Crossover Point: Where Fixed Costs Meet Variable Costs

The crossover point, also known as the break-even point, is that production quantity where total revenue equals total costs. This crucial point signifies the transition from operating at a loss to generating profit. Understanding the crossover point is fundamental for businesses of all sizes, from small startups to multinational corporations, as it provides crucial insights into pricing strategies, production planning, and overall financial viability. This article will delve deep into the concept, exploring its calculation, significance, and practical applications.

Understanding the Components: Fixed and Variable Costs

Before diving into the crossover point itself, it's essential to grasp the two primary cost components involved:

1. Fixed Costs:

These are expenses that remain constant regardless of the production volume. They're incurred even if no units are produced. Examples include:

- Rent: Monthly rent for the factory or office space.

- Salaries: Fixed salaries paid to employees.

- Insurance: Premiums paid for property or liability insurance.

- Depreciation: The gradual decrease in value of assets over time.

- Loan Payments: Regular payments on business loans.

Fixed costs are often depicted graphically as a horizontal line because they remain unchanged across different production levels.

2. Variable Costs:

These are expenses that directly relate to the production volume. They increase as production increases and decrease as production decreases. Examples include:

- Raw Materials: The cost of materials used in production.

- Direct Labor: Wages paid to workers directly involved in production.

- Utilities: Energy costs associated with production (electricity, gas).

- Packaging: Cost of materials used to package the product.

- Shipping: Costs associated with delivering the product to customers.

Variable costs are typically depicted as a diagonal line on a graph, increasing proportionately with production volume.

Calculating the Crossover Point

The crossover point is calculated by equating total revenue with total costs. The formula can be expressed in several ways, depending on the level of detail required:

1. Simple Crossover Point Calculation (Units):

This method focuses on determining the number of units that need to be sold to reach the break-even point.

- Crossover Point (Units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

This formula assumes a linear relationship between production and both revenue and variable costs.

2. Crossover Point Calculation (Sales Revenue):

This method focuses on the total revenue needed to reach the break-even point.

- Crossover Point (Sales Revenue) = Fixed Costs / ((Selling Price per Unit - Variable Cost per Unit) / Selling Price per Unit)

This formula expresses the break-even point in terms of total revenue generated.

Example:

Let's consider a company producing widgets. Their fixed costs are $10,000 per month, their variable cost per widget is $5, and their selling price per widget is $10.

Using the unit-based formula:

Crossover Point (Units) = $10,000 / ($10 - $5) = 2,000 units

This means the company needs to sell 2,000 widgets to break even.

Using the sales revenue formula:

Crossover Point (Sales Revenue) = $10,000 / (($10 - $5) / $10) = $20,000

This means the company needs to generate $20,000 in sales revenue to break even.

Significance of the Crossover Point

The crossover point holds immense significance for various business decisions:

1. Pricing Strategies:

Understanding the crossover point helps businesses determine a profitable selling price. A price too low might not cover costs, while a price too high might deter customers. Analyzing the crossover point allows for a strategic pricing approach that balances profitability and market competitiveness.

2. Production Planning:

Knowing the crossover point guides production planning. Businesses can adjust production volume to ensure they're operating above the break-even point and maximizing profit.

3. Investment Decisions:

The crossover point is a critical factor in investment appraisal. Investors use it to assess the viability of a project by determining how quickly the project will generate sufficient revenue to cover its costs.

4. Financial Forecasting:

The crossover point is crucial for financial forecasting. Businesses can use it to predict future profitability based on anticipated sales volumes and costs.

5. Risk Assessment:

By analyzing the sensitivity of the crossover point to changes in cost or price, businesses can assess their vulnerability to various market conditions and plan accordingly. A high sensitivity suggests a greater level of risk.

Limitations of the Crossover Point Analysis

While invaluable, the crossover point analysis has some limitations:

- Simplicity: The basic model assumes a linear relationship between cost, revenue, and production. In reality, this relationship might be more complex, especially at higher production volumes.

- Static Nature: The analysis is typically conducted at a specific point in time. Cost structures and market conditions can change, rendering the analysis less accurate over time.

- Ignoring Demand: The model doesn't explicitly consider market demand. Even if a company reaches the crossover point, it might not be able to sell the necessary number of units due to low market demand.

- Simplified Cost Classification: Classifying costs as purely fixed or variable can be challenging in reality. Some costs might have both fixed and variable components.

Beyond the Basic Model: Advanced Considerations

To address some of the limitations of the basic crossover point analysis, businesses often incorporate more sophisticated approaches:

- Margin of Safety: This concept calculates the difference between actual sales and the crossover point sales. A higher margin of safety indicates a lower risk of incurring losses.

- Sensitivity Analysis: This technique examines how changes in various parameters (e.g., selling price, variable costs) affect the crossover point. It provides insights into the risk associated with different scenarios.

- Multi-Product Analysis: For businesses producing multiple products, the crossover point needs to be calculated considering the contribution margin of each product.

- Non-Linear Cost and Revenue Functions: For situations where the cost and revenue relationships aren't linear, more complex mathematical models or simulations might be necessary.

Conclusion: The Crossover Point as a Strategic Tool

The crossover point, while a seemingly simple concept, plays a vital role in guiding business decisions. It serves as a crucial benchmark for assessing profitability, planning production, setting prices, and managing risk. While limitations exist, understanding and utilizing the crossover point, alongside more sophisticated analysis techniques, can significantly enhance a business's financial performance and long-term sustainability. By carefully considering fixed and variable costs, businesses can effectively strategize their way towards profitability and sustained success. The crossover point isn't merely a number; it's a strategic tool that empowers informed decision-making and ensures a business operates efficiently and profitably.

Latest Posts

Latest Posts

-

Which Behavior Is Strongly Associated With Task Oriented Style

Mar 19, 2025

-

What Is A Companys Documented Philosophy Called

Mar 19, 2025

-

The Secrets Of Marketing Does Not Involves

Mar 19, 2025

-

If You Damage An Unattended Vehicle You Must

Mar 19, 2025

-

Employers Are Responsible For Identifying Foreseeable Hazards

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Crossover Point Is That Production Quantity Where __________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.