The First Portion Of A Covered Major Medical Insurance Expense

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

Understanding the First Portion of Covered Major Medical Insurance Expenses: Deductibles, Coinsurance, and Copays

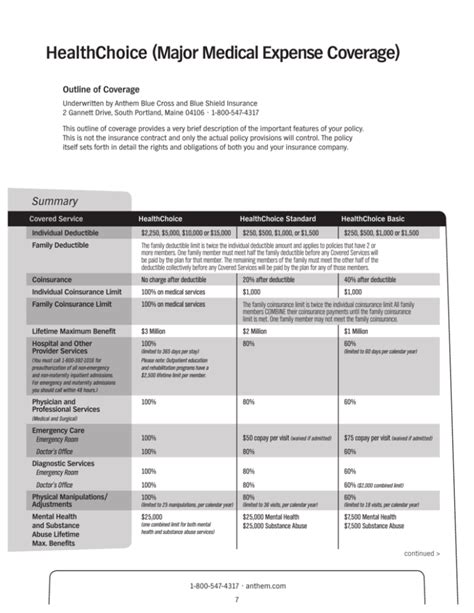

Major medical insurance is designed to protect you from the devastating financial impact of unexpected and serious illnesses or injuries. However, navigating the complexities of your policy, particularly understanding how the first portion of expenses is handled, can be daunting. This comprehensive guide breaks down the initial costs you’ll typically encounter before your insurance kicks in fully, empowering you to make informed decisions about your healthcare and finances.

Deciphering the Initial Out-of-Pocket Costs

Before your major medical insurance starts covering a significant portion of your healthcare expenses, you’ll likely encounter several initial cost-sharing mechanisms. These are designed to share the risk between you and the insurance company and can significantly impact your overall healthcare costs. Let's examine each component:

1. The Deductible: Your First Line of Defense

The deductible is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company begins to pay. Think of it as your initial investment in your health insurance coverage. Once you meet your deductible, your insurance company will typically start covering a larger percentage of your eligible expenses. Deductibles can vary significantly depending on your plan, ranging from a few hundred dollars to several thousand dollars per year.

Important Considerations Regarding Deductibles:

- Individual vs. Family Deductible: Some plans have a separate deductible for each individual covered under the policy, while others have a single family deductible. If you have a family plan, meeting the family deductible means that everyone covered under that plan will have their eligible expenses covered after that threshold is reached.

- In-Network vs. Out-of-Network Deductibles: Many plans have different deductible amounts depending on whether you receive care from in-network or out-of-network providers. In-network providers have negotiated discounted rates with your insurance company, leading to potentially lower overall costs. Out-of-network care often requires you to pay a higher portion upfront.

- Annual Renewal: Deductibles typically reset at the beginning of each policy year. This means you'll need to meet your deductible again each year, even if you haven't had any significant healthcare expenses during the previous year.

2. Coinsurance: Sharing the Burden After the Deductible

After you've met your deductible, you're not completely off the hook. Coinsurance is the percentage of covered healthcare expenses you're responsible for paying after your deductible has been met. For example, if your coinsurance is 20%, you'll pay 20% of the cost of covered services, while your insurance company pays the remaining 80%.

Understanding Coinsurance Nuances:

- Percentage Based: Coinsurance is expressed as a percentage, not a fixed dollar amount. This percentage remains constant until you reach your out-of-pocket maximum (discussed later).

- Applies to Covered Services Only: Coinsurance only applies to services and expenses covered by your insurance plan. Non-covered services remain your full responsibility.

- Coordination with Deductible: Coinsurance calculations begin only after your deductible has been fully satisfied.

3. Copays: Fixed Fees for Specific Services

Copays are fixed dollar amounts you pay for certain covered services, such as doctor's office visits or prescription drugs. Unlike deductibles and coinsurance, copays are typically paid at the time of service. They are often a smaller amount compared to deductibles and help manage the cost of routine care.

Key Aspects of Copays:

- Service Specific: Copays vary depending on the type of service. A copay for a routine doctor's visit might be significantly lower than a copay for a specialist visit.

- Pre-determined Amounts: Copays are fixed dollar amounts outlined in your insurance plan's summary of benefits and coverage (SBC).

- Paid at the Time of Service: You'll typically pay your copay directly to the healthcare provider at the time of the visit or when picking up a prescription.

The Out-of-Pocket Maximum: Your Financial Ceiling

Your major medical insurance plan will likely include an out-of-pocket maximum. This is the most you'll have to pay out-of-pocket for covered services in a given policy year. Once you reach this limit, your insurance company will cover 100% of covered expenses for the remainder of the year.

Why Understanding the Out-of-Pocket Maximum is Crucial:

- Predictability: Knowing your out-of-pocket maximum gives you a clearer picture of your potential maximum healthcare expense for the year.

- Financial Planning: This information can be invaluable for budgeting and financial planning, especially if you anticipate significant healthcare costs.

- Protection from Catastrophic Expenses: The out-of-pocket maximum provides crucial protection against unexpected and potentially devastating medical bills.

Navigating the First Portion of Expenses: Practical Strategies

Understanding your plan's specifics regarding deductibles, coinsurance, copays, and the out-of-pocket maximum is only half the battle. Here are some practical strategies to help you navigate the first portion of your major medical expenses:

- Review Your Summary of Benefits and Coverage (SBC): Your SBC provides a clear and concise summary of your plan's benefits and cost-sharing responsibilities. Carefully review this document to understand your specific plan details.

- Utilize In-Network Providers: Choosing in-network providers can significantly reduce your out-of-pocket expenses by leveraging negotiated rates with your insurance company.

- Negotiate Medical Bills: Don't hesitate to negotiate medical bills, especially for larger expenses. Many providers are willing to work with patients to create payment plans or offer discounts.

- Explore Financial Assistance Programs: Various financial assistance programs, such as hospital financial aid, can help alleviate the burden of high medical costs.

- Maintain Accurate Records: Keeping meticulous records of all medical bills, payments, and insurance claims is essential for tracking your progress towards meeting your deductible and out-of-pocket maximum.

- Ask Questions: Don't hesitate to contact your insurance company or your healthcare provider with any questions or concerns about your expenses or coverage.

Beyond the Basics: Advanced Considerations

The information above covers the fundamental aspects of the first portion of major medical insurance expenses. However, several other factors can influence your costs:

- Pre-existing Conditions: Depending on your plan and the specifics of your pre-existing condition, your insurance may have limitations on coverage during the first year or two of coverage.

- Waiting Periods: Some plans have waiting periods before certain benefits, like maternity care, become active.

- Prescription Drug Coverage: Many plans have separate formularies and cost-sharing structures for prescription drugs, including copays, tiers, and prior authorizations.

- Preventive Care: Many plans offer 100% coverage for preventive services, regardless of your deductible or out-of-pocket maximum. Taking advantage of these services can help prevent costly health problems down the line.

Conclusion: Informed Healthcare Decisions

Understanding the first portion of your covered major medical expenses—deductibles, coinsurance, and copays—is crucial for effective healthcare financial planning. By carefully reviewing your plan's details, utilizing available resources, and practicing proactive financial management, you can navigate these initial costs and ensure your health insurance provides the protection you need. Remember that proactive communication with your insurance provider and healthcare team is essential to avoid surprises and make informed healthcare decisions. Your health and financial well-being depend on your understanding of these important elements of your insurance coverage.

Latest Posts

Latest Posts

-

In General Medevac Helicopters Should Be Utilized When

Mar 21, 2025

-

Match The Heart Valve With Its Description

Mar 21, 2025

-

El Futbol En Europa Es Muy Similar Al Futbol Americano

Mar 21, 2025

-

Which List Represents The Steps For Analyzing Visual Art

Mar 21, 2025

-

Exercise 22 Review Sheet Art Labeling Activity 1

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The First Portion Of A Covered Major Medical Insurance Expense . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.