The Notice Of Claims Provision Requires A Policyowner To

Breaking News Today

Mar 30, 2025 · 5 min read

Table of Contents

The Notice of Claims Provision: What Policyholders Need to Know

A notice of claims provision is a crucial part of most insurance policies. It outlines the steps a policyholder must take when filing a claim. Understanding this provision is vital to ensure a smooth and successful claims process. Failure to comply can severely jeopardize your chances of receiving compensation. This comprehensive guide will dissect the notice of claims provision, explaining its requirements, common pitfalls, and how to navigate the process effectively.

Understanding the Notice of Claims Provision

The notice of claims provision isn't a standardized, single clause. Its specifics vary depending on the type of insurance (health, auto, home, life, etc.), the insurer, and the specific policy. However, the core principle remains consistent: prompt and accurate notification of the insurer is paramount. This means you must inform your insurer of a potential claim as soon as reasonably possible after an incident occurs.

Key Aspects of a Typical Notice of Claims Provision:

-

Timeliness: This is arguably the most critical aspect. The policy will specify a timeframe within which you must notify the insurer. This can range from a few days to several weeks, depending on the circumstances and the type of insurance. Missing this deadline can be a significant reason for claim denial.

-

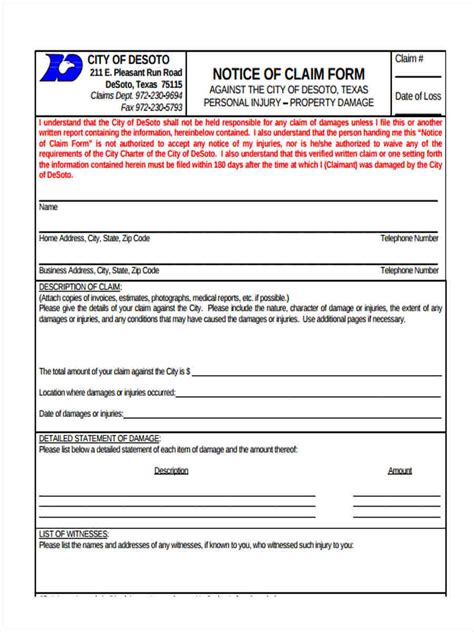

Method of Notification: The provision usually details acceptable methods of notification. This might include written notice (certified mail is recommended for proof of delivery), phone calls, or online reporting through the insurer's website or app. It's best to use multiple methods to ensure your notification is received. For example, send a certified letter and follow up with a phone call to confirm receipt.

-

Required Information: The notice should include specific information about the incident, such as the date, time, location, and a detailed description of what happened. Depending on the type of claim, you might also need to provide information about involved parties, witnesses, and any police reports.

-

Consequences of Non-Compliance: This section explains the repercussions of failing to provide timely and proper notification. The most common consequence is claim denial. This means the insurance company refuses to pay out on your claim.

Common Types of Insurance and Their Notice of Claims Requirements

Let's look at how the notice of claims provision plays out in various insurance types:

1. Health Insurance:

Health insurance policies usually require prompt notification of the insurer, often within a specific timeframe (e.g., 24-48 hours) for specific procedures or treatments. While not always strictly enforced as a claim denial reason, failing to follow protocols could delay reimbursements or lead to disputes. It's crucial to report claims promptly and accurately. Keep records of all communication with the insurer, including dates, times, and names of individuals you spoke with.

2. Auto Insurance:

Auto insurance policies generally require immediate notification of the insurer after an accident. This is crucial, especially if there are injuries or significant property damage. Delaying notification could lead to claim denial, particularly if you are at fault. Contact your insurer as soon as possible, ideally before leaving the accident scene. Provide accurate details, including police report information if available.

3. Homeowners Insurance:

Homeowners insurance policies typically require notification within a reasonable time after a covered event, such as a fire, theft, or storm damage. The specific timeframe might be vaguely defined (e.g., "as soon as reasonably practicable") but prompt reporting is essential. Document the damage with photos and videos, and contact your insurer immediately. Begin the process of securing your property to prevent further damage.

4. Life Insurance:

Life insurance policies usually have less stringent requirements concerning immediate notice, focusing more on the claim process initiated after the death of the insured. However, timely notification of the death is essential for initiating the claim and beginning the benefit disbursement process. Providing accurate documentation, including the death certificate and policy details, is paramount.

5. Disability Insurance:

Disability insurance policies often have more stringent notice of claim requirements than other types of insurance. Early notification is absolutely crucial. These policies typically have waiting periods before benefits kick in, and timely reporting ensures that the waiting period starts on schedule. Failure to provide timely notice could result in the denial of benefits.

Navigating the Notice of Claims Process Successfully

To successfully navigate the notice of claims process, consider these steps:

-

Read Your Policy Carefully: Thoroughly review your insurance policy, particularly the notice of claims provision. Understand the specific requirements, timeframes, and acceptable methods of notification.

-

Keep Detailed Records: Maintain meticulous records of all communication with your insurer, including dates, times, names, and a summary of conversations. This documentation can be invaluable if disputes arise.

-

Provide Accurate Information: Be honest and accurate in all communications. Providing false or misleading information can lead to claim denial.

-

Follow Up: After providing initial notification, follow up with the insurer to confirm receipt and inquire about the status of your claim.

-

Seek Professional Help: If you are unsure about the notice of claims requirements or encounter difficulties with the process, consult with an insurance professional or attorney.

Common Pitfalls to Avoid

Several common pitfalls can jeopardize your claim. Avoid these:

-

Delayed Notification: Failing to meet the time limits stipulated in your policy is a major cause of claim denials.

-

Inaccurate Information: Providing inaccurate or incomplete information can lead to delays or rejection of your claim.

-

Lack of Documentation: Poor record-keeping can make it difficult to prove your case if a dispute arises.

-

Ignoring Communication: Failing to respond to the insurer's requests for information can delay or derail the claims process.

-

Not Understanding Your Policy: A lack of understanding of the notice of claims provision can lead to unforeseen complications.

The Importance of Prompt Action

The notice of claims provision underscores the importance of prompt action after an insured event. Delayed reporting can significantly impact your ability to receive compensation. Timely notification, accurate information, and thorough documentation are essential for a successful claims process. Proactive measures, such as carefully reviewing your policy and keeping detailed records, can significantly reduce the risk of claim denial and ensure a smoother experience.

Conclusion: Protecting Your Rights

Understanding the notice of claims provision is a cornerstone of effective insurance management. By adhering to the stipulated requirements and taking proactive steps, policyholders can significantly increase their chances of a successful claim. Remember, your insurance policy is a contract, and fulfilling your obligations under that contract is crucial to securing the protection you've paid for. Prioritize understanding your policy, acting promptly, and keeping detailed records to safeguard your rights and interests.

Latest Posts

Latest Posts

-

True Or False Acetaminophen Poisoning Is An Acute Illness

Apr 01, 2025

-

Which Of The Following Is A Correct Match

Apr 01, 2025

-

The End Of Big Trees Commonlit Answers

Apr 01, 2025

-

All Of The Following People Should Receive W 2 Forms Except

Apr 01, 2025

-

Nurse Logic Knowledge And Clinical Judgment Beginner

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Notice Of Claims Provision Requires A Policyowner To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.