The Par Value Per Share Of Common Stock Represents

Breaking News Today

Mar 29, 2025 · 6 min read

Table of Contents

The Par Value Per Share of Common Stock: A Comprehensive Guide

The par value per share of common stock is a seemingly simple concept, yet it holds significant implications for corporations, investors, and legal frameworks. Understanding its meaning, purpose, and limitations is crucial for navigating the complexities of corporate finance and investment decisions. This comprehensive guide delves deep into the intricacies of par value, exploring its historical context, current relevance, and future prospects.

What is Par Value Per Share of Common Stock?

Par value, also known as nominal value or face value, is the arbitrary monetary value assigned to a share of common stock by a company's charter or articles of incorporation. It's a legal minimum value, essentially a historical artifact that often bears little relation to the stock's market value. Think of it as a placeholder value, a nominal figure with limited practical significance in today's financial markets. This value is established during the company's incorporation process and rarely changes thereafter.

Important Distinction: The par value is not the price at which the stock is sold to investors. The market price, determined by supply and demand in the stock market, fluctuates constantly and can be significantly higher or lower than the par value.

Historical Context and Evolution of Par Value

Originally, par value served a crucial purpose. In the early days of corporations, it represented a minimum contribution from shareholders, protecting creditors by ensuring a certain level of capital within the company. This provided some assurance that the company would have assets to cover its liabilities. It also played a role in determining the legal capital of the corporation – the minimum amount of capital that must be retained for the protection of creditors.

However, the relevance of par value has diminished considerably over time. The rise of sophisticated financial instruments and the deregulation of capital markets have lessened the importance of this historical safeguard. Today, many companies issue shares with a low par value, such as $0.01 or $0.001, rendering the initial purpose virtually obsolete.

The Significance of Par Value in Modern Corporate Finance

While its original purpose has faded, par value still holds some significance, albeit often indirectly:

1. Legal and Regulatory Compliance:

- Minimum Capital Requirements: Although often nominal, the par value still contributes to the calculation of the company's stated capital. This is the minimum amount of capital that must be retained, offering a theoretical protection for creditors. Specific regulatory requirements may vary by jurisdiction.

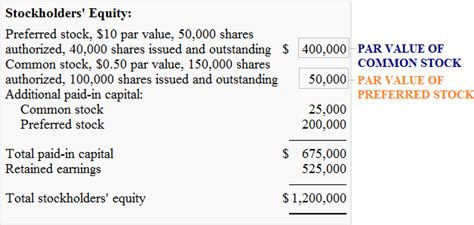

- Accounting Implications: Par value impacts the accounting treatment of equity transactions. The difference between the issue price and the par value is recorded as additional paid-in capital on the balance sheet. This represents the premium investors pay above the minimum legal value.

- State Corporate Laws: State laws often stipulate minimum par values for shares. These laws vary across jurisdictions and add another layer to compliance considerations for businesses.

2. Stock Splits and Dividends:

- Stock Splits: Par value can play a role in calculating the adjusted par value after a stock split. For example, a 2-for-1 stock split would halve the par value per share.

- Stock Dividends: Similar to stock splits, stock dividends can involve adjustments to the par value of outstanding shares.

3. Limited Liability Protection (Indirectly):

While not a direct safeguard, the existence of a par value, even a nominal one, contributes to the overall structure that ultimately supports limited liability for shareholders. This structure involves complex legal and financial interplays, but the par value forms a small part of that overall framework.

The Difference Between Par Value and Market Value

This is perhaps the most critical distinction to grasp.

- Par Value: An arbitrarily assigned nominal value, determined at the time of incorporation and generally remaining constant. It has minimal bearing on the actual worth of the stock.

- Market Value: The price at which a share of stock trades in the open market. This value is entirely driven by supply and demand, influenced by factors like company performance, investor sentiment, and overall market conditions. Market value fluctuates constantly.

The disconnect between par value and market value highlights the limited practical relevance of par value in modern investing. Investors are far more concerned with the market price and its potential for appreciation or depreciation.

Par Value and Different Types of Stock

While most commonly associated with common stock, the concept of par value extends to other types of shares as well:

- Preferred Stock: Preferred stock can also have a par value. This value plays a similar role in accounting and legal compliance as it does for common stock. However, the importance of par value is somewhat diminished given the nature of preferred stock's dividend preferences.

- Treasury Stock: When a company repurchases its own shares, this becomes treasury stock. Treasury stock typically retains its original par value, although it no longer represents outstanding shares.

The Implications of a Low or No Par Value

Many companies choose to issue shares with a very low par value, such as $0.01 or even $0.001, or even opt for no-par stock. This approach offers several advantages:

- Flexibility: It provides greater flexibility in setting the offering price of the stock. The offering price is not constrained by a significant par value.

- Reduced Complexity: Simplifies accounting and administrative processes related to equity transactions.

- Avoidance of Legal Constraints: Minimizes the constraints related to minimum capital requirements imposed by the par value.

The Future of Par Value

The continued decline in the relevance of par value seems inevitable. Its primary role is increasingly limited to legal compliance and accounting conventions. As regulatory frameworks evolve and financial markets continue to modernize, we might expect a further erosion of the significance of par value. It is likely to remain a historical artifact, a relic of an earlier era in corporate finance, while its practical significance continues to fade into the background. However, its complete disappearance from corporate charters is unlikely in the near future due to its ongoing relevance in fulfilling specific legal and accounting obligations.

Practical Considerations for Investors

For investors, the par value is largely irrelevant in investment decisions. Focus should be placed on the market value, the company's financial performance, its growth prospects, and other relevant factors affecting the stock's price. Understanding the distinction between par value and market value is crucial for making informed investment choices.

Conclusion: Understanding the Context is Key

While the par value per share of common stock may seem like a minor detail, understanding its history, current role, and limitations is essential for investors and corporate managers alike. Its original purpose as a safeguard for creditors has largely faded, but it continues to play a role in legal and accounting contexts. However, the market value—driven by supply and demand—remains the primary factor influencing investment decisions. By appreciating the historical context and the subtle yet important continuing implications of par value, individuals can navigate the complexities of the financial world with greater clarity and make more informed judgments. The ongoing evolution of financial regulations and markets might lead to further changes in the importance of par value, but for the foreseeable future, understanding its nuances is still a key element of navigating corporate finance.

Latest Posts

Latest Posts

-

A Normal Level Of Consciousness In An Infant Quizlet

Mar 31, 2025

-

A Republic Is A Form Of Government Where Quizlet

Mar 31, 2025

-

According To The Diathesis Stress Model Of Schizophrenia Quizlet

Mar 31, 2025

-

A Proximal Lad Lesion Is A Blockage Quizlet

Mar 31, 2025

-

Which Of The Following Is Not A Function Of Skin

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Par Value Per Share Of Common Stock Represents . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.