The Price Elasticity Of Demand Measures The:

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

The Price Elasticity of Demand Measures the Responsiveness of Quantity Demanded to a Change in Price

The price elasticity of demand (PED) is a crucial concept in economics that measures the responsiveness of the quantity demanded of a good or service to a change in its price. Understanding PED is vital for businesses in making pricing decisions, predicting market reactions, and maximizing revenue. This comprehensive guide will delve into the intricacies of PED, exploring its calculation, different types, influencing factors, and practical applications.

Understanding Price Elasticity of Demand

In essence, PED answers the question: how much will the quantity demanded change if the price changes? A high PED indicates that a small price change leads to a large change in quantity demanded. Conversely, a low PED implies that even a significant price change results in only a minor alteration in quantity demanded.

This responsiveness is not just a random occurrence; it's driven by various factors inherent to the good or service itself and the market conditions. Understanding these factors allows businesses to predict how their consumers will react to pricing strategies and make informed choices.

Calculating Price Elasticity of Demand

PED is calculated using the following formula:

PED = (% Change in Quantity Demanded) / (% Change in Price)

Let's break down this formula:

-

% Change in Quantity Demanded: This measures the percentage change in the quantity of a good or service consumers are willing and able to buy. It's calculated as:

[(New Quantity - Old Quantity) / Old Quantity] * 100 -

% Change in Price: This measures the percentage change in the price of the good or service. It's calculated as:

[(New Price - Old Price) / Old Price] * 100

Example:

Suppose the price of apples increases from $1 to $1.20 per pound, leading to a decrease in quantity demanded from 1000 pounds to 800 pounds.

- % Change in Quantity Demanded = [(800 - 1000) / 1000] * 100 = -20%

- % Change in Price = [(1.20 - 1) / 1] * 100 = 20%

Therefore, PED = -20% / 20% = -1

The negative sign indicates an inverse relationship: as price increases, quantity demanded decreases (the law of demand). We typically ignore the negative sign when interpreting the magnitude of elasticity. In this case, the PED is 1, indicating unitary elasticity.

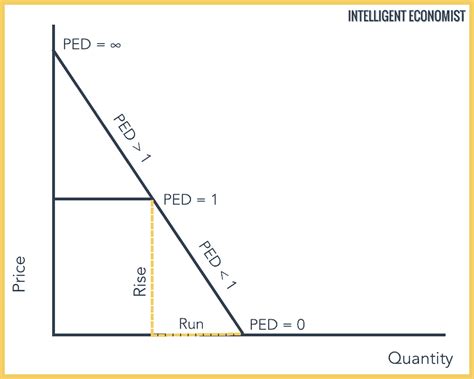

Types of Price Elasticity of Demand

PED can be categorized into several types based on the magnitude of its value:

1. Elastic Demand (PED > 1):

This signifies that the percentage change in quantity demanded is greater than the percentage change in price. A small price increase leads to a significant drop in demand, and vice-versa. Goods with many substitutes tend to exhibit elastic demand. For example, if the price of Coca-Cola increases, consumers might readily switch to Pepsi or other cola brands.

2. Inelastic Demand (PED < 1):

Here, the percentage change in quantity demanded is less than the percentage change in price. Even substantial price changes have a relatively small impact on the quantity demanded. Necessities like gasoline, prescription drugs, or essential food items often display inelastic demand. Consumers will likely continue purchasing these goods despite price increases.

3. Unitary Elastic Demand (PED = 1):

In this case, the percentage change in quantity demanded equals the percentage change in price. A proportional change in price results in a proportional change in quantity demanded. This scenario is less common than elastic or inelastic demand.

4. Perfectly Elastic Demand (PED = ∞):

This is a theoretical extreme where any price increase leads to zero demand. This is often observed in markets with numerous perfect substitutes and easy entry and exit of firms.

5. Perfectly Inelastic Demand (PED = 0):

This theoretical extreme implies that changes in price have absolutely no effect on quantity demanded. This scenario is rare in the real world.

Factors Affecting Price Elasticity of Demand

Several factors influence the price elasticity of demand for a particular good or service:

1. Availability of Substitutes:

Goods with close substitutes tend to have higher PED. Consumers can easily switch to alternatives if the price of the original good increases.

2. Necessity vs. Luxury:

Necessities (goods essential for survival) generally exhibit lower PED than luxury goods (non-essential goods). Consumers are less likely to reduce their consumption of necessities even if prices rise.

3. Proportion of Income Spent:

Goods that constitute a small proportion of a consumer's income typically have lower PED than goods representing a significant portion. A price increase in a relatively inexpensive item will have less impact than an increase in a pricey item.

4. Time Horizon:

PED tends to be higher in the long run than in the short run. Consumers have more time to adjust their consumption patterns and find substitutes over time.

5. Brand Loyalty:

Strong brand loyalty can lead to lower PED. Consumers might continue buying a particular brand even if prices rise, due to their preference or habit.

6. Consumer Perception:

The perceived value or uniqueness of a product can influence its PED. A highly valued or unique product might have lower PED.

Applications of Price Elasticity of Demand

Understanding PED is crucial for various economic and business applications:

1. Pricing Decisions:

Businesses use PED to determine optimal pricing strategies. For goods with elastic demand, smaller price increases are preferable to avoid significant drops in demand. For goods with inelastic demand, businesses might be able to increase prices without experiencing a drastic decline in sales.

2. Revenue Management:

PED helps businesses predict the impact of price changes on total revenue. Increasing prices for inelastic goods could increase total revenue, while increasing prices for elastic goods may decrease total revenue.

3. Tax Policy:

Governments use PED to assess the impact of taxes on consumers. Taxes on goods with inelastic demand (like cigarettes) will generate more revenue without significantly affecting quantity demanded.

4. Government Regulations:

Understanding PED can inform government regulations on price controls or subsidies. Price ceilings on essential goods with inelastic demand could lead to shortages.

5. Market Analysis:

PED is a valuable tool for market research and analysis. It helps businesses understand consumer behavior and predict market trends.

Limitations of Price Elasticity of Demand

While PED is a powerful tool, it has some limitations:

-

It's a static measure: PED is calculated at a specific point in time and may not accurately reflect changes in demand over time.

-

It assumes ceteris paribus: PED calculations assume that all other factors remain constant, which is rarely the case in the real world. Changes in consumer income, tastes, or the prices of related goods can affect demand.

-

Data availability: Accurate data on quantity demanded and price changes is crucial for reliable PED calculation, but such data may not always be readily available or reliable.

-

It doesn't consider consumer surplus: While PED focuses on quantity demanded, it doesn't fully capture the overall welfare effects of price changes on consumers.

Conclusion

The price elasticity of demand is a fundamental concept in economics with significant implications for businesses, governments, and consumers. Understanding its calculation, types, influencing factors, and applications is vital for making informed decisions about pricing strategies, tax policies, and other economic policies. While it has limitations, PED remains an indispensable tool for analyzing market behavior and predicting the impact of price changes on quantity demanded and total revenue. By considering the factors affecting PED and its inherent limitations, businesses and policymakers can leverage its insights to achieve their economic objectives effectively. Continuous monitoring of market dynamics and consumer behavior is essential for accurate PED estimations and successful application in real-world scenarios.

Latest Posts

Latest Posts

-

Why Are Fuel Leaks A Problem Aceable

Mar 15, 2025

-

The Ideas Addressed In The Image Most Directly Relate To

Mar 15, 2025

-

Jasmin Belongs To The Chess Club On Her Campus

Mar 15, 2025

-

Select The Category That Would Yield Quantitative Data

Mar 15, 2025

-

Nominal Gross Domestic Product Measures The Dollar Value Of

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about The Price Elasticity Of Demand Measures The: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.