The Primary Goal Of Financial Management Is To Maximize:

Breaking News Today

Mar 27, 2025 · 6 min read

Table of Contents

The Primary Goal of Financial Management is to Maximize: Shareholder Wealth

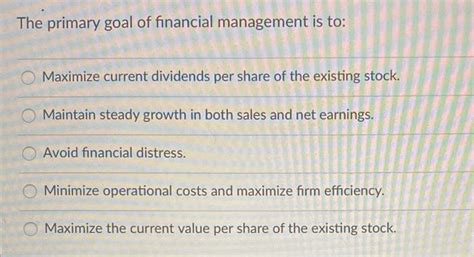

The primary goal of financial management is a topic frequently debated, yet the prevailing and most widely accepted answer remains maximizing shareholder wealth. While other objectives like maximizing profits or market share exist, they are ultimately subordinate to the overarching goal of enhancing shareholder value. This article delves deep into the nuances of this concept, exploring its implications, challenges, and the various strategies employed to achieve it.

Understanding Shareholder Wealth Maximization

Shareholder wealth maximization doesn't simply mean maximizing short-term profits. Instead, it focuses on increasing the long-term market value of the firm's equity. This is achieved by making sound financial decisions that generate strong returns for investors, reflected in a higher stock price and increased dividend payouts. The market value of a firm’s equity reflects investors’ expectations regarding the firm's future profitability and risk. Therefore, maximizing shareholder wealth requires a holistic approach that considers both factors.

Key Aspects of Shareholder Wealth Maximization:

-

Stock Price Appreciation: The most direct indicator of shareholder wealth is the increase in the company's stock price. A rising stock price reflects investor confidence in the company's future prospects.

-

Dividend Payments: Consistent and growing dividend payouts provide shareholders with a direct return on their investment. A healthy dividend policy demonstrates financial strength and commitment to shareholder returns.

-

Risk Management: Shareholder wealth maximization isn't solely about maximizing returns; it also involves managing risk effectively. Excessive risk-taking can lead to significant losses, eroding shareholder value.

-

Long-Term Perspective: It's crucial to adopt a long-term perspective. Focusing solely on short-term gains can jeopardize long-term sustainability and ultimately harm shareholder value.

-

Ethical Considerations: While profit maximization is a key component, it must be achieved ethically and legally. Unethical or illegal practices can severely damage the company's reputation and ultimately destroy shareholder value.

Maximizing Shareholder Wealth: Strategies and Tactics

Several key strategies and tactics are employed by businesses to maximize shareholder wealth. These are interconnected and require a well-coordinated approach.

1. Profitability Enhancement:

-

Revenue Growth: Increasing sales and market share through effective marketing, product innovation, and strategic expansion is fundamental to boosting profitability. This often involves in-depth market research, competitive analysis, and a clear understanding of customer needs.

-

Cost Reduction: Streamlining operations, improving efficiency, negotiating better deals with suppliers, and implementing cost-saving technologies can significantly improve profit margins. Lean manufacturing principles and Six Sigma methodologies can be powerful tools here.

-

Pricing Strategies: Careful pricing strategies, taking into account both competitor pricing and consumer demand elasticity, play a vital role in maximizing revenue and profitability. Value-based pricing and dynamic pricing models are commonly used.

-

Operational Efficiency: Improving operational efficiency encompasses all aspects of a business, from production and supply chain management to customer service and administrative processes. Automation, process optimization, and technology upgrades can significantly boost efficiency.

2. Strategic Investment Decisions:

-

Capital Budgeting: This involves evaluating and selecting long-term investment projects, such as new equipment, expansion into new markets, or research and development initiatives. Tools like Net Present Value (NPV) and Internal Rate of Return (IRR) are used to assess the financial viability of these projects.

-

Mergers and Acquisitions: Acquiring other companies or merging with them can offer significant advantages, such as access to new markets, technologies, or talent. However, careful due diligence and strategic planning are essential for successful M&A transactions.

-

Research and Development: Investing in R&D is crucial for developing new products and services, staying ahead of the competition, and maintaining a competitive edge. This requires a long-term view and often involves significant upfront investment with uncertain returns.

3. Financial Structure Optimization:

-

Capital Structure Decisions: This involves determining the optimal mix of debt and equity financing. The goal is to find the balance that minimizes the cost of capital and maximizes shareholder value. This requires understanding the impact of leverage on a company's financial risk and return.

-

Working Capital Management: Efficient management of working capital – current assets and liabilities – is crucial for ensuring liquidity and maximizing profitability. This involves optimizing inventory levels, managing receivables effectively, and securing favorable terms from suppliers.

-

Dividend Policy: Deciding on an appropriate dividend payout ratio is an important aspect of financial management. It involves balancing the desire to return profits to shareholders with the need to retain earnings for reinvestment in growth opportunities.

4. Risk Management:

-

Financial Risk Management: This involves managing risks associated with the company's financial position, such as interest rate risk, currency risk, and credit risk. Hedging strategies, such as derivatives, can be used to mitigate these risks.

-

Operational Risk Management: Managing operational risks, such as supply chain disruptions, production failures, and cybersecurity breaches, is crucial for maintaining profitability and stability. Robust contingency plans and risk mitigation strategies are vital.

-

Strategic Risk Management: Identifying and mitigating risks related to the company's overall business strategy is crucial for long-term success. This requires regular review and adaptation of the strategy in response to changing market conditions.

Challenges to Shareholder Wealth Maximization:

While maximizing shareholder wealth is the primary goal, several challenges can hinder its achievement.

-

Agency Problems: Conflicts of interest can arise between managers and shareholders, as managers may prioritize their own interests over those of the shareholders. Effective corporate governance mechanisms are crucial to mitigate this.

-

Market Volatility: Unforeseen economic downturns, market crashes, and geopolitical events can significantly impact a company's performance and shareholder value, regardless of how well-managed the company is.

-

Competition: Intense competition can erode profit margins and make it challenging to maintain a sustainable competitive advantage.

-

Regulatory Changes: Changes in regulations, taxes, and industry standards can significantly impact a company's profitability and ability to maximize shareholder value.

-

Ethical Considerations: Unethical or illegal activities can severely damage a company's reputation and destroy shareholder value. Maintaining strong ethical standards is crucial for long-term success.

Alternative Goals and their Limitations:

While shareholder wealth maximization is the dominant paradigm, some argue for alternative goals such as:

-

Profit Maximization: This focus lacks a time dimension and ignores risk. Short-term profits can be achieved at the expense of long-term sustainability and shareholder value.

-

Stakeholder Theory: This approach emphasizes balancing the interests of all stakeholders, including employees, customers, suppliers, and the community. While important for long-term sustainability, it can sometimes conflict with the interests of shareholders.

Conclusion:

Maximizing shareholder wealth is the most widely accepted primary goal of financial management. It's a dynamic process that requires a comprehensive approach encompassing profitability enhancement, strategic investment decisions, financial structure optimization, and effective risk management. While challenges exist, a well-defined strategy, strong corporate governance, and a long-term perspective are crucial for achieving this overarching objective and ensuring the sustainable success of a firm. Ignoring this primary goal ultimately risks jeopardizing the long-term viability and attractiveness of the company to investors. Ultimately, a focus on shareholder wealth benefits not only investors but also contributes to a healthier and more vibrant economy.

Latest Posts

Latest Posts

-

The Letters F I F O Refer To

Mar 30, 2025

-

Awareness Of Death Often Causes Midlife Adults To

Mar 30, 2025

-

Which Of The Following Is An Example Of Vicarious Reinforcement

Mar 30, 2025

-

The Cross Bridge Cycle Starts When

Mar 30, 2025

-

All Of The Following Are Effective Countermeasures

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about The Primary Goal Of Financial Management Is To Maximize: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.