The Step Is To Determine Whether Cash Flows Are Relevant.

Breaking News Today

Mar 29, 2025 · 6 min read

Table of Contents

Determining the Relevance of Cash Flows: A Comprehensive Guide

Cash flow analysis is a cornerstone of financial decision-making. Understanding whether cash flows are relevant to a specific situation is crucial for accurate forecasting, investment appraisal, and overall financial health assessment. This comprehensive guide delves into the multifaceted aspects of determining cash flow relevance, exploring various scenarios and providing practical insights.

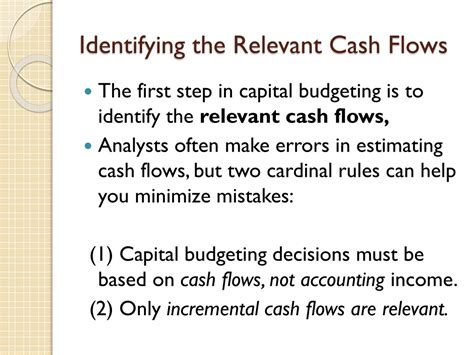

What Constitutes Relevant Cash Flows?

Before diving into specific methodologies, it’s crucial to define what constitutes relevant cash flows. Relevant cash flows are those future cash inflows and outflows that differ between alternative courses of action being considered. They are incremental, meaning they represent the change in cash flows resulting from a specific decision. Irrelevant cash flows, conversely, are those that don't change based on the chosen course of action. These are often sunk costs (already incurred and unrecoverable), or cash flows unrelated to the decision at hand.

Key Characteristics of Relevant Cash Flows:

- Future Oriented: They focus on the anticipated cash flows resulting from a decision, not past events.

- Incremental: They represent the difference in cash flows between alternatives.

- Opportunity Costs: These represent the potential benefits forgone by choosing one option over another. They are crucial for a complete picture of relevance.

- Taxes: Tax implications significantly impact cash flows and should always be factored into the analysis.

- After-tax Effects: The analysis should incorporate the after-tax effect of all cash flows to reflect their true impact on a company’s financial position.

Identifying Relevant Cash Flows: A Step-by-Step Approach

Determining the relevance of cash flows often requires a structured approach. The following steps will guide you through this process:

Step 1: Clearly Define the Decision

This is the foundational step. What specific decision requires cash flow analysis? Are you evaluating a new project, replacing existing equipment, or altering a production process? The clarity of the decision directly influences the identification of relevant cash flows. Ambiguity here will lead to inaccuracies in the subsequent analysis. For example, are you considering expanding into a new market or simply updating your current marketing strategy? These are very different decisions with vastly different relevant cash flows.

Step 2: Identify All Potential Cash Flows

This step involves brainstorming all potential cash inflows and outflows related to the decision. Don't overlook any potential cash flows, no matter how small or seemingly insignificant. This includes:

- Initial Investment: This encompasses the initial capital expenditure required for the project. Consider both tangible assets (equipment, property) and intangible assets (software licenses, patents).

- Operating Cash Flows: These are the cash flows generated from the day-to-day operations of the project. Include revenues, variable costs, fixed costs, and working capital changes.

- Terminal Cash Flows: These are the cash flows at the end of the project's life. Consider salvage value of assets, potential costs of decommissioning, and any other final cash inflows or outflows.

- Indirect Effects: Don't overlook the indirect impact on other parts of the business. For example, a new product line might cannibalize sales of existing products – this impact needs to be factored in.

Step 3: Distinguish Between Relevant and Irrelevant Cash Flows

This crucial step involves separating the wheat from the chaff. Irrelevant cash flows often include:

- Sunk Costs: These are past expenditures that cannot be recovered, regardless of the decision. For example, research and development costs already incurred are irrelevant to a decision about whether to proceed with the project.

- Opportunity Costs: While these are relevant, they're often overlooked. Opportunity costs represent the potential benefits lost by choosing one option over another. For instance, if land is used for one project, the potential rental income from leasing it is an opportunity cost.

- Financing Costs: Interest payments on loans are typically excluded from the analysis because they are accounted for separately in the discount rate used to evaluate the project's profitability.

- General Overhead Costs: Unless directly attributable to the project (and incremental), these are generally irrelevant.

Step 4: Quantify Relevant Cash Flows

Once you’ve identified relevant cash flows, quantify them using realistic estimates. This will involve market research, financial projections, and potentially expert opinions. Sensitivity analysis, which examines the impact of changes in key assumptions on the results, can be helpful at this stage.

Step 5: Perform Cash Flow Analysis

Numerous techniques are available for analyzing cash flows, including:

- Net Present Value (NPV): This discounts future cash flows back to their present value, providing a measure of the project's profitability.

- Internal Rate of Return (IRR): This calculates the discount rate at which the NPV of the project equals zero.

- Payback Period: This determines how long it takes for the project to recoup its initial investment.

Relevance in Different Contexts

The relevance of cash flows varies depending on the context. Let’s examine a few key scenarios:

Capital Budgeting Decisions

In capital budgeting, determining the relevance of cash flows is paramount. All cash flows should be incremental and after-tax. Sunk costs, allocated overhead, and financing costs are generally excluded. The focus is solely on future, project-specific cash flows.

Mergers and Acquisitions

When evaluating a merger or acquisition, relevant cash flows encompass the synergies expected from combining the businesses. This involves identifying potential cost savings, revenue growth opportunities, and any changes in working capital requirements. Intangible assets like brand value and intellectual property should be considered, although valuation can be challenging.

Financial Distress

In situations of financial distress, the relevance of cash flows shifts toward immediate liquidity. The ability to generate sufficient cash to meet immediate obligations takes precedence over longer-term projects. This emphasizes the importance of short-term cash flow forecasts and potentially drastic measures to enhance liquidity.

Working Capital Management

Efficient working capital management requires a close monitoring of cash flows. The goal is to ensure sufficient liquidity while minimizing idle cash. Relevant cash flows in this context are related to accounts receivable, accounts payable, inventory, and short-term investments.

Dealing with Uncertainty and Estimation Errors

Cash flow projections inherently involve uncertainty. Several techniques can mitigate the impact of estimation errors:

- Sensitivity Analysis: This technique explores the impact of changes in key assumptions on the results. By varying inputs, you can gain a clearer understanding of the project's risk profile.

- Scenario Analysis: This technique creates different scenarios based on various possible outcomes, allowing for a more comprehensive risk assessment.

- Monte Carlo Simulation: This sophisticated technique uses random sampling to generate a distribution of possible outcomes, providing a more robust estimate of project value and risk.

Conclusion

Determining the relevance of cash flows is a critical skill for financial professionals and business decision-makers. By following a structured approach, identifying all potential cash flows, carefully distinguishing between relevant and irrelevant items, and employing appropriate analytical techniques, you can make more informed and accurate financial decisions. Remember that understanding the context of the decision and incorporating effective risk management techniques are crucial for the reliability and usefulness of your cash flow analysis. Ignoring these steps can lead to flawed conclusions and potentially disastrous outcomes. The process requires careful consideration, accurate data, and a deep understanding of the underlying financial principles. Through diligent application of these principles, you can build a more robust and reliable foundation for financial planning and decision-making.

Latest Posts

Latest Posts

-

A Cost Of Living Adjustment Is Based On The Quizlet

Apr 01, 2025

-

Asthma Is Cause By Which Type Of Response Quizlet

Apr 01, 2025

-

Circumcision Is The Surgical Removal Of The Quizlet

Apr 01, 2025

-

Careers In Business Management And Administration Quizlet

Apr 01, 2025

-

A Records Freeze Includes Which Of The Following

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Step Is To Determine Whether Cash Flows Are Relevant. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.