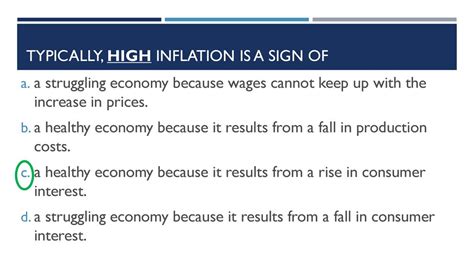

Typically High Inflation Is A Sign Of

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Typically, High Inflation is a Sign Of… Trouble

High inflation, a persistent increase in the general price level of goods and services in an economy, is rarely a positive sign. While some economists might argue for a small, controlled amount of inflation being healthy for economic growth, sustained high inflation usually signals underlying economic weaknesses and imbalances. This article will delve into the various factors that typically accompany high inflation, explaining why it's often a significant cause for concern.

The Usual Suspects: Underlying Causes of High Inflation

High inflation rarely appears out of thin air. It's usually the result of a complex interplay of factors, often stemming from imbalances in the fundamental economic equation of supply and demand. Let's explore the most common culprits:

1. Demand-Pull Inflation: Too Much Money Chasing Too Few Goods

This classic scenario occurs when aggregate demand (total spending in an economy) outpaces aggregate supply (total production). Think of it like this: if everyone suddenly has more money to spend, but the amount of goods and services available hasn't increased proportionally, prices will inevitably rise to balance the equation. Several factors can contribute to demand-pull inflation:

- Increased Consumer Spending: Fueled by factors like rising wages, increased consumer confidence, or readily available credit, a surge in consumer spending can quickly outstrip supply, driving prices up.

- Government Spending: Large-scale government spending programs, particularly if not matched by increased productivity, can inject significant amounts of money into the economy, leading to increased demand and inflation. This is often referred to as "fiscal inflation".

- Increased Investment: A boom in investment, while generally positive, can also contribute to inflation if the increase in demand for resources and labor exceeds the available supply.

- Increased Exports: A significant increase in exports can lead to higher demand for domestically produced goods, potentially pushing prices up.

2. Cost-Push Inflation: Rising Production Costs

In contrast to demand-pull inflation, cost-push inflation arises from increases in the cost of production. When the cost of inputs like labor, raw materials, or energy increases, businesses often pass these higher costs onto consumers in the form of higher prices. This can be a vicious cycle, as higher prices can lead to further wage demands, perpetuating the inflationary spiral. Key contributors include:

- Rising Wages: If wages rise faster than productivity, the cost of production increases, leading to higher prices. This is particularly concerning in situations where labor unions have significant bargaining power.

- Increased Raw Material Prices: Fluctuations in commodity prices, particularly for essential raw materials like oil or food, can significantly impact production costs and fuel inflation. Geopolitical events, supply chain disruptions, or natural disasters can all contribute to this.

- Supply Chain Bottlenecks: Disruptions to global supply chains, whether due to pandemics, natural disasters, or geopolitical tensions, can lead to shortages and increased prices for certain goods.

- Increased Energy Costs: Energy is a critical input for most industries. Significant increases in energy prices, whether due to rising oil prices or increased regulation, can have a cascading effect on inflation.

3. Built-In Inflation: The Wage-Price Spiral

This type of inflation is self-perpetuating. It occurs when higher prices lead to demands for higher wages, which in turn lead to higher production costs and further price increases. This creates a vicious cycle that's difficult to break without intervention.

4. Monetary Inflation: Too Much Money in Circulation

This relates directly to the money supply. When a central bank prints or creates too much money, it can lead to a devaluation of the currency and a subsequent increase in prices. This is often associated with government policies aimed at stimulating economic growth through excessive money printing, known as "monetarism". Excessive money supply growth without a corresponding increase in goods and services will inevitably lead to higher prices.

Identifying the Signs: Recognizing High Inflation

While the headline inflation rate (usually measured by the Consumer Price Index or CPI) provides a general indication, several other signs can point towards high or impending inflation:

- Rising Asset Prices: Inflation often manifests in rapidly rising asset prices, such as real estate, stocks, and precious metals. This is because investors seek to protect their wealth from the erosion of purchasing power caused by inflation.

- Increasing Commodity Prices: A significant increase in the price of raw materials, such as oil, metals, and agricultural products, is a strong indicator of potential inflation.

- Wage Growth Outpacing Productivity: When wages increase at a faster rate than worker productivity, businesses may pass on these increased labor costs to consumers in the form of higher prices.

- Shortages of Goods: Persistent shortages of goods and services can be a sign of demand outpacing supply, a classic contributor to inflation.

- Increased Borrowing Costs: As central banks try to combat inflation, they often raise interest rates, leading to higher borrowing costs for businesses and consumers. This can, paradoxically, further dampen economic activity.

The Consequences of High Inflation: A Cascade of Negative Effects

High inflation isn't simply an inconvenience; it can have severe and far-reaching consequences for individuals, businesses, and the economy as a whole:

- Erosion of Purchasing Power: The most direct consequence is the decline in the purchasing power of money. People's savings and income lose value, making it harder to afford essential goods and services.

- Uncertainty and Reduced Investment: High inflation creates uncertainty about future prices, discouraging investment and economic growth. Businesses are hesitant to make long-term commitments when prices are volatile.

- Increased Poverty and Inequality: High inflation disproportionately affects low-income households, who spend a larger share of their income on essentials. This can exacerbate income inequality and lead to increased poverty.

- Distorted Market Signals: Inflation can distort market signals, making it difficult for businesses to make efficient allocation decisions. Price increases don't always reflect genuine increases in demand or scarcity.

- Social Unrest: Persistently high inflation can lead to social unrest and political instability, as people struggle to cope with the rising cost of living.

Mitigation Strategies: How to Combat High Inflation

Tackling high inflation requires a multifaceted approach, involving both monetary and fiscal policies:

- Monetary Policy: Central banks typically use monetary policy tools, such as raising interest rates, to curb inflation. Higher interest rates make borrowing more expensive, reducing consumer spending and investment, thereby cooling down demand.

- Fiscal Policy: Governments can use fiscal policy, such as reducing government spending or increasing taxes, to reduce aggregate demand. However, these measures can have negative impacts on economic growth.

- Supply-Side Policies: Policies aimed at increasing productivity and improving supply chains can help address cost-push inflation. This might involve investments in infrastructure, education, and technology.

- Wage and Price Controls: In extreme cases, governments may resort to wage and price controls, but these are often ineffective and can lead to shortages and black markets.

Conclusion: A Persistent Threat Requiring Vigilance

High inflation is a serious economic issue with far-reaching consequences. Understanding its underlying causes and recognizing its warning signs is crucial for policymakers, businesses, and individuals alike. While there are various strategies to mitigate its effects, a proactive and comprehensive approach is essential to prevent high inflation from spiraling out of control and causing significant damage to the economy. Continuous monitoring and careful policy adjustments are key to maintaining price stability and promoting sustainable economic growth. The interplay between monetary policies, fiscal policies, and structural reforms remains central to managing inflation effectively and fostering a healthy economy. Ignoring the signs or delaying necessary actions can lead to prolonged periods of economic hardship, ultimately impacting everyone's standard of living. Therefore, vigilance and informed action are crucial to navigate the complexities of high inflation and safeguard long-term economic prosperity.

Latest Posts

Latest Posts

-

During A 2014 Archeological Dig In Spain

Mar 19, 2025

-

Match Each Type Of Capillary To Its Most Likely Location

Mar 19, 2025

-

You Know These Facts About A Companys Prior Calendar Year

Mar 19, 2025

-

What Are The Three Main Types Of Driving Environments

Mar 19, 2025

-

The Experiments Of Meselson And Stahl Showed That Dna

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Typically High Inflation Is A Sign Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.