Wall Street Prep Excel Crash Course Exam Answers

Breaking News Today

Mar 26, 2025 · 5 min read

Table of Contents

Wall Street Prep Excel Crash Course Exam Answers: A Comprehensive Guide

Landing a coveted role in finance often hinges on demonstrating proficiency in Microsoft Excel. The Wall Street Prep Excel Crash Course is a popular resource for aspiring analysts aiming to hone their skills and ace those crucial Excel assessments. This comprehensive guide delves into the key concepts covered in the course, provides insights into tackling common exam question types, and offers strategies for maximizing your learning and achieving a high score.

Understanding the Wall Street Prep Excel Crash Course

The Wall Street Prep Excel Crash Course is designed to equip you with the advanced Excel skills demanded by investment banks, hedge funds, and other financial institutions. It covers a range of topics crucial for financial modeling, data analysis, and presentation, including:

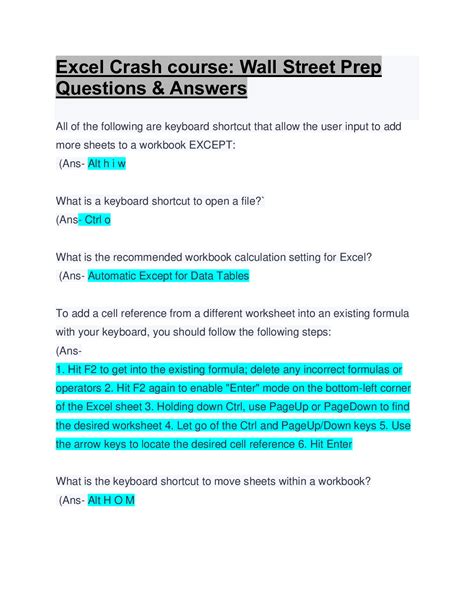

- Keyboard Shortcuts: Mastering keyboard shortcuts is paramount for efficiency. The course emphasizes shortcuts that significantly reduce the time spent on repetitive tasks, a crucial skill in high-pressure finance environments.

- Data Manipulation & Cleaning: This section focuses on techniques for cleaning, transforming, and organizing large datasets. This often involves handling inconsistencies, missing values, and duplicate entries—essential for building accurate financial models.

- Formulas & Functions: A deep dive into crucial Excel functions, including VLOOKUP, HLOOKUP, INDEX, MATCH, SUMIF, SUMIFS, COUNTIF, COUNTIFS, and many more. Understanding these functions is vital for automating calculations and performing complex data analysis.

- Data Visualization: Creating clear and impactful charts and graphs is crucial for presenting data effectively. The course emphasizes the creation of professional-looking visualizations that communicate key insights clearly.

- Pivot Tables & Pivot Charts: These powerful tools are invaluable for summarizing and analyzing large datasets. The course trains you on how to create and effectively utilize pivot tables and charts for insightful data analysis.

- Financial Modeling Techniques: This section typically covers techniques specific to financial modeling, such as building DCF models, LBO models, and other valuation models. Mastering these is key to success in many finance roles.

Exam Question Types & Strategies

The Wall Street Prep Excel Crash Course exam typically assesses your understanding through a variety of question types, including:

- Multiple Choice Questions: These test your knowledge of formulas, functions, shortcuts, and fundamental concepts. Effective preparation involves thoroughly reviewing the course material and practicing with numerous sample questions.

- Scenario-Based Questions: These questions present real-world financial scenarios and require you to apply your Excel skills to solve specific problems. Practice solving a wide variety of scenarios to build your problem-solving abilities.

- Practical Application Questions: These often involve tasks like creating a specific chart, using a particular function to solve a problem, or cleaning a dataset. Hands-on practice is essential to master these types of questions.

- Data Interpretation Questions: These test your ability to extract meaningful insights from data presented in various formats. Sharpen your data interpretation skills by working with diverse datasets and identifying key trends.

Strategies for Success

To effectively prepare for the Wall Street Prep Excel Crash Course exam and excel in your finance career, consider these strategies:

- Structured Learning: Break down the course material into manageable chunks and focus on mastering one concept at a time. This method enhances retention and prevents information overload.

- Consistent Practice: Regular practice is crucial. Dedicate time each day to work through practice problems and apply the concepts learned. Consistent practice builds muscle memory and improves speed and accuracy.

- Hands-On Approach: Don’t just passively read the materials. Actively engage by working through the examples and creating your own practice exercises. This ensures a deeper understanding of the concepts.

- Focus on Efficiency: Aim to solve problems efficiently using the most appropriate functions and keyboard shortcuts. Time management is a critical skill in the finance industry.

- Simulate Exam Conditions: Take practice exams under timed conditions to get accustomed to the pressure of the actual exam. This helps identify areas where you need further improvement.

- Utilize Online Resources: While this guide provides valuable information, exploring other online resources, tutorials, and forums can supplement your learning and provide additional practice problems. Remember to focus on reputable sources.

- Seek Feedback: If possible, seek feedback on your work from peers or mentors to identify areas for improvement. Constructive criticism can be invaluable for refining your skills.

Advanced Excel Techniques for the Exam

Beyond the foundational concepts, the exam might also test your understanding of more advanced techniques, including:

- Array Formulas: These powerful formulas allow for complex calculations across multiple cells simultaneously. Mastering array formulas can significantly enhance your modeling efficiency.

- Data Validation: This technique helps ensure data accuracy by restricting the type of data entered into cells. Understanding data validation is crucial for building robust and reliable models.

- Named Ranges: Using named ranges improves the readability and maintainability of your spreadsheets. This makes your work easier to understand and collaborate on.

- Macros & VBA: While not always a major focus, some advanced exams might test basic understanding of Macros and Visual Basic for Applications (VBA) to automate tasks.

Understanding the Importance of Excel in Finance

The importance of advanced Excel skills in finance cannot be overstated. From building complex financial models to analyzing market data, Excel is a critical tool for nearly every role in the industry. The Wall Street Prep Excel Crash Course is a significant investment in your career, equipping you with the skills to succeed in a highly competitive field.

Beyond the Exam: Mastering Excel for Your Career

Passing the Wall Street Prep Excel Crash Course exam is a significant achievement, but true mastery requires ongoing learning and application. Continuously seeking opportunities to enhance your Excel skills will be an invaluable asset throughout your career. This could involve exploring more advanced functions, working on personal projects, or participating in online communities focused on Excel proficiency.

Conclusion

The Wall Street Prep Excel Crash Course is a rigorous yet rewarding program designed to prepare aspiring finance professionals for the challenges of the industry. By understanding the key concepts, practicing diligently, and employing effective learning strategies, you can significantly increase your chances of success on the exam and embark on a fulfilling career in finance. Remember, consistent practice and a deep understanding of the underlying principles are key to achieving a high score and ultimately, mastering the powerful tool that is Microsoft Excel. Good luck!

Latest Posts

Latest Posts

-

Which Is A True Statement Regarding Depressive Disorders

Mar 27, 2025

-

What Is One Of The Characteristics Of Multicultural Literature

Mar 27, 2025

-

Which Of These Is The Best Example Of Fragmentation

Mar 27, 2025

-

The Most Likely Cause Of Bedding In This Image Is

Mar 27, 2025

-

Match Each Definition With The Correct Term

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Wall Street Prep Excel Crash Course Exam Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.