What Does Level Refer To In Level Term Insurance

Breaking News Today

Mar 30, 2025 · 6 min read

Table of Contents

What Does "Level" Refer To in Level Term Insurance?

Level term insurance is a popular type of life insurance due to its simplicity and affordability. But what exactly does "level" mean in this context? Understanding this term is crucial to making an informed decision about your life insurance needs. This comprehensive guide will delve deep into the meaning of "level" in level term insurance, explaining its implications for premiums, coverage, and overall value.

Understanding the Basics of Term Life Insurance

Before we dive into the specifics of "level" term insurance, let's establish a foundational understanding of term life insurance itself. Term life insurance provides coverage for a specified period, or "term," such as 10, 20, or 30 years. If the insured passes away during the term, the beneficiaries receive the death benefit. If the insured survives the term, the policy expires, and there's no further coverage unless renewed (often at a higher premium).

Decoding "Level" in Level Term Life Insurance

The word "level" in level term life insurance refers to two key aspects:

1. Level Premiums

The most significant aspect of "level" is the constant premium payment. Unlike some other types of life insurance, level term insurance policies maintain a consistent premium throughout the entire term. This means you'll pay the same amount each year for the duration of the policy, providing predictable budgeting and financial planning. This predictability is a major advantage, especially for individuals seeking long-term financial security. Knowing exactly how much you'll pay each year eliminates the uncertainty and potential for unexpected increases, which can be especially important during times of financial instability.

Why are level premiums important?

- Budgeting: Consistent premiums simplify budgeting and financial planning. You can easily factor this expense into your monthly or annual budget without worrying about fluctuating costs.

- Predictability: Knowing the exact cost for the entire term offers peace of mind and reduces financial uncertainty. This is especially beneficial for long-term financial planning, such as saving for retirement or providing for your family's future.

- Financial Stability: Level premiums help maintain financial stability, preventing unexpected increases that could strain your finances, particularly during difficult economic periods.

2. Level Death Benefit

The second key aspect of "level" in level term insurance is the constant death benefit. This means the amount of money paid to your beneficiaries upon your death remains the same throughout the policy's term. This differs from other insurance types where the death benefit might increase or decrease over time. The consistent death benefit ensures that your loved ones receive the agreed-upon sum, regardless of when you pass away during the term.

Why is a level death benefit important?

- Financial Security for Loved Ones: A level death benefit provides consistent financial security for your beneficiaries, offering a reliable sum to help them manage expenses and maintain their lifestyle after your passing.

- Inflation Protection: While the death benefit doesn't directly adjust for inflation, the guaranteed fixed amount provides a known and predictable financial resource for your beneficiaries.

- Planning Certainty: The consistent death benefit simplifies estate planning and financial arrangements for your family. They know exactly what financial support to expect.

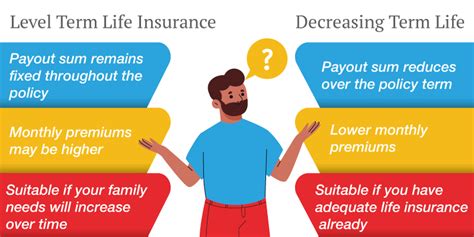

Level Term Insurance vs. Other Term Life Insurance Types

To fully appreciate the value of level term insurance, let's compare it to other types of term life insurance:

1. Decreasing Term Life Insurance

In decreasing term life insurance, the death benefit decreases over time, usually following a predetermined schedule. This type of insurance is generally cheaper initially, but the coverage shrinks each year, eventually reaching zero at the end of the term. This may be suitable for specific scenarios like paying off a mortgage, where the debt reduces over time. However, it's not ideal for long-term financial security for loved ones.

2. Increasing Term Life Insurance

Increasing term life insurance features a death benefit that increases over time, usually at a fixed rate or in line with inflation. This type offers protection against inflation, ensuring the death benefit maintains its purchasing power. However, premiums are usually higher than level term insurance.

3. Return of Premium Term Life Insurance

Return of premium (ROP) term life insurance returns the premiums paid if the insured survives the policy term. While this offers a financial benefit if you live past the term, premiums are significantly higher than standard level term insurance.

Choosing the Right Term for Your Level Term Insurance

The length of the term you choose for your level term insurance is a crucial decision based on your individual circumstances and financial goals. Consider these factors:

- Age: Younger individuals often opt for longer terms (20 or 30 years) to cover major life events like raising a family and paying off a mortgage. Older individuals might prefer shorter terms to align with their financial goals and remaining life expectancy.

- Financial Goals: Determine what you want your life insurance to achieve. Is it to cover outstanding debts, provide for your family's education, or ensure their financial stability after your death?

- Budget: Align your term length with your budget. Longer terms generally have higher premiums than shorter terms.

- Health: Your health status can affect your eligibility and premium rates. It's crucial to get quotes from multiple insurers to find the most competitive option.

Level Term Insurance: Pros and Cons

Like any financial product, level term insurance has advantages and disadvantages:

Pros:

- Predictable premiums: Consistent payments simplify budgeting.

- Consistent death benefit: Provides reliable financial security for beneficiaries.

- Affordability: Generally cheaper than other types of life insurance, making it accessible to a wider range of individuals.

- Simplicity: Easy to understand and purchase, requiring less complex financial knowledge.

Cons:

- Temporary coverage: Coverage ends after the chosen term unless renewed (often at a higher premium).

- No cash value: Unlike whole life insurance, there's no cash value accumulation.

- Premiums may increase upon renewal: Renewing a policy after the term expires typically results in higher premiums.

Factors Affecting Level Term Insurance Premiums

Several factors influence the premiums for level term insurance policies:

- Age: Younger applicants generally receive lower premiums than older applicants.

- Health: Individuals with pre-existing health conditions might face higher premiums or even be declined coverage.

- Gender: In some regions, gender still plays a role in premium calculations.

- Smoking status: Smokers typically pay higher premiums compared to non-smokers.

- Policy term length: Longer terms generally come with higher premiums.

- Death benefit amount: Higher death benefit amounts will result in higher premiums.

Conclusion: Making the Right Choice

Level term life insurance offers a straightforward and affordable way to provide financial protection for your loved ones. Its "level" premiums and death benefits offer predictability and peace of mind. However, it's crucial to carefully consider the term length, your budget, and your specific financial needs before making a decision. Comparing quotes from multiple insurers and consulting with a financial advisor can help you determine if level term insurance is the right choice for your unique circumstances. Remember, the goal is to secure a policy that adequately protects your family's future while aligning with your financial capabilities. Understanding the nuances of "level" in level term insurance empowers you to make an informed decision that offers both financial security and peace of mind.

Latest Posts

Latest Posts

-

A Common Cause Of Shock In An Infant Is

Apr 01, 2025

-

You Are Working As Part Of A Bls Team

Apr 01, 2025

-

Which Vessel Does Not Branch Off Of The Aorta

Apr 01, 2025

-

Selecciona La Palabra Que No Esta Relacionada

Apr 01, 2025

-

A Nurse Is Preparing To Administer Phenylephrine To A Client

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about What Does Level Refer To In Level Term Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.