What Does The Information Demonstrate About Alex's Investments

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

- What Does The Information Demonstrate About Alex's Investments

- Table of Contents

- What Does the Information Demonstrate About Alex's Investments? A Comprehensive Analysis

- Understanding Alex's Investment Landscape: The Data Points

- Analyzing Alex's Investment Strategy: Strengths and Weaknesses

- Strengths:

- Weaknesses:

- Deep Dive into Specific Investment Areas

- Stock Investments:

- Bond Investments:

- Real Estate Investments:

- Mutual Funds:

- Recommendations for Improvement

- Conclusion: A Path Towards Optimized Investing

- Latest Posts

- Latest Posts

- Related Post

What Does the Information Demonstrate About Alex's Investments? A Comprehensive Analysis

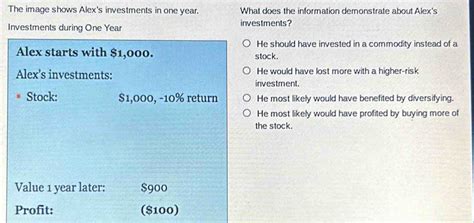

Analyzing an individual's investment portfolio requires a holistic view, considering risk tolerance, investment goals, diversification strategies, and overall performance. This article delves into a hypothetical case study of "Alex" and their investments, exploring the strengths and weaknesses revealed by the available data. We will examine the information (which will be presented throughout the article), drawing conclusions about Alex's investment approach and offering suggestions for potential improvements. Note: This analysis is for illustrative purposes only and does not constitute financial advice.

Understanding Alex's Investment Landscape: The Data Points

Before we dissect Alex's investment strategy, we need the data. Let's assume the following information is available about Alex's investments:

-

Investment Timeline: Alex has been investing for 10 years.

-

Investment Portfolio: Alex's portfolio consists of the following:

- Stocks (60%): A mix of large-cap, mid-cap, and small-cap stocks, with a significant portion invested in technology companies.

- Bonds (25%): Primarily government and investment-grade corporate bonds.

- Real Estate (10%): One rental property.

- Mutual Funds (5%): A mix of index funds and actively managed funds.

-

Risk Tolerance: Alex has a moderately high risk tolerance.

-

Investment Goals: Long-term wealth building, retirement savings.

-

Past Performance: Alex's portfolio has shown an average annual return of 8% over the past 10 years, slightly outpacing the overall market average.

-

Recent Market Volatility: Alex's portfolio experienced significant fluctuations during recent periods of market instability, highlighting the inherent volatility of a moderately high-risk portfolio.

Analyzing Alex's Investment Strategy: Strengths and Weaknesses

Based on the provided information, we can begin to analyze the strengths and weaknesses of Alex's investment approach.

Strengths:

- Diversification (to an extent): Alex's portfolio includes a mix of asset classes (stocks, bonds, real estate, mutual funds), demonstrating a basic understanding of diversification. This helps to mitigate risk, preventing complete reliance on any single asset class. However, the significant concentration in technology stocks might be a concern, as discussed below.

- Long-Term Perspective: Investing for 10 years showcases a commitment to long-term growth, a crucial element for successful wealth building. The consistent investment over this period contributes significantly to the positive returns observed.

- Above-Average Returns: An average annual return of 8% over 10 years exceeds the average market return, suggesting skillful investment choices and potentially a good understanding of market timing or stock selection.

- Moderate Risk Tolerance Alignment: The portfolio composition reflects Alex's moderately high risk tolerance. The higher allocation to stocks allows for higher potential returns but also entails greater volatility.

Weaknesses:

- Over-Concentration in Technology Stocks: A considerable portion of the stock holdings being in technology companies is a potential risk. While technology stocks have historically offered high growth potential, they are also known for their volatility. A downturn in the tech sector could significantly impact the overall portfolio performance. This lack of diversification within the stock portion of the portfolio is a significant weakness.

- Limited Real Estate Holdings: While real estate is part of the portfolio, the allocation is relatively low (10%). Real estate can act as a good hedge against inflation and provide additional diversification benefits. Increasing this allocation could enhance the portfolio's overall resilience.

- Active vs. Passive Management Imbalance: The mix of active and passive investments needs further scrutiny. While active management can lead to outperformance under specific circumstances, it also comes with higher fees. A more in-depth look at the performance of individual actively managed funds compared to their benchmark indices is essential. A larger allocation to low-cost index funds could potentially improve long-term returns.

- Lack of Transparency in Bond Selection: The information only mentions government and investment-grade corporate bonds. Without further details on the specific maturity dates and credit quality of these bonds, it's challenging to assess the overall risk and return profile of this portion of the portfolio.

Deep Dive into Specific Investment Areas

Let's now examine each investment area in more detail:

Stock Investments:

The concentration in technology stocks is a major point of concern. While past performance may justify this strategy, over-reliance on a single sector is a significant risk. Diversification across different sectors (healthcare, energy, consumer goods, etc.) is crucial for mitigating risk and potentially achieving better risk-adjusted returns. Analyzing the individual stocks within the portfolio would help in identifying specific holdings that might be underperforming or carry excessive risk.

Bond Investments:

A more detailed breakdown of the bond holdings is crucial. Factors such as duration (sensitivity to interest rate changes), credit quality, and diversification across different issuers are vital for evaluating the bond portion of the portfolio. Longer-duration bonds, while offering higher yields, can be susceptible to significant price declines when interest rates rise. A balanced mix of short-term, intermediate-term, and long-term bonds is recommended for optimal risk management.

Real Estate Investments:

The limited real estate investment (only one rental property) suggests a missed opportunity for greater diversification. Owning rental properties can offer a steady stream of passive income and a hedge against inflation. However, real estate is also illiquid and carries inherent risks such as property maintenance, vacancy rates, and local market fluctuations. A careful assessment of local market conditions and the potential return on investment (ROI) for additional properties would be beneficial.

Mutual Funds:

The exact composition of the mutual funds needs further investigation. The performance of actively managed funds needs to be carefully scrutinized, comparing them to their benchmarks. If active funds consistently underperform their passive counterparts (index funds) after accounting for fees, a reallocation toward lower-cost index funds would be advisable.

Recommendations for Improvement

Based on our analysis, here are some recommendations for optimizing Alex's investment portfolio:

- Diversify Stock Holdings: Reduce concentration in technology stocks by investing in other sectors. Consider using sector-specific ETFs or mutual funds to achieve broader diversification.

- Increase Real Estate Allocation: Explore opportunities to increase the real estate allocation, perhaps adding another rental property or investing in real estate investment trusts (REITs).

- Analyze Bond Portfolio: Conduct a thorough review of the bond holdings, evaluating duration, credit quality, and diversification. Consider diversifying across various bond maturities and issuers.

- Reassess Active Management: Carefully review the performance of actively managed funds compared to benchmark indices. If consistently underperforming, reallocate funds towards low-cost index funds.

- Regular Portfolio Rebalancing: Implement a regular rebalancing strategy to maintain the desired asset allocation. Rebalancing helps to control risk and capitalize on market fluctuations.

- Consider Tax-Efficient Investing: Explore tax-advantaged accounts like 401(k)s and IRAs to minimize the tax burden on investment returns.

Conclusion: A Path Towards Optimized Investing

This analysis demonstrates that while Alex's investment approach shows some positive elements, such as a long-term perspective and above-average returns, there is significant room for improvement. Addressing the weaknesses identified, particularly the over-concentration in technology stocks and the limited diversification within specific asset classes, is crucial for enhancing long-term growth and mitigating risk. By implementing the recommended strategies, Alex can create a more robust and resilient investment portfolio that aligns better with their risk tolerance, investment goals, and overall financial objectives. Remember, regular review and adjustment are key to long-term investment success. Consider consulting with a qualified financial advisor for personalized guidance and support.

Latest Posts

Latest Posts

-

Withdrawal From Long Term Use Of Sedative Hypnotic Drugs Is Characterized By

Mar 17, 2025

-

What Are Textiles And Where Were They Used In Spain

Mar 17, 2025

-

Campaign Fundraising Tends To Be A Much Greater Challenge For

Mar 17, 2025

-

Which Three Topics Became A Major Focus Of The Enlightenment

Mar 17, 2025

-

What Should An Effective Letter Of Transmittal Include

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about What Does The Information Demonstrate About Alex's Investments . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.