What Is A Bonds Current Yield Quizlet

Breaking News Today

Mar 24, 2025 · 6 min read

Table of Contents

What is a Bond's Current Yield? A Comprehensive Guide

Understanding bonds and their various metrics is crucial for any serious investor. One such metric, often appearing in finance courses and exams (like those found on Quizlet), is the current yield. This article delves deep into the concept of a bond's current yield, explaining its calculation, interpretation, and its role in investment decisions. We'll explore its limitations, compare it with other yield measures, and finally, provide you with practical examples to solidify your understanding.

What is Current Yield?

The current yield of a bond is a measure of its annual income relative to its current market price. It represents the return an investor would receive if they bought the bond at its current market price and held it for one year. Unlike the yield to maturity (YTM), which considers the bond's price at maturity, the current yield focuses solely on the current income stream.

In simple terms: Current yield tells you how much you'll earn annually per dollar invested today.

Formula:

The current yield is calculated using the following formula:

Current Yield = (Annual Coupon Payment / Current Market Price) * 100%

Where:

- Annual Coupon Payment: This is the fixed amount of interest the bond issuer pays annually. It's usually expressed as a percentage of the bond's face value (par value).

- Current Market Price: This is the price at which the bond is currently trading in the market. It can fluctuate based on various factors, including interest rate changes, credit ratings, and market sentiment.

Why is Current Yield Important?

The current yield provides a quick snapshot of a bond's return potential relative to its current market value. It's a valuable tool for several reasons:

- Comparative Analysis: It allows investors to compare the income potential of different bonds. A higher current yield suggests a potentially greater return compared to a bond with a lower current yield, assuming all other factors are equal.

- Screening Tool: Investors can use current yield as a screening tool to identify potentially attractive bonds. For instance, an investor seeking high income might focus on bonds with significantly higher current yields.

- Quick Assessment: It offers a quick and easy way to assess a bond's attractiveness without delving into complex calculations like YTM.

- Understanding Market Dynamics: Changes in a bond's current yield can reflect changes in market sentiment and interest rates. An increase in current yield might indicate that the bond's price has fallen, reflecting negative market sentiment or rising interest rates. Conversely, a decrease in current yield could suggest a price increase, often due to positive sentiment or falling interest rates.

Current Yield vs. Yield to Maturity (YTM)

While both current yield and YTM measure a bond's return, they differ significantly:

- Time Horizon: Current yield considers only the current income stream, while YTM considers the total return including both coupon payments and the difference between the purchase price and the face value at maturity.

- Maturity Value: YTM incorporates the bond's price at maturity, while current yield ignores this factor.

- Complexity: Current yield is a simpler calculation, while YTM requires more complex calculations that often involve iterative processes.

Which one is better?

Neither is inherently "better" – the appropriate measure depends on the investor's investment horizon and goals. For short-term investors, the current yield might be more relevant, while long-term investors should focus more on the YTM. For example, if you only intend to hold the bond for a year, the current yield is most relevant as it reflects your actual return.

Limitations of Current Yield

Despite its usefulness, current yield has limitations:

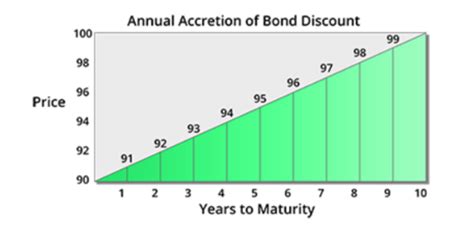

- Ignores Capital Gains/Losses: The biggest drawback is its failure to account for capital gains or losses resulting from the difference between the purchase price and the face value at maturity. This is especially important for bonds bought at a discount or premium.

- Static Measure: It's a static measure reflecting only the current market price and annual coupon. It doesn't account for future price changes.

- Oversimplification: It simplifies the bond's return by only considering the current income stream, neglecting the time value of money.

Calculating Current Yield: Practical Examples

Let's illustrate the current yield calculation with a few examples:

Example 1:

A bond with a face value of $1,000 has an annual coupon payment of $60 (6% coupon rate). The current market price is $950.

Current Yield = ($60 / $950) * 100% = 6.32%

Example 2:

A bond with a face value of $1,000 has an annual coupon payment of $80 (8% coupon rate). The current market price is $1,100.

Current Yield = ($80 / $1,100) * 100% = 7.27%

Example 3: A zero-coupon bond has no annual coupon payment. Thus, its current yield is 0%. However, its YTM reflects the potential return based on the difference between its purchase price and its face value at maturity.

These examples demonstrate how the current yield changes based on the relationship between the coupon payment and the market price.

Factors Affecting Current Yield

Several factors can influence a bond's current yield:

- Interest Rates: A rise in general interest rates typically leads to a fall in bond prices and thus an increase in current yield. Conversely, a decline in interest rates usually leads to a rise in bond prices and a decrease in current yield.

- Credit Rating: Bonds with higher credit ratings (indicating lower risk) generally command higher prices and thus have lower current yields. Conversely, lower-rated bonds often have higher current yields to compensate investors for the increased risk.

- Market Sentiment: Overall investor sentiment can influence bond prices and, consequently, current yields. Positive sentiment might drive prices up and reduce current yields, while negative sentiment could push prices down and increase current yields.

- Time to Maturity: The time to maturity influences a bond's price and thus its current yield. Generally, bonds closer to maturity have less price fluctuation than longer-term bonds.

- Inflation Expectations: Inflation expectations significantly impact bond yields. Higher inflation expectations usually lead to higher interest rates and, consequently, higher current yields (assuming all other factors remain constant).

Current Yield and Investment Decisions

The current yield provides valuable information for investment decisions, but it's crucial to consider it in conjunction with other factors:

- Investment Horizon: A short-term investor might prioritize current yield, while a long-term investor would place more emphasis on YTM.

- Risk Tolerance: High-yield bonds often come with higher risk. Investors should assess their risk tolerance before investing in such bonds.

- Diversification: Diversifying across different bond types and issuers is crucial to reduce overall portfolio risk.

- Inflation: Consider inflation's impact on the real return. A high nominal current yield might be eroded by high inflation.

- Credit Risk: Thoroughly assess the creditworthiness of the bond issuer to mitigate potential default risk.

Conclusion

The current yield provides a quick and easily calculated measure of a bond's annual return relative to its current market price. While it offers valuable insights for investors, it's essential to remember its limitations and consider it alongside other factors like YTM, credit rating, and the investor's risk tolerance and investment horizon. Using current yield effectively, in conjunction with other analysis, allows for a more comprehensive understanding of bond investments and enables more informed decision-making. Remember that while a higher current yield can be attractive, it's crucial to assess the underlying risks before committing capital. Understanding the interplay between current yield and other bond characteristics is key to successful bond investing. Never rely solely on current yield; use it as one piece of a larger puzzle in your investment strategy.

Latest Posts

Latest Posts

-

A Criticism Of Interest Group Pluralism Is

Mar 25, 2025

-

Rn Alterations In Kidney Function And Elimination Assessment

Mar 25, 2025

-

The Compliance Monitoring Component Of An Infection Control Plan Should

Mar 25, 2025

-

A 49 Year Old Female Patient Arrives At The Hospital

Mar 25, 2025

-

When An Agency Places A Stolen Lost

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about What Is A Bonds Current Yield Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.