What Is The Correct Definition Of Collateral For Potential Cosigners

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

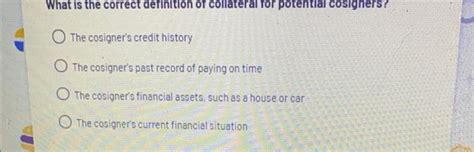

What is the Correct Definition of Collateral for Potential Cosigners?

Understanding the true meaning of collateral is crucial, especially for those considering co-signing a loan. This comprehensive guide will delve deep into the definition of collateral, its implications for cosigners, and the critical factors you need to consider before agreeing to co-sign. We'll explore different types of collateral, the risks involved, and how to protect yourself as a cosigner.

What is Collateral?

In the simplest terms, collateral is an asset that a borrower pledges to a lender as security for a loan. If the borrower defaults on the loan – meaning they fail to make payments as agreed – the lender can seize and sell the collateral to recoup their losses. This acts as a safety net for the lender, mitigating their risk.

Think of it like this: you're borrowing money, and you're offering something valuable as insurance. If you can't pay back the loan, the lender gets to keep that valuable item.

Collateral can take many forms, including but not limited to:

- Real Estate: This is a common type of collateral, encompassing houses, land, and commercial properties. Its value is relatively stable and easily assessed.

- Vehicles: Cars, trucks, boats, and motorcycles can all serve as collateral. Their value depreciates over time, so the lender will closely monitor its worth.

- Investments: Stocks, bonds, and other securities can be used as collateral, though their value fluctuates more significantly than real estate.

- Business Assets: For business loans, collateral might include equipment, inventory, accounts receivable, or intellectual property.

- Personal Property: Valuable items such as jewelry, antiques, or collections can sometimes be used, but their liquidity (ease of selling) can be a factor.

Collateral and Cosigners: A Deeper Dive

When you co-sign a loan, you become jointly and severally liable for the debt. This means the lender can pursue you for the full amount of the loan if the primary borrower defaults. The presence of collateral doesn't necessarily absolve you from responsibility.

While the lender does have collateral to fall back on, they will likely attempt to recover the debt from the cosigner first because it's often easier and cheaper than going after the collateral. This is because the legal process of seizing and selling collateral can be time-consuming and expensive. The lender might pursue the cosigner to avoid these additional costs.

Therefore, understanding the type and value of the collateral is crucial for potential cosigners. A high-value, easily liquidated asset provides more security for the lender, potentially reducing the likelihood of them pursuing the cosigner. However, even with substantial collateral, cosigners remain at risk if the borrower defaults and the collateral's value is insufficient to cover the entire debt.

Risks for Cosigners: Beyond the Collateral

Even with seemingly sufficient collateral, cosigners face significant risks:

- Damage to Credit Score: A default on the loan will severely damage both the borrower's and the cosigner's credit scores. This can make it difficult to obtain future loans, rent an apartment, or even get a job.

- Financial Burden: If the borrower defaults, the cosigner becomes responsible for the full loan amount, plus any accrued interest and fees. This can lead to substantial financial hardship.

- Lengthy Legal Battles: Recovering the debt from the cosigner can involve lengthy and costly legal proceedings.

- Strained Relationships: Co-signing a loan can put a strain on personal relationships if the borrower defaults and the cosigner is forced to cover the debt.

- Collateral Doesn't Guarantee Protection: Even if the loan has collateral, the lender may still pursue the cosigner, especially if the collateral is difficult to liquidate or if its value is less than the outstanding debt.

Protecting Yourself as a Potential Cosigner

Before agreeing to co-sign a loan, take the following steps to protect yourself:

- Thoroughly Investigate the Borrower's Financial Situation: Assess their income, credit history, and debt-to-income ratio. A comprehensive understanding of their financial stability is essential.

- Review the Loan Agreement Carefully: Understand the terms and conditions of the loan, including the interest rate, repayment schedule, and the type and value of the collateral. Don't hesitate to seek legal advice if needed.

- Assess the Value of the Collateral: Independently verify the value of the collateral. A professional appraisal might be necessary, particularly for real estate or valuable personal property.

- Consider a Limited Liability Clause (If Possible): In some cases, it's possible to negotiate a limited liability clause that restricts the cosigner's liability to a specific amount. This is not always feasible, however.

- Maintain Open Communication with the Borrower: Regular communication about the loan's repayment progress can help identify potential problems early on.

- Document Everything: Keep copies of all loan documents, communication with the lender and borrower, and any agreements made.

- Seek Legal Counsel: Consult with a lawyer or financial advisor before co-signing any loan. They can explain the risks and help you understand your rights and obligations.

Types of Collateral and Their Implications for Cosigners

Let's examine specific types of collateral and their implications for cosigners:

Real Estate as Collateral

Real estate is often considered a secure form of collateral due to its relatively stable value. However, the foreclosure process can be lengthy and costly. Even with real estate as collateral, the lender might still pursue the cosigner, especially if the property's value decreases significantly or if there are liens or other encumbrances on the property.

Vehicles as Collateral

Vehicles depreciate rapidly, making them less secure collateral than real estate. The lender will likely require comprehensive insurance on the vehicle. If the borrower defaults, the lender will repossess the vehicle and sell it, but the proceeds might not fully cover the loan amount, leaving the cosigner liable for the remaining balance.

Investments as Collateral

Investments are a volatile form of collateral, as their value can fluctuate dramatically. The lender will need to monitor the value of the investments closely. If the value drops significantly, the cosigner's risk increases, as the collateral might not be sufficient to cover the debt.

Business Assets as Collateral

Business assets such as equipment, inventory, or accounts receivable can be used as collateral for business loans. However, the value of these assets can be difficult to assess accurately, and liquidating them might be challenging. This increases the risk for the cosigner.

Conclusion: Cosigning Requires Careful Consideration

Co-signing a loan is a significant financial commitment with substantial potential risks for the cosigner, even with collateral in place. The presence of collateral does not guarantee protection from financial liability. Thorough due diligence, understanding the risks, and seeking professional advice are crucial before agreeing to co-sign. Remember, a damaged credit score and significant financial burden are very real possibilities if the borrower defaults, regardless of the collateral's existence. Approach co-signing with caution and a complete understanding of the potential consequences.

Latest Posts

Latest Posts

-

Many Different Types Of Personnel Work With Classified Information

Mar 14, 2025

-

Which Of The Following Scenarios Describe A Potential Insider Threat

Mar 14, 2025

-

After A Classified Document Is Leaked Online

Mar 14, 2025

-

Which Of The Following Represents Critical Information

Mar 14, 2025

-

Fundamentals Of Physics 12 Edition Instructors Solutions Manual Pdf

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about What Is The Correct Definition Of Collateral For Potential Cosigners . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.